Ethereum Rejected at $1.3K but is a Drop to $1K Back in Play? (ETH Price Analysis)

Following yesterday’s Fed interest rate announcement, Ethereum’s price has seemingly taken a U-turn, getting rejected from a significant resistance zone. Another bearish phase could soon begin unless the market rebounds over the next few days.

Technical Analysis

By: Edris

The Daily Chart

On the daily chart, the price has failed to break above the $1300 level and is currently falling to the downside. The 50-day moving average has also been tested around the same area, but the price was also unsuccessful in closing above it.

In case the price somehow breaks above the $1300 level and the above-mentioned moving average, the 200-day moving average around the $1400 mark would be the first potential obstacle.

However, considering the current market structure, which hints at a failed breakout from the $1300 level, a drop toward $1000 would be the more likely outcome. The $1000 area would be a key level to watch as it could lead to another disastrous crash if broken to the downside.

The 4-Hour Chart

In the 4-hour timeframe, the current market structure becomes more clear. The price has been impulsively rejected from the $1300 resistance level and is currently bound to retest the $1240 support area.

The rejection was signaled beforehand, as the RSI indicator has been trending around the overbought area, pointing to a probable bearish reversal in the short term. The popular oscillator has now dropped below the 50% mark, indicating a bearish dominance as the momentum is shifting downward.

Unless the market structure changes in the next few days, a retest of the $1240 support level and even a crash towards the stronger $1100 area would be probable in the coming weeks.

Sentiment Analysis

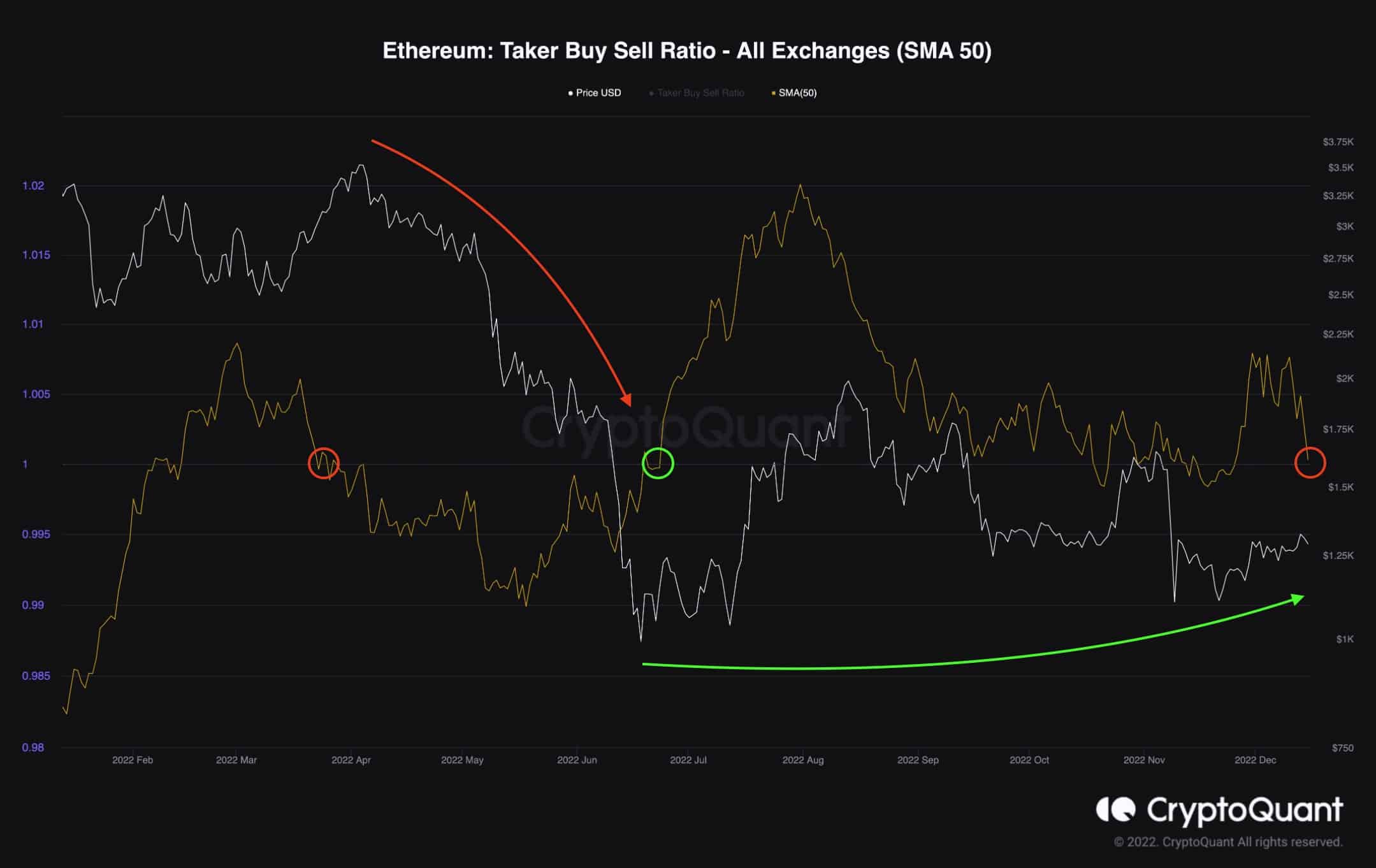

Ethereum Taker Buy Sell Ratio

While Ethereum’s price has been showing relative resilience by not making a new lower low during the FTX crash, the futures market could be suggesting that things are about to change.

This chart demonstrates the 50-day moving average of the Taker Buy Sell Ratio, which is primarily used for evaluating the futures market sentiment, as it indicates whether the bulls or bears are more aggressive.

Values above 1 are associated with bullish sentiment; conversely, values below 1 showcase the bears’ dominance.

Shifts above or below this threshold are also important, as the metrics’ decline below 1 in March signaled the eventual crash, which started soon after. On the contrary, as the ratio rose above 1 in June, the crash came to a halt, and the market has been consolidating and even experiencing short-term price rallies.

Currently, the Taker Buy Sell Ratio is rapidly approaching 1, which indicates aggressive short selling happening in the futures market.

In the event the metric drops below 1, the bears would assert their dominance once again, and a further crash could be on the horizon for Ethereum.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Gate

Gate  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD