Crypto expert identifies key Ethereum price level to hold in order to reach $1,500

As the cryptocurrency market continues to switch between green and red after a difficult few weeks, Ethereum (ETH) is making small daily gains, leading crypto experts to identify crucial levels for these modest increases to continue.

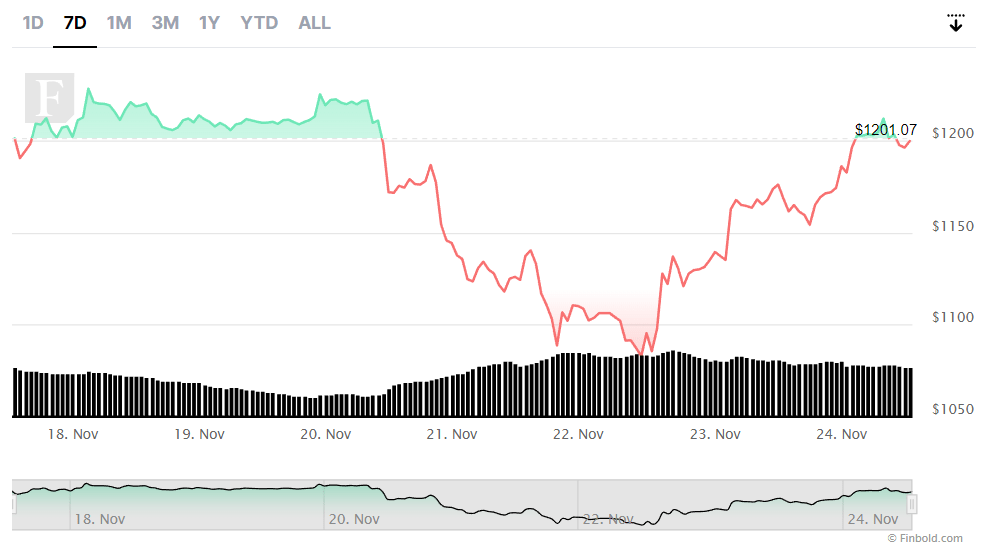

Indeed, Ethereum is facing crucial resistance at around $1,200-$1,2500, which it needs to break in order to push toward the first price target at $1,336 and the second at $1,547, according to an analysis by the crypto trading expert Michaël van de Poppe, published on November 24.

As he added:

“Preferably want to see it sustain above $1,150.”

It is also worth mentioning that Bitcoincenter’s Ethereum rainbow chart had earlier breached the ‘Fire sale’ spot, the lowest band on the chart, last recorded in March 2020, as it was left without any lined-up catalysts that could trigger a bullish run.

Low price = chance to accumulate?

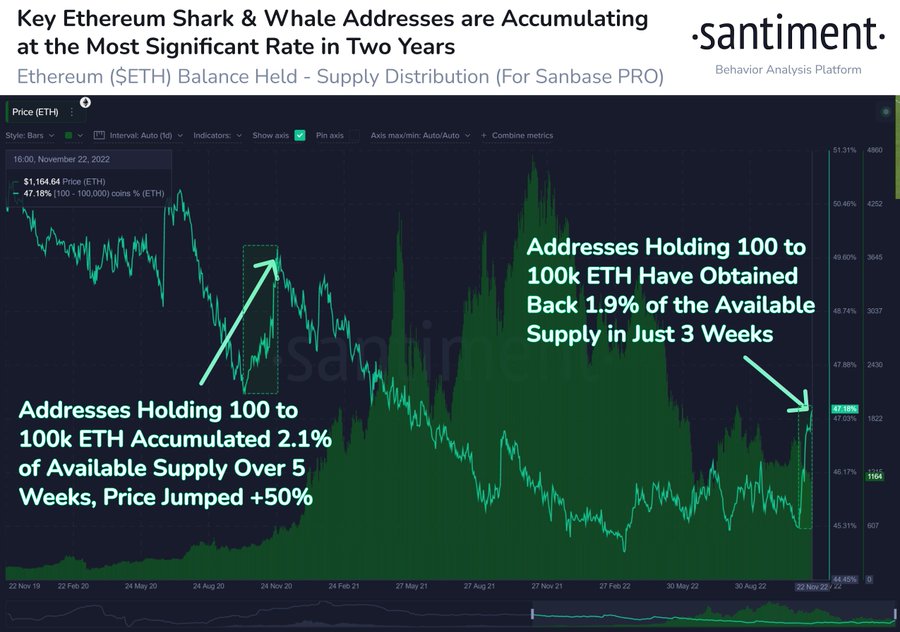

Meanwhile, the current price of Ethereum seems to have captured the attention of shark and whale investors (holding between 100 and 100,000 ETH), as they have been accumulating at the most significant rate in two years.

On top of that, the crypto community remains bullish on the price of Ethereum by the year’s end, estimating it would trade at an average of $1,465 on December 31, 2022, although this is a slightly lower prediction than the one earlier reported by Finbold, which stood at $1,509.

Ethereum price analysis

At press time, Ethereum was approaching Van de Poppe’s resistance zone, trading at $1,195, up 2.33% on the day. However, it was still down 0.39% across the previous week, adding up to the cumulative loss of 11.56% on the monthly chart.

With its market capitalization standing at $146.18 billion, Ethereum retains the position of the second-largest decentralized finance (DeFi) token, second only to Bitcoin (BTC), as per CoinMarketCapdata retrieved by Finbold on November 24.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Zcash

Zcash  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Ravencoin

Ravencoin  Polygon

Polygon  Decred

Decred  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Status

Status  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Hive

Hive  Waves

Waves  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Energi

Energi