Slump In Ethereum Derivatives Signal Strong Price Action In Short Term

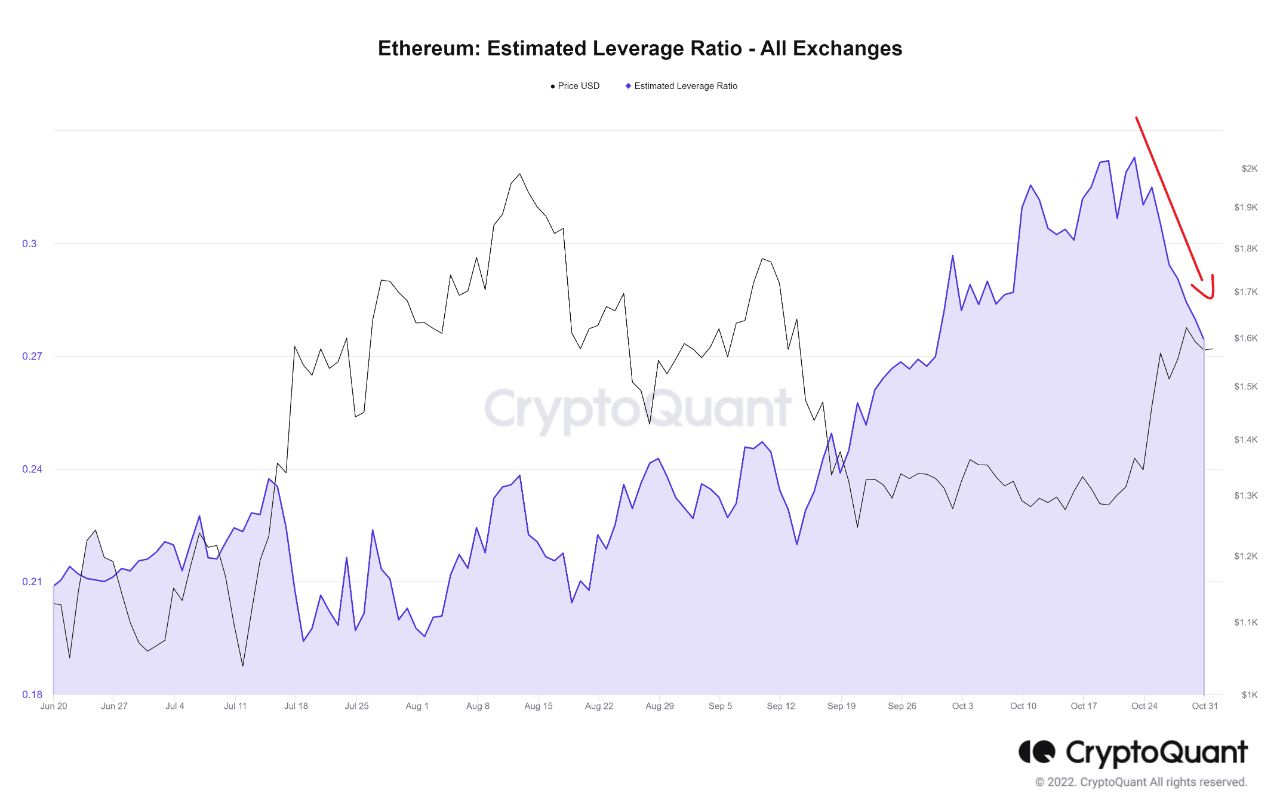

A few weeks back, the crypto market seemed to be dominated by derivatives for both Bitcoin and Ethereum. Additionally, during the past few months, the leverage in Ethereum (ELR) has increased to such high levels which are unheard of (The OI increases too).

This showed investors & traders were taking an extra risk in their positions.

Positive Impact on ETH Price

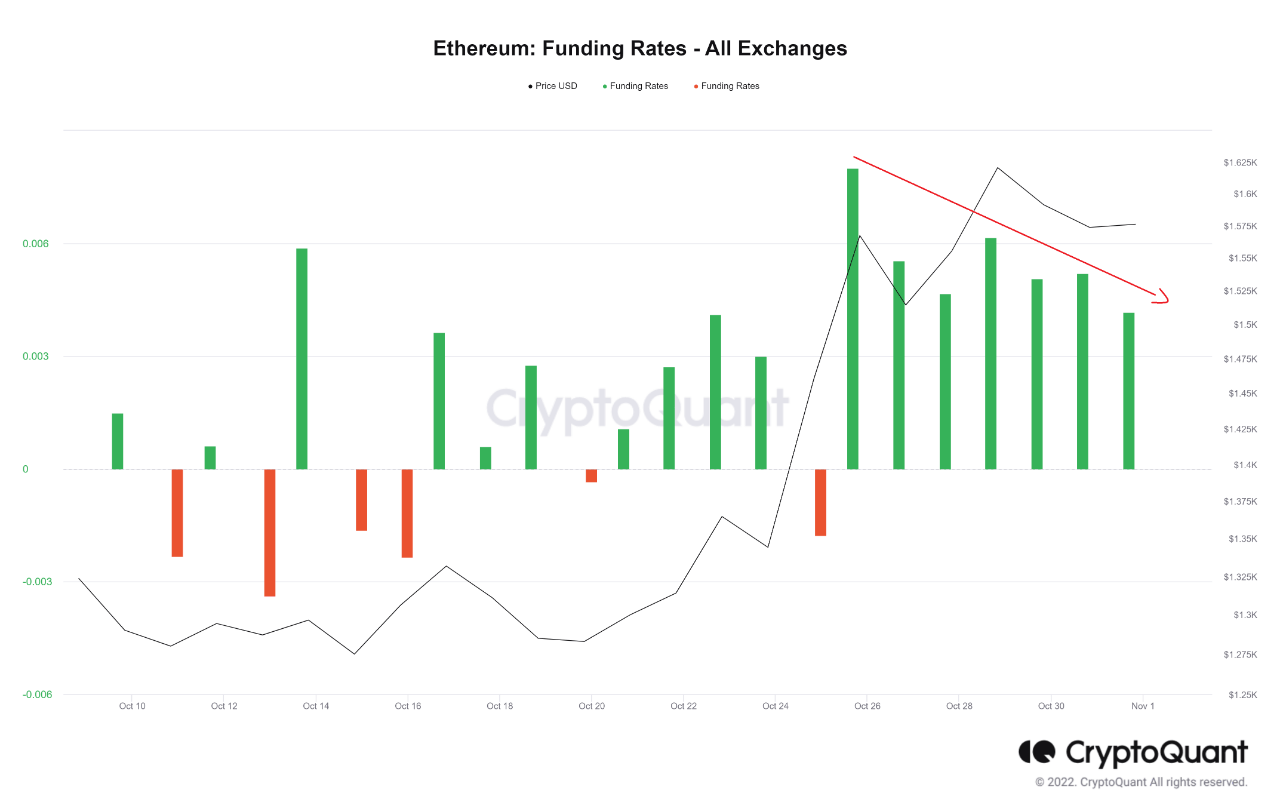

All of these caused Ethereum to rise by almost 30% over the past month. The Funding Rate also revealed that the majority of investors were long on Ethereum.

Tides Might Turn

However, the leverage and the passion reflected in the funding are currently beginning to decline. This can mean that investors who were at first willing to take significant risks have already made the decision to progressively close their positions. The long-term pressure from derivatives appears to be starting to lessen.

At the time of writing, the Ethereum price is $1,559.29 USD with a 24-hour trading volume of $13,427,764,204 USD. Ethereum is down 0.90% in the last 24 hours & down by 66% in a one-year timeframe.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Lisk

Lisk  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD