Ethereum Rushing Toward $1,800: Crypto Market Review, October 31

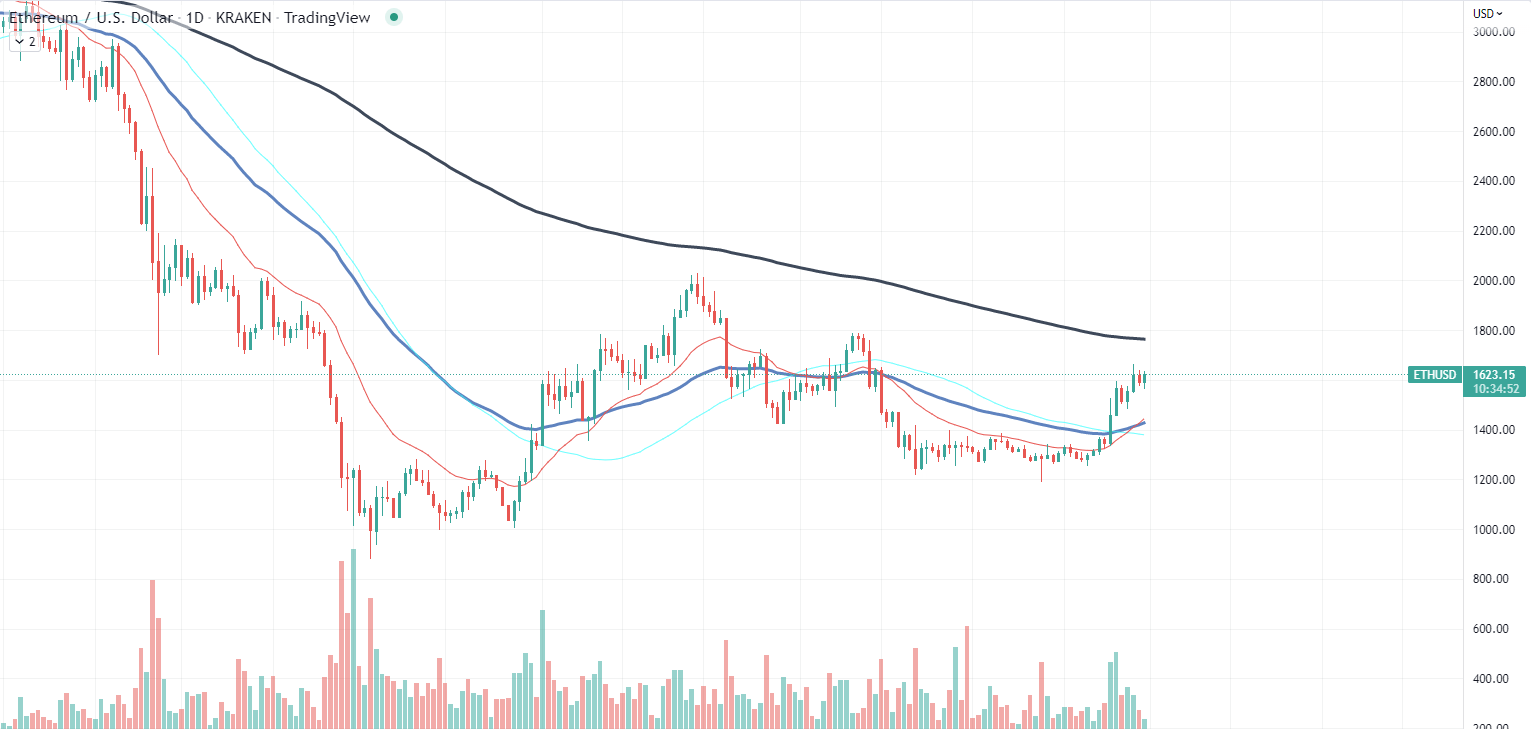

Ethereum was mostly the reason behind the most recent growth on the cryptocurrency market as the second biggest cryptocurrency rushed toward the local resistance and successfully broke it. Despite losing momentum, the continuation of the rally is still possible.

$1,800 is next destination

While Ether has not yet reached the next psychological level at $1,700, the real resistance for the second biggest digital assets in the world is a bit higher from a technical perspective. The $1,700 will most likely get broken relatively fast if Ether gains momentum on the market, but $1,800 is another story.

According to the daily chart of ETH, bulls have formed a solid resistance at $1,775, which is being confirmed by the cross-exchange orderbook. There are two reasons behind it: the 200-day moving average and the historical resistance level that formed after Ether broke down from $1,780 and lost almost 20% of its value in a few days.

The points of large and strong breakdowns usually turn into resistance levels as investors tend to sell assets actively to break even. As this process repeats, consolidation channels are forming and causing prolonged consolidations. Once traders get rid of most of their funds, a new breakout becomes a matter of time.

For now, Ethereum is moving sideways due to lack of volume on the market. The most likely reason behind the lack of momentum could be tied to increased fears among investors caused by the oversold nature of Ethereum.

However, even a slight correction or consolidation will lead to RSI returning to the normal zone, which will be a signal for investors and traders to resume inflows on the market.

Dogecoin needs it for continuation

The memecoin’s 140% revived interest in risky assets once again. However, it was not easy to keep up the pace we saw on DOGE from the beginning, and the most important thing the memecoin needs right now is a correction.

The continuation of the rally will most certainly cause even more retail inflows to the coin, which is a negative factor for assets that go through a volatile rally. Whenever the first correction happens, the market will not be able to cover the existing selling pressure and Dogecoin will face the fate of assets like Shiba Inu.

However, a correction at the right time will allow the memecoin to cooldown and then proceed upward. During the last rally in April 2021, Doge lost almost 70% of its value after the first correction following the pump but managed to climb even further since the reversal that allowed DOGE to cooldown appeared a few days after the initial pump.

At press time, Dogecoin is trading at $0.12 with a 3.4% price increase in the last 24 hours, but considering its volatility, the situation on the market might change drastically in a matter of hours.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Tezos

Tezos  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD