These On-Chain Indicators Offer Insight Into the Next Ethereum (ETH) Price Action

The world’s second-largest cryptocurrency Ethereum (ETH) has also been under strong selling pressure moving to $1,200 amid the market shakeout caused by the FTX collapse. As of press time, ETH is trading 4.3% up at a price of $1,282 and a market cap of $156.9 billion.

The on0-chain indicators hint at new interesting developments. Over the last year, the Ethereum shark and whale addresses have been shedding much of their supply. But since the FTX collapse last month, there’s an interesting trend reversal observed.

Since the implosion of the FTX exchange, all the Ethereum addresses holding between 100 to 1m coins have accumulated 1.36% of the overall ETH supply. This jump in the total large addresses of Ethereum hints at a bullish momentum going ahead.

Courtesy: Santiment

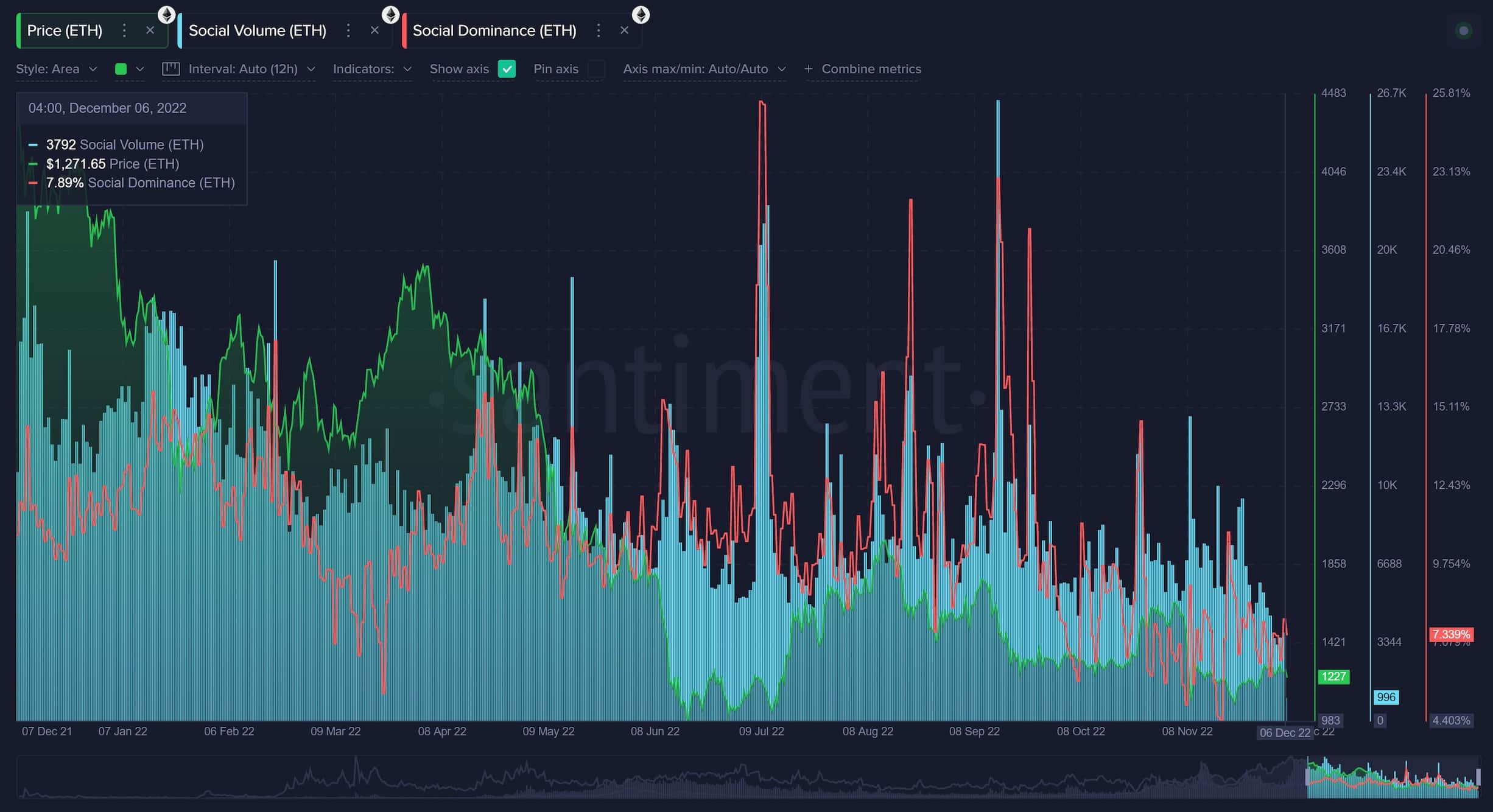

Ethereum (ETH) Social Volume, Dominance, and Exchange Supply

Since the Merge event in mid-September 2022, the discussion around Ethereum has been on a decline. Since late October 2022, the discussions around Ethereum have dropped to the lowest percentage among the top 100 assets. On-chain data provider Santiment notes:

The lack of interest since The Merge event is indicative that whales, could push up prices with little resistance, making this a bullish metric.

Courtesy: Santiment

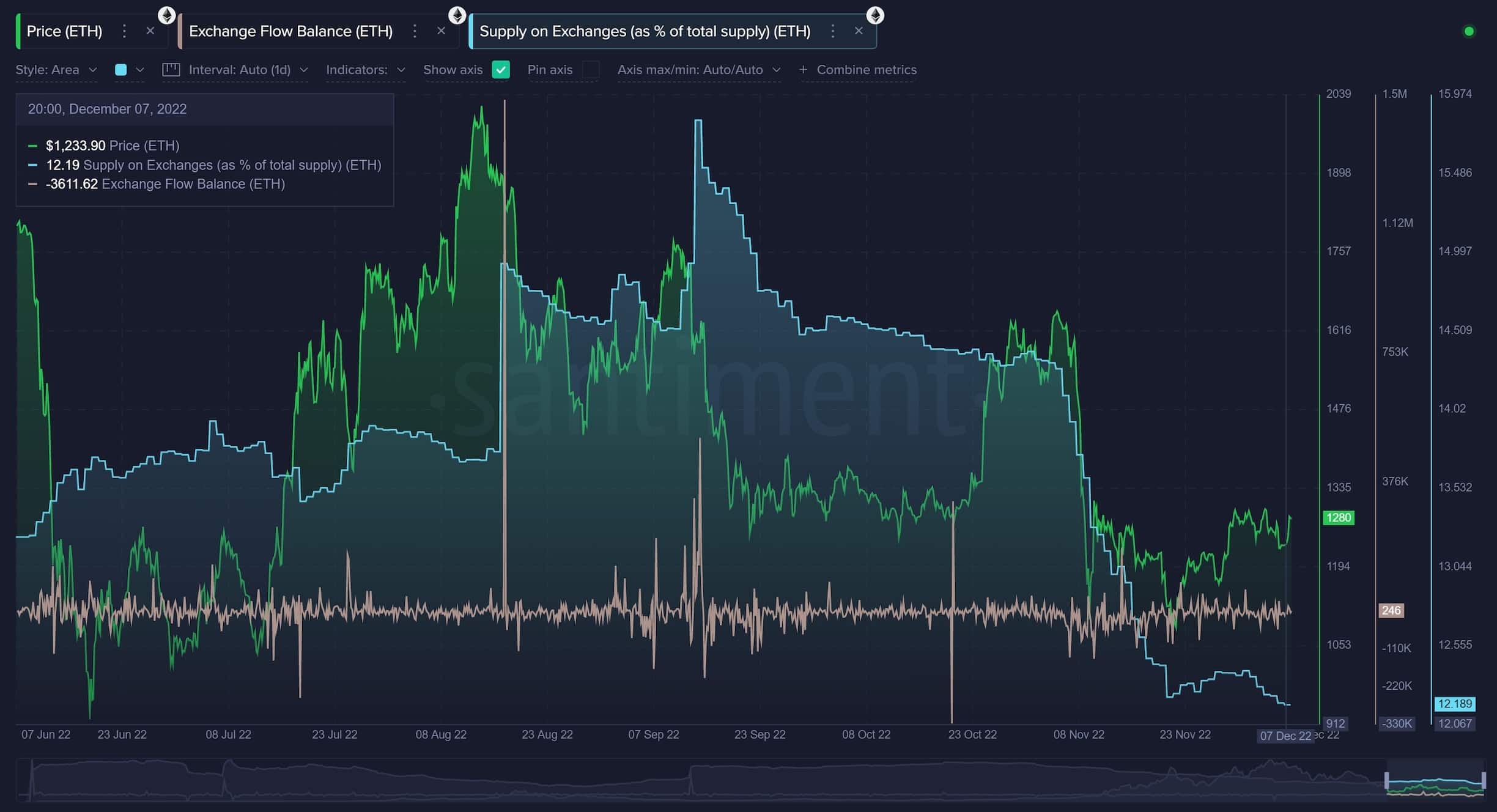

Another bullish indicator is that the ETH supply sitting on exchanges has dropped massively over the last month. Only 12.1% of the total ETH supply sits on the exchanges which is now at a four-year low.

There’s been a 75% drop in the ETH supply on exchanges in the last 13 months. However, if all these ETH start coming to exchange, it could trigger more sell-offs. But indicators for the same are not round the corner.

The Santiment report notes: the more the supply of ETH on exchanges declines, the better of a case that can be made that we’re nearing a bottom. For that reason, we certainly have to consider this metric as a bullish indicator for Ethereum.

Courtesy: Santiment

During the FTX collapse, there were a large number of shorts by the trader. This led to ETH short liquidations on the exchanges, leading to a 17% price jump in ETH, as expected. Currently the funding rates are neutral and we can’t say in which direction the next liquidations would happen.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Tezos

Tezos  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD