One Final Capitulation Crash Before Bitcoin Reversal? Analyst Benjamin Cowen Analyzes Potential BTC Bottom

Crypto analyst Benjamin Cowen is examining the historical patterns of Bitcoin bear markets to estimate when BTC could bottom out.

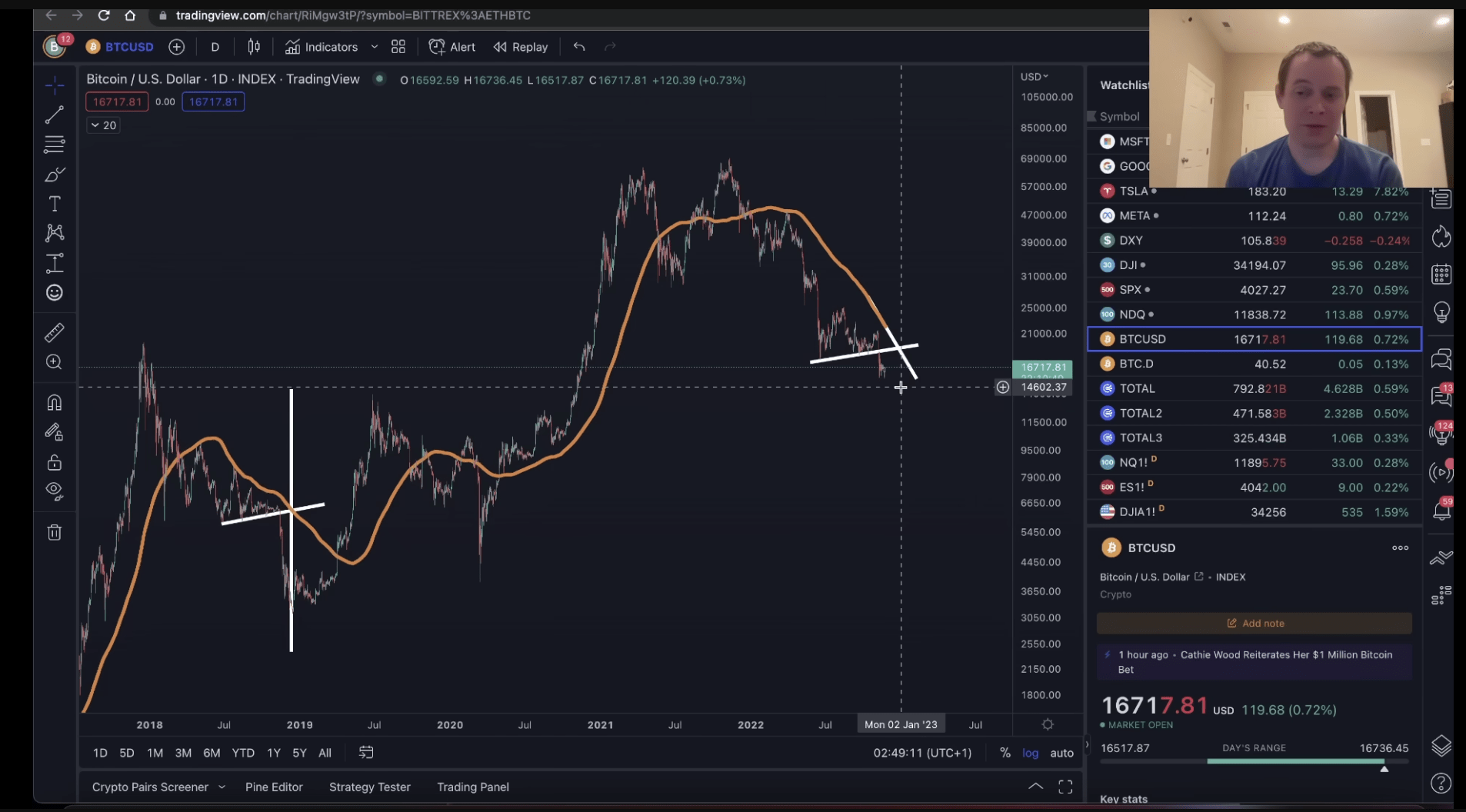

In a new strategy session, Cowen says it would be reasonable to expect a bottoming scenario similar to that of 2018, where BTC’s price made a series of slightly higher lows before sharply capitulating to new lows to reach its floor.

“So far in 2022 making the case for the bottom has not really served anyone well, and that’s why at the beginning of the year we said, ‘Look, don’t spend too much mental energy trying to call a bottom in 2022…’

When you’re in the bear market, you just give it a little more time and we tend to go lower.

If you were to follow a similar type of pattern here – we could sort of extrapolate out the 200-day simple moving average if it were to continue on down on its current trajectory, where might it cross?”

Source: Benjamin Cowen/YouTube

Based on the historical comparison, Cowen says that a potential capitulation event could occur around December 25th of this year, where Bitcoin reaches its lowest point before preparing for another bull market.

“You could see that it would cross somewhere in late December, right around Christmas, December 25th, December 26th, December 27th, around the holidays is where it would cross.

I can’t really say for sure, obviously, if it’s going to play out in the exact same fashion but I will say this. This bear market has been going on for over a year now, and historically, bear markets for Bitcoin last about a year. The one in 2014 lasted 14 months, and the one in 2018 lasted about 12 months, so in that context you could argue that we’re well within the window as to when bottoms typically occur in terms of time.”

At time of writing, Bitcoin is swapping hands for $16,608, a fractional dip on the day.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Bitcoin Diamond

Bitcoin Diamond