Ethereum(ETH) Prices Dip Further by 0.84% Amidst Bear Influence

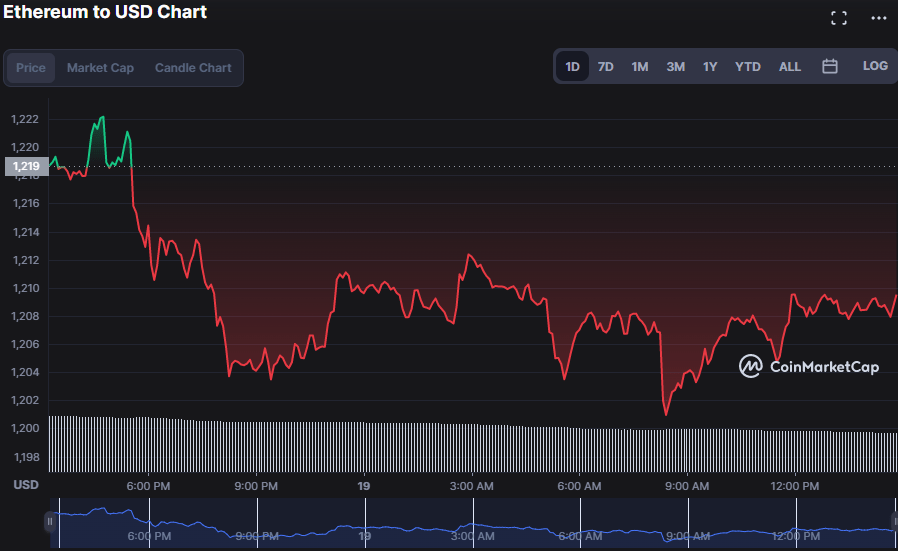

After encountering resistance at $1,222.20, the price of Ethereum (ETH) has been steadily declining over the last 24 hours, retracing to lows of $1,208.02 by 0.84%.

The decline in market capitalization and 1-day trading volume of 0.78% and 30.64%, respectively, to $147,885,939,434 and $6,441,941,911 reinforces this bearish momentum.

ETH/USD 24-hour price chart (Source: CoinMarketCap)

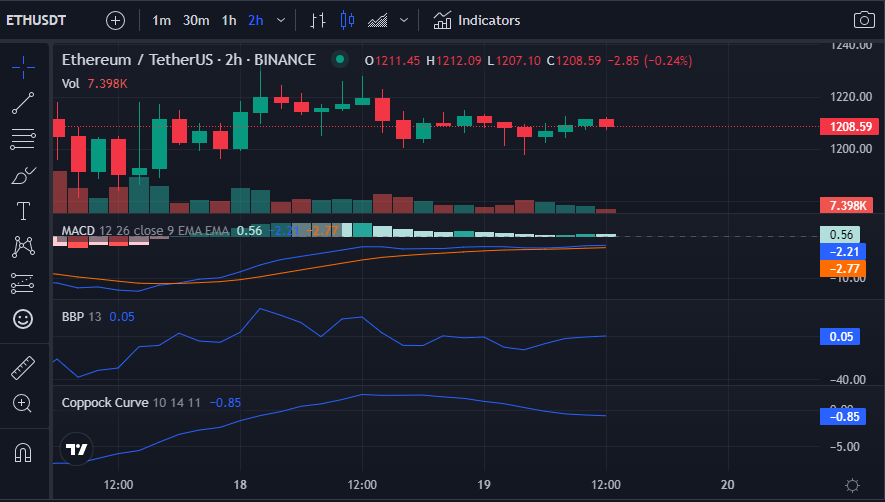

With a reading of -2.28, the Moving Average Convergence Divergence (MACD) forecasts a bullish turnaround as it makes a bullish crossover (crossing above the signal line). However, its movement in the negative territory indicates that the bears are still in control of the market; if the bulls continue to battle, this bear control may be invalidated.

The bullish turnaround on the ETH market is bolstered by the Bull Bear Power (BBP) moving into positive territory with a reading of 0.09. However, the Coppock Curve’s trend in the negative region with a reading of -0.83 dims this light.

ETH/USD 2-hour price chart (Source: CoinMarketCap)

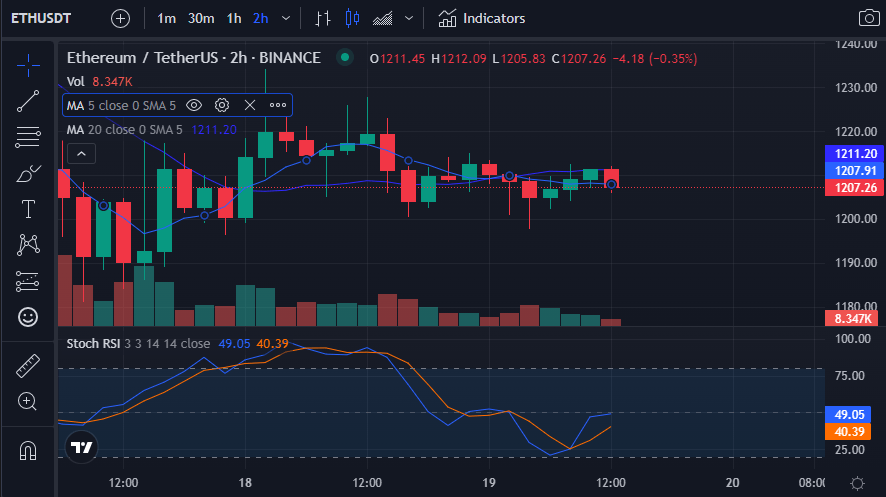

On the ETH 2-hour price chart, a bearish crossover occurs when the shorter MA crosses below the longer MA, with the 5-day MA touching 1207.80 and the 20-day MA touching 1211.19. The price action below both Moving Averages is propping up this negative trend.

With a reading of 49.57, the Stoch RSI suggests a possible bullish reversal because there is equal buying and selling pressure when it reads “50,” denoting that it is neither overbought nor oversold.

ETH/USD 2-hour price chart (Source: CoinMarketCap)

To counteract the bears and the present situation, the bulls must maintain the resistance level and drive prices higher.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Ontology

Ontology  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren