ETH Price Analysis: A Positive Market Trend Is on but Won’t Last Long

Michael Van de Poppe, a famous crypto analyst, explains that the positive market trend will last only a short time. Poppe analysis is based on weak indices from the market trend. He analysed that the ETH price can be pushed to $1907, but the bulls are vulnerable to a consistent bull run.

As the bulls and bears argue about price movements, it will take time to predict the future price of Ethereum. Although the technical indicators now favour the bulls, traders should be aware of the possibility of the reverse.

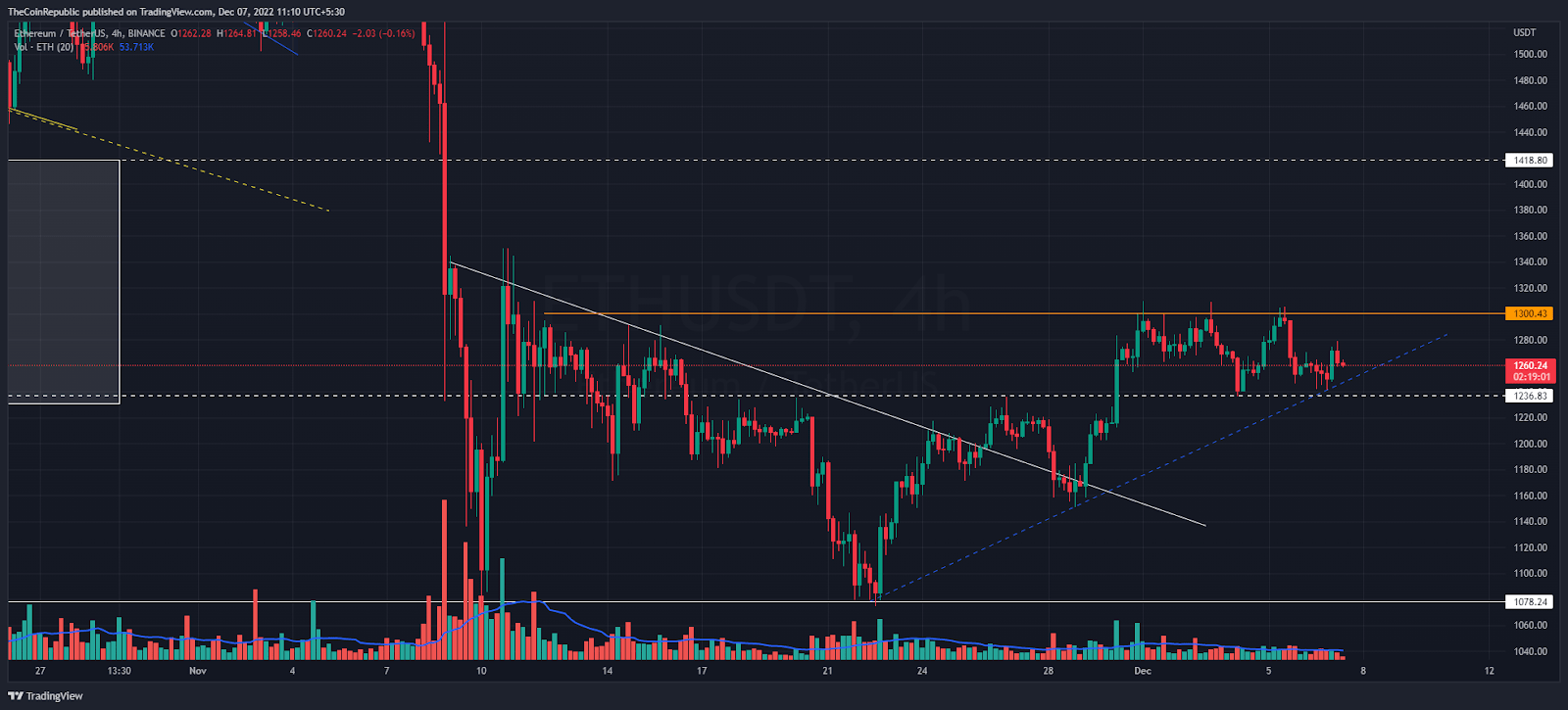

ETH technical analysis

According to CoinMarketCap, ETH has increased by 0.03% during the past 24 hours. As a result, at the time of writing, the price of ETH is $1,215.44. The price of ETH is still down 11.27% over the past week, despite the 24-hour surge.

Source: Trading View

The previously breached moving indicators are being retested by the decentralised smart-contract token, which offers a shorter period for traders wary of making a move.

This positive development is obscured by the Bollinger Band’s upward rise, which saw the upper band reach $1224 and the lower band reach $1206 on the ETH price chart. This movement suggests the end of the bearish trend as buying pressure rises. When the market price rises close to the top band, it often denotes that the bulls are in control and are about to launch a bull run.

Source: Trading View

The RSI is entering overbought territory on the 4-hour chart at 54.23, which indicates intense sell pressure. In the near term, ETH appears hostile. In the most recent hours, a red candlestick also exhibits a surge in sell orders pushing the price toward $1214.

However, there is support for the price at $1210, which will stop it from falling any further. As a result, we anticipate a slight price retracement.The retracement level at $1230 may be quickly reached if buying pressure picks up again.

On the other hand, a break below the $1210 level of resistance would reinforce the negative trend. In that case, the bears can push the price below the $1200 mark.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren