Bitcoin Bear Market is Over: 3 Technical Arguments

Bitcoin Bear Market: The crypto market has experienced a slight recovery, with the Bitcoin price reclaiming the $20,000 area. But, the long-term downtrend is far from over. Major cryptos are still 80-90% below their all-time highs.

Nevertheless, more and more arguments are emerging in favor of the thesis that the decline and accumulation period in the crypto market is about to end. BeInCrypto presents 3 technical arguments that suggest that the macro Bitcoin bottom has already been reached, and a bullish trend reversal may be near.

Bitcoin Bear Market: Looking at BTC Price Action

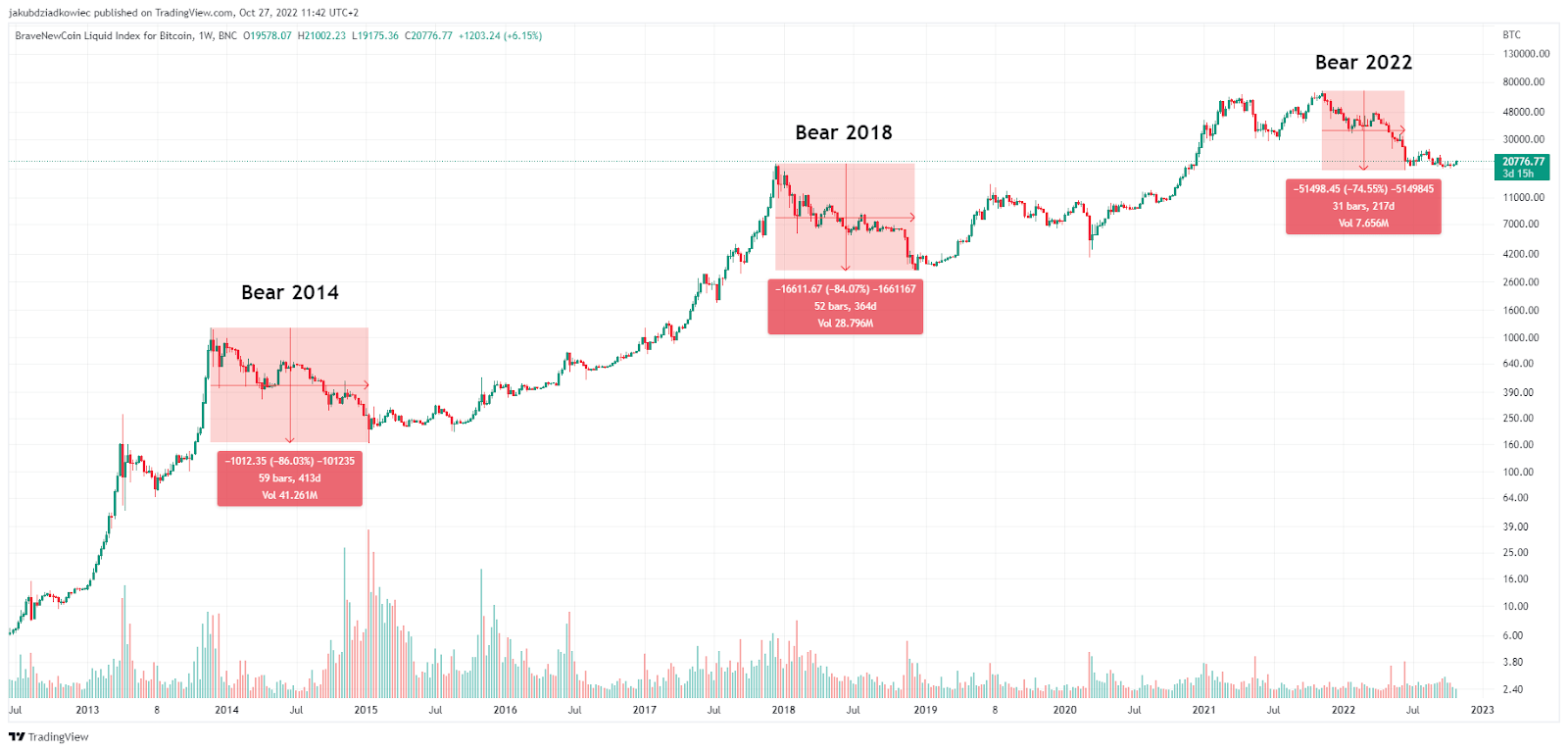

Bitcoin price has been dropping since reaching the all-time high (ATH) of $69,000 on November 10, 2021. Since then, the BTC price has lost 74.5% and hit a low of $17,600 on June 18, 2022. The Bitcoin bear market has lasted for at least 350 days.

Compared with previous cycles, we see that the decline so far has been milder than in the previous two Bitcoin bear markets. In 2014, Bitcoin price declined 86% from its historical ATH of $1177. Whereas in 2018, BTC price declined 84% against the previous ATH at $19,764.

Thus, if Bitcoin price were to reach a lower low, which would be comparable to historical declines, long-term support should be found in the $10,000 area (for an 85% decline from the ATH). Relative to the current valuation near $20,000, this would be a decline of another 50% and a definite deepening of the cryptocurrency winter.

Chart by Tradingview

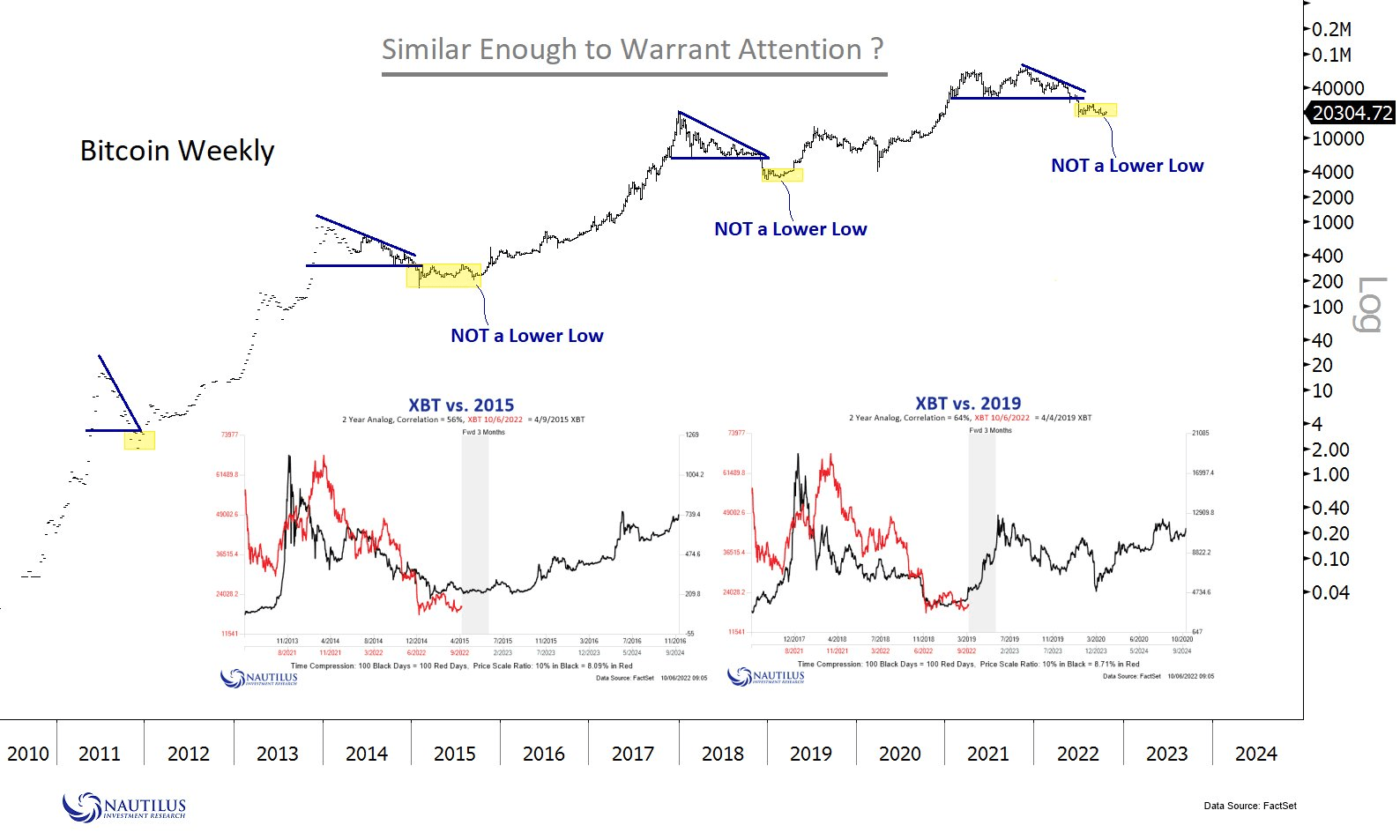

Fractals Without a Lower Low

Recently, a number of charts and technical arguments have emerged in favor of an alternative scenario and the impending end of the Bitcoin bear market. One of them was posted on Twitter by user @NautilusCap. In his fractal analysis, we see a long-term logarithmic chart of Bitcoin price, where historical BTC bear markets have been fitted into a descending triangle pattern.

In all three cases, there was a breakdown from this pattern, which in the short term led to a macro bottom of the BTC price. This was followed by an accumulation (yellow area), the completion of which was the start of an upward trend. The analyst stresses that a lower low was not generated during the accumulation period.

Source: Twitter

In addition, the chart compares the current Bitcoin price (red line) with the scaled-up BTC price action in 2015 and 2019, respectively. In those periods, there was a historical accumulation at the bottom of Bitcoin bear markets. The correlation with today’s price action was 56% and 64%, respectively.

By comparing these fractals, it appears that the current accumulation may last about 3 more months before a bullish reversal begins.

3 Technical Arguments

Another argument is provided by a chart tweeted by user @Washigorira. This time the monthly chart of Bitcoin and the Bollinger Bands Breakout Oscillator indicator is taken into account. This indicator measures two series of breakout data between the price and the extremes of Bollinger Bands. Bullish breakouts are represented by the blue areas of the indicator, while the red areas represent bearish breakouts.

In the analyst’s interpretation, it appears that the red chart is flattening. Historically, this has been correlated with the end of a Bitcoin bear market (red dashed lines). The red area may still dominate in the months to come. But reaching the maximum levels of the red breakout signals an imminent change in trend.

Source: Twitter

The Ultimate Oscillator Returns from Oversold Area

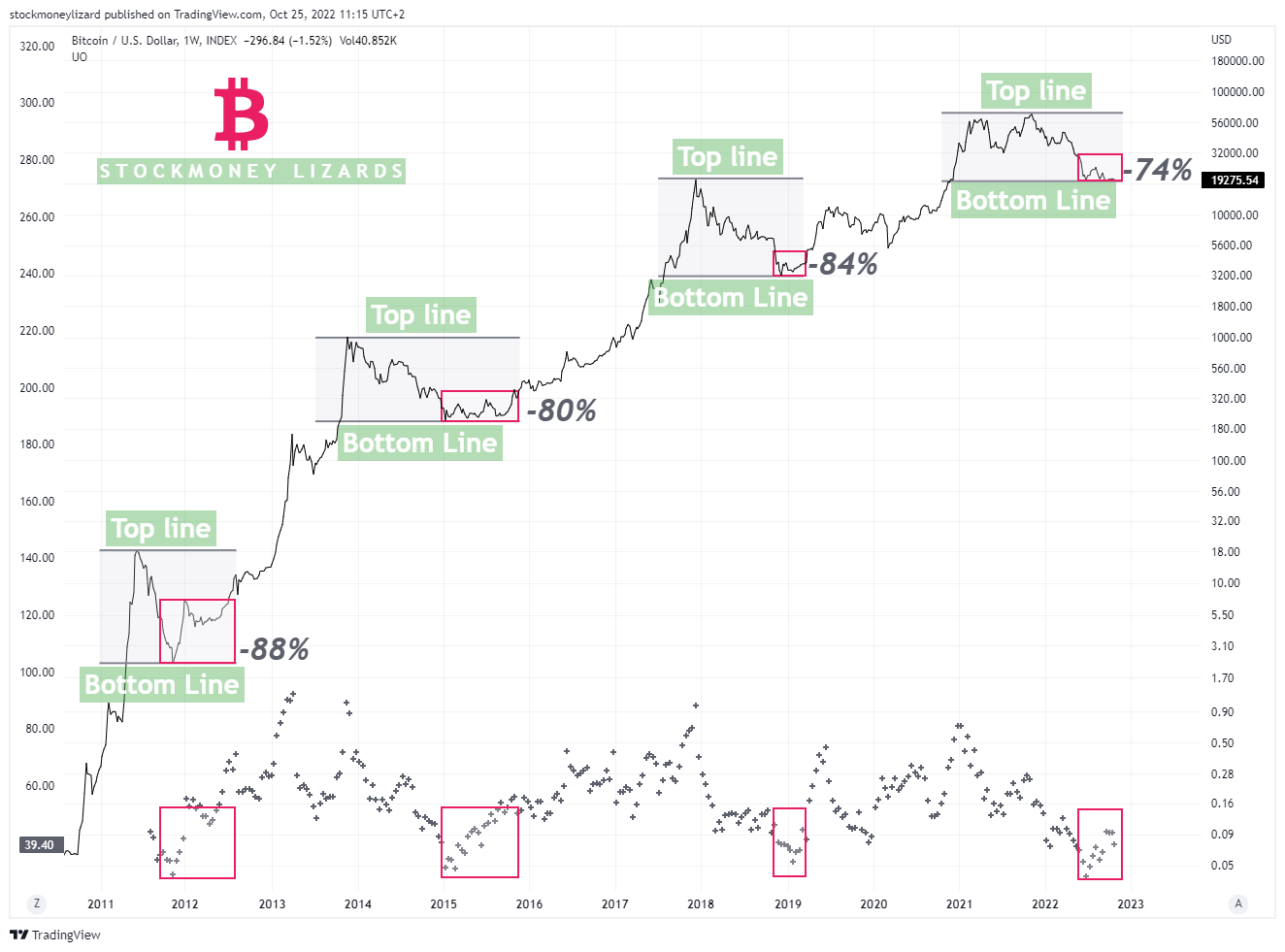

The last argument coming from long-term Bitcoin price charts was presented on Twitter by analyst @StockmoneyL. He also used a weekly logarithmic chart of the BTC price. He juxtaposes the upper and lower ranges of historical Bitcoin bear markets and the so-called Ultimate Oscillator.

This indicator, developed by Larry Williams, attempts to correct the inadequacies of indicators relating to various time frames. The Ultimate Oscillator does this by using three different time intervals (7, 14, and 28), which represent short-, medium- and long-term market trends. Its interpretation is similar to the RSI indicator. So analysts try to find bullish and bearish divergences and pay attention to overbought or oversold areas.

In the chart below, we see that the Ultimate Oscillator always reached extreme oversold values around the macro bottom of the Bitcoin bear market. It then slowly increased during the accumulation period. A similar situation is occurring now. So @StockmoneyL suggests that the end of the Bitcoin bear market is near (red areas).

Source: Twitter

For the latest BeInCrypto Bitcoin (BTC) and altcoins analysis, click here.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD