Bitcoin is on the verge of a bullish breakout; $18k BTC in sight?

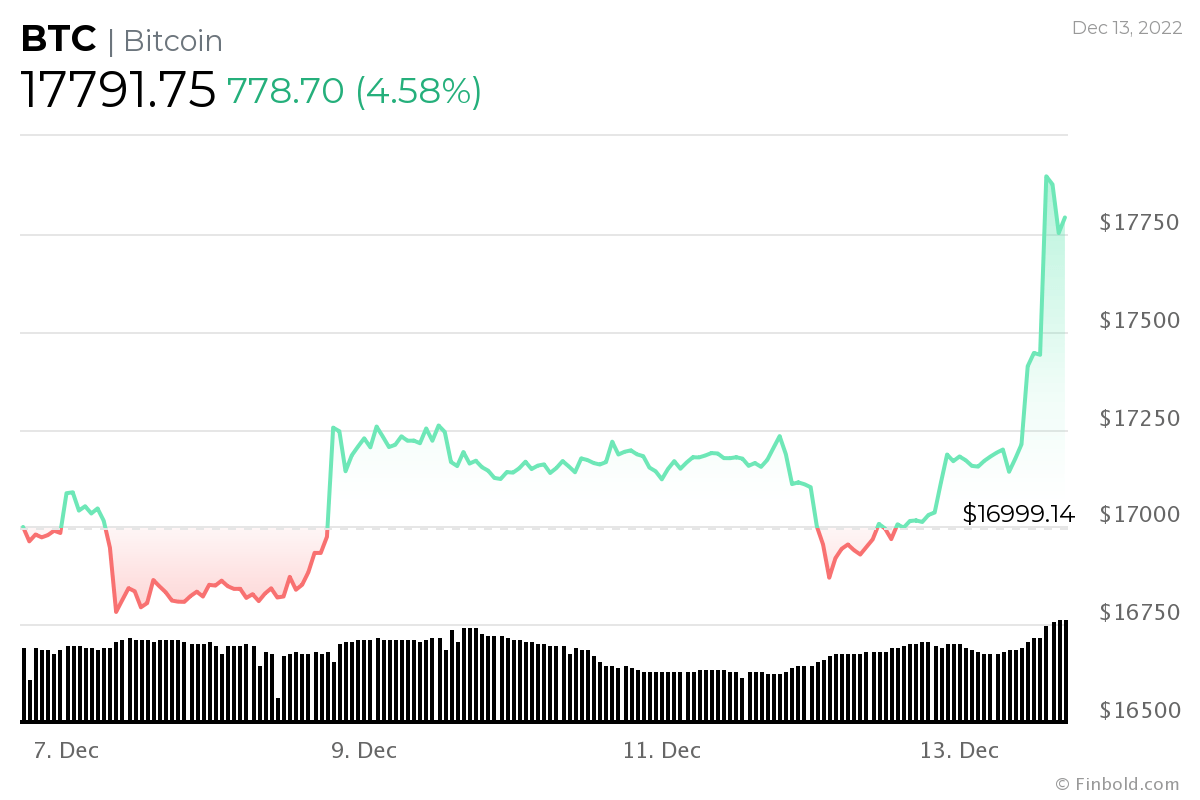

After weeks of consolidation, Bitcoin (BTC) and the general cryptocurrency market has recorded a short-term rally in reaction to positive inflation data on December 13.

The rally has seen Bitcoin hit a new four-week high, with investors monitoring the asset’s price movement for a bottom that would likely usher in a new price breakout. Based on the flagship cryptocurrency’s latest price movement, Kitco News analyst Jim Wycoff on December 13 pointed out that Bitcoin has potentially begun a ‘bullish upside breakout.’

According to Wycoff, Bitcoin bulls have built a near-term technical advantage after a tussle of almost equal strengths.

“Today’s price action has produced what looks to be the beginning of a bullish upside “breakout” from the choppy and sideways trading range on the daily bar chart to suggest a price uptrend will develop. Bulls have gained the near-term technical advantage,” Wycoff said.

Bitcoin positive reaction to CPI data

Indeed, Bitcoin rallied after the latest Consumer Price Index (CPI) indicated that the Federal Reserve was making significant steps in winning the war to bring down inflation. The latest data showed that November inflation came in at 7.1% on a year-on-year basis compared to the 7.3% forecast, while monthly CPI was 0.1% less versus the 0.3% expected.

In this line, the crypto market has been monitoring the inflation data since it will determine the Fed’s next policy on interest rates. Overall, Bitcoin has been weighed by the high inflation with the tighter monetary policy putting pressure on risky assets.

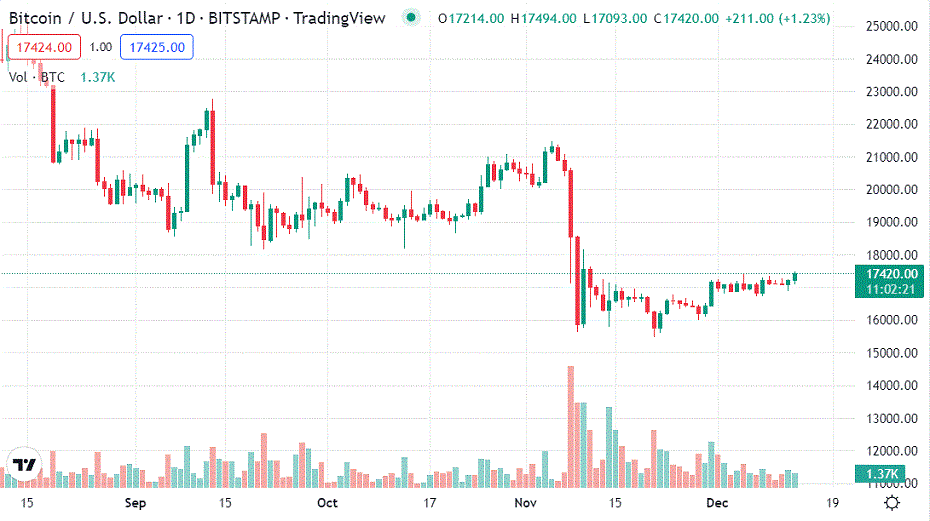

Bitcoin price analysis

By press time, Bitcoin was trading at $17,791, recording daily gains of almost 5% while weekly gains stand at 4.5%.

Bitcoin is looking forward to reclaiming the $18,000 zone that acted as a critical support level for the asset in recent weeks. However, with inflation cooling down, the ability of Bitcoin to sustain the gains will mostly depend on the bull’s potential to overpower bears.

In recent weeks, Bitcoin has consolidated around the $17,000 level. Notably, if Bitcoin fails to hold the $17,000 position, the asset will be in line for a possible further correction.

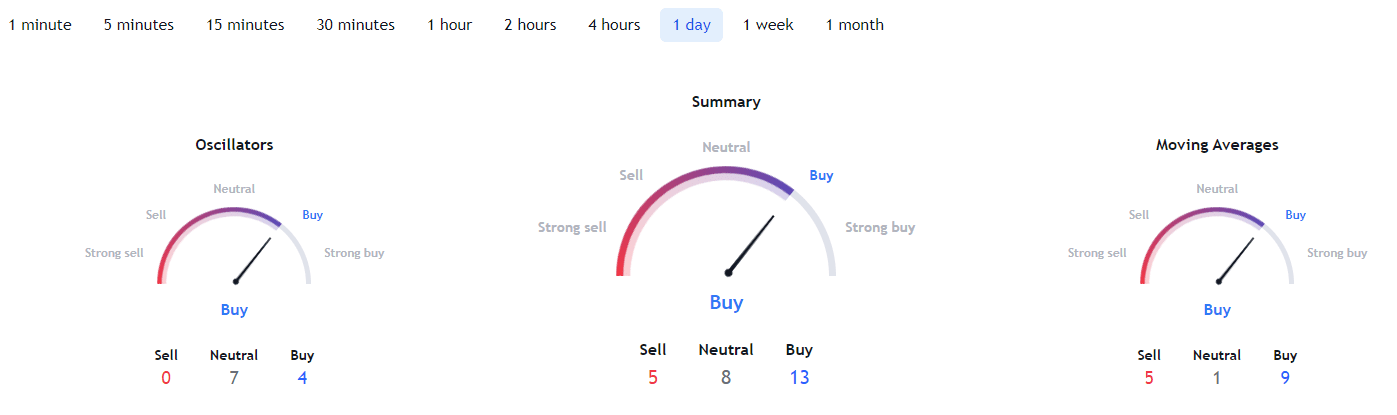

Bitcoin technical analysis

Elsewhere, Bitcoin’s latest gains have been reflected in the asset’s technical analysis. A summary of the daily gauges on TradingView aligns with ‘buy’ sentiment at 13 while moving averages are also for buying at 9. Oscillators are for the ‘buy’ sentiment at 4.

The reaction to the CPI data shows that Bitcoin has temporarily put aside effects from any possible criminal charges and reserve concerns regarding the Binance crypto exchange. At the same time, Bitcoin is building momentum following the arrest of FTX founder Sam Bankman-Fried.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  Cronos

Cronos  OKB

OKB  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Maker

Maker  Zcash

Zcash  Tether Gold

Tether Gold  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Decred

Decred  Synthetix Network

Synthetix Network  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Status

Status  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  NEM

NEM  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD