Bitcoin Price Prediction as Crypto Prices Bounce From the Bottom – $20,000 Soon?

Bitcoin remained in a narrow trading range of $16,000 to $17,250 on Friday as the ongoing FUD continues to keep price action limited. The Securities Commission of the Bahamas (SCB) was watching FTX earlier this week.

The Financial Crimes Investigation Branch and the regulator worked together to investigate FTX’s violations. The development came after FTX announced that, at the SCB’s request, it would begin allowing Bahamian funds withdrawals, which the commission quickly denied.

However, recent reports show that the SCB had already taken action against the exchange days before it launched its investigation.

The regulatory body announced on November 17 that it had taken custody of the assets of FTX Digital Markets (FDM) by transferring them to a digital wallet under the SCB’s jurisdiction. The commission stated that these actions were taken to protect client funds and interests.

As more regulators began to investigate the bankrupt company, FTX exchange, its situation deteriorated. The collapse of the exchange has caused significant disruptions in the cryptocurrency market.

Following this event, Bitcoin holders may choose to protect their assets by selling them. Furthermore, due to unpredictability, the price could change in any direction.

El Salvador to Start Buying 1 Bitcoin Every Day

El Salvador’s president, Nayib Bukele, announced on November 17 that his country will begin purchasing one Bitcoin per day. El Salvador is said to have completed its final Bitcoin purchase, 80 BTC at $19,000 each, in July 2022, three and a half months ago.

El Salvador has 2,381 BTC with an average purchase price of $43,357, according to BuyBitcoinWorldwide data.

The main factor used to calculate this amount is the president’s announcement of Bitcoin investments. However, no record of the purchases has been made public or available on the network, so it cannot be confirmed.

According to media reports, the country spent more than $103.23 million on Bitcoin purchases. However, because the most popular cryptocurrency is currently valued at around $16,500, this implies a loss of more than $63 million, as the actual value of its stockpile is $39.47 million.

The declaration also responds to Bukele’s earlier comments on the FTX controversy, in which the president of El Salvador stated on November 14 via Twitter that «FTX is the polar opposite of Bitcoin.»

Bukele, a vocal Bitcoin supporter and believer, claimed that Bitcoin was created to combat Ponzi schemes, bank runs, and financial system fraud. Because repurchasing is increasing Bitcoin adoption in the country, this news may boost BTC/USD.

Crypto Market Turnaround

Following the recent drama involving FTX and other exchange platforms, blockchain analytics firm Santiment tweeted a chart outlining the conditions for a crypto market recovery.

According to the tweet, cryptocurrency often succeeds when exchanges are not the primary focus. One of the most significant exchange crashes in history was the FTX crash. As a result, its shockwaves may have «long-lasting shockwaves.»

According to the tweet, the critical turning point for the cryptocurrency industry will occur when attention returns to Bitcoin (BTC), the market leader, and away from exchange tokens.

According to a chart posted on Twitter by Santiment yesterday, the price of BTC/USD typically falls when the social dominance of exchange tokens increases.

Bitcoin Price Prediction

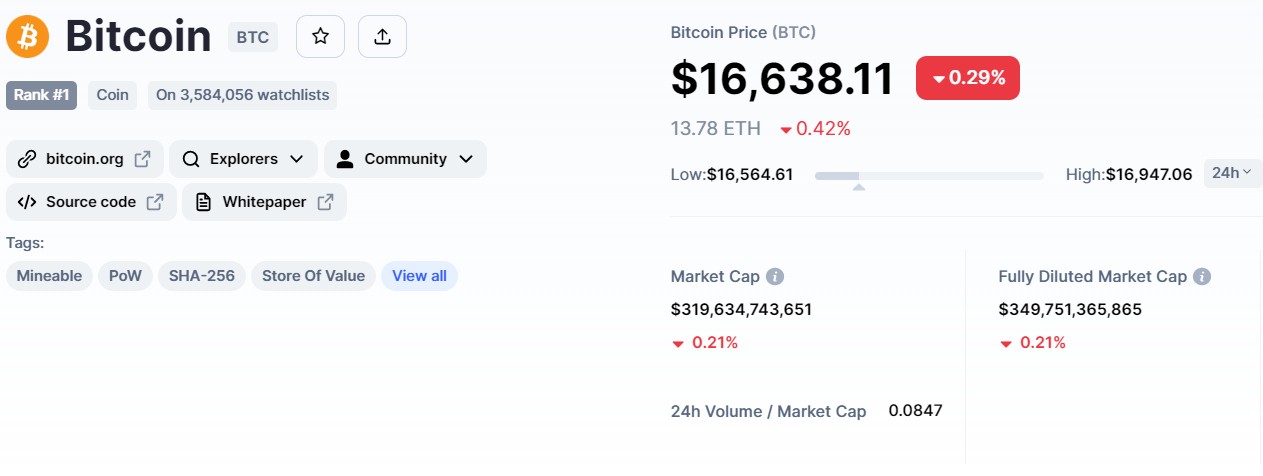

It began trading at $16,827, with a high of $16,832 and a low of $ 16,673. BTC/USD is currently trading at $16,790.00, up by 1.62% in 24 hours. Moreover, its price has dropped by over 4% in a week.

Bitcoin Price & Tokenomics — Source: Tradingview

Bitcoin is consolidating in a wide trading range between $16,000 and $17,200, with a breakout determining future price action. Bitcoin completed a 38.2% Fibonacci retracement at the $18,100 level in the 4-hour timeframe and has now fallen below the 23.6% Fibonacci level of $17,250.

On the downside, Bitcoin’s immediate support is at $17,250, and if the bearish trend continues, the price could fall as low as $15,850. Because the RSI and 50-day moving average indicate a bearish bias, the price of Bitcoin could fall to $15,850 if current support fails to hold.

Bitcoin Price Chart — Source: Tradingview

While the MACD is in a selling zone, recent histograms are contracting, indicating a waning bearish bias. Today, however, selling is visible below the $17,250 level. Increased BTC demand, on the other hand, has the potential to push the BTC/USD price above $18,250 and toward $20,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Dash

Dash  Algorand

Algorand  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur