Coinbase CPO departs as exchange restructures product team

Coinbase’s chief product officer departed as the exchange restructured its product team.

Surojit Chatterjee stepped down on Oct. 28 as part of a reorganization that will split Coinbase’s product talent into four divisions, according to a filing with the Securities and Exchange Commission.

The product team — responsible for building out institutional and retail products — will be reconfigured into four divisions, with four directors reporting directly to CEO Brian Armstrong, who will take a more hands-on approach with the products.

The more focused groups are expected to allow the firm to work more nimbly and make quicker decisions, though it’s unclear if there will be significant cost savings.

Chatterjee’s departure is the latest among a spate of exits in the crypto industry, including those from Celsius Network and Voyager Digital, which continue to pick up the pieces after declaring bankruptcy in July. The CEO and founder of crypto exchange Kraken, as well as the CEOs of MicroStrategy, Genesis and Alameda Research, also left their posts in recent months as crypto prices have cratered.

“We’re empowering leaders within the company to make better decisions, faster, and to innovate more agilely,” company spokesman Elliott Suthers said. “These leaders will be closer to their products and our customers, which is critical in creating the type of user experiences that will drive the next evolution of the cryptoeconomy.”

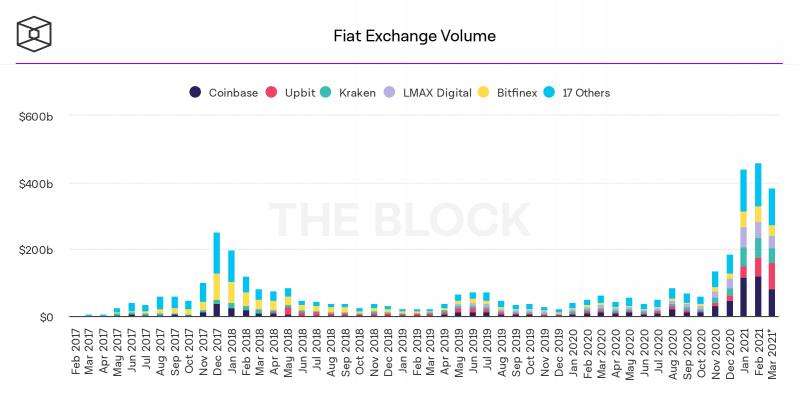

The news comes a day ahead of third-quarter earnings and amid a brutal period for crypto exchanges, which rely heavily on trading-fee revenue to turn a profit. Crypto exchange in October volumes fell to the lowest levels since Dec. 2020, despite a slight uptick in cryptocurrency prices. Last month, Coinbase turned over $47 billion in total trading volumes, down from $149 billion in the year prior, according to The Block’s data dashboard.

Coinbase veteran Max Branzburg will head up consumer including products such as its NFT platform and wallet, while former Goldman Sachs managing director Gregor Tusar will lead Coinbase’s institutional products, which spans institutional custody and prime brokerage. Meanwhile, Will Robinson and Manish Gupta will handle the firm’s developer-focused products and infrastructure, respectively.

Chatterjee—who joined Coinbase in 2020 from Google —will serve as an advisor to the firm until February.

Elsewhere, other firms have announced layoffs and executive departures including Alexander Höptner’s departure from Bitmex last week, which was followed by the firm cutting 30% of its staff yesterday. Digital Currency Group promoted Mark Murphy to president yesterday, amid a restructuring.

Against this market backdrop, Wall Street analysts have lost faith in Coinbase, with the average price target falling from an all-time high of $426 per share in Nov. 2021 to $93 per share on Oct. 29, according to FactSet data.

However, a speedier Coinbase could be a welcome sign for analysts, who have called out the firm in past reports.

In an August earnings call, KBW’s Kyle Voigt asked if the firm felt pressured by fast-moving competitors who weren’t afraid to explore new product lines.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD