Bitcoin Whale Activity On A Major Decline, Further BTC Fall Ahead?

The world’s largest cryptocurrency Bitcoin (BTC) has faced strong selling pressure and is currently holding under $17,000 levels. Another major development is that the whale interest in Bitcoin has been declining which could be a sign of worry going ahead.

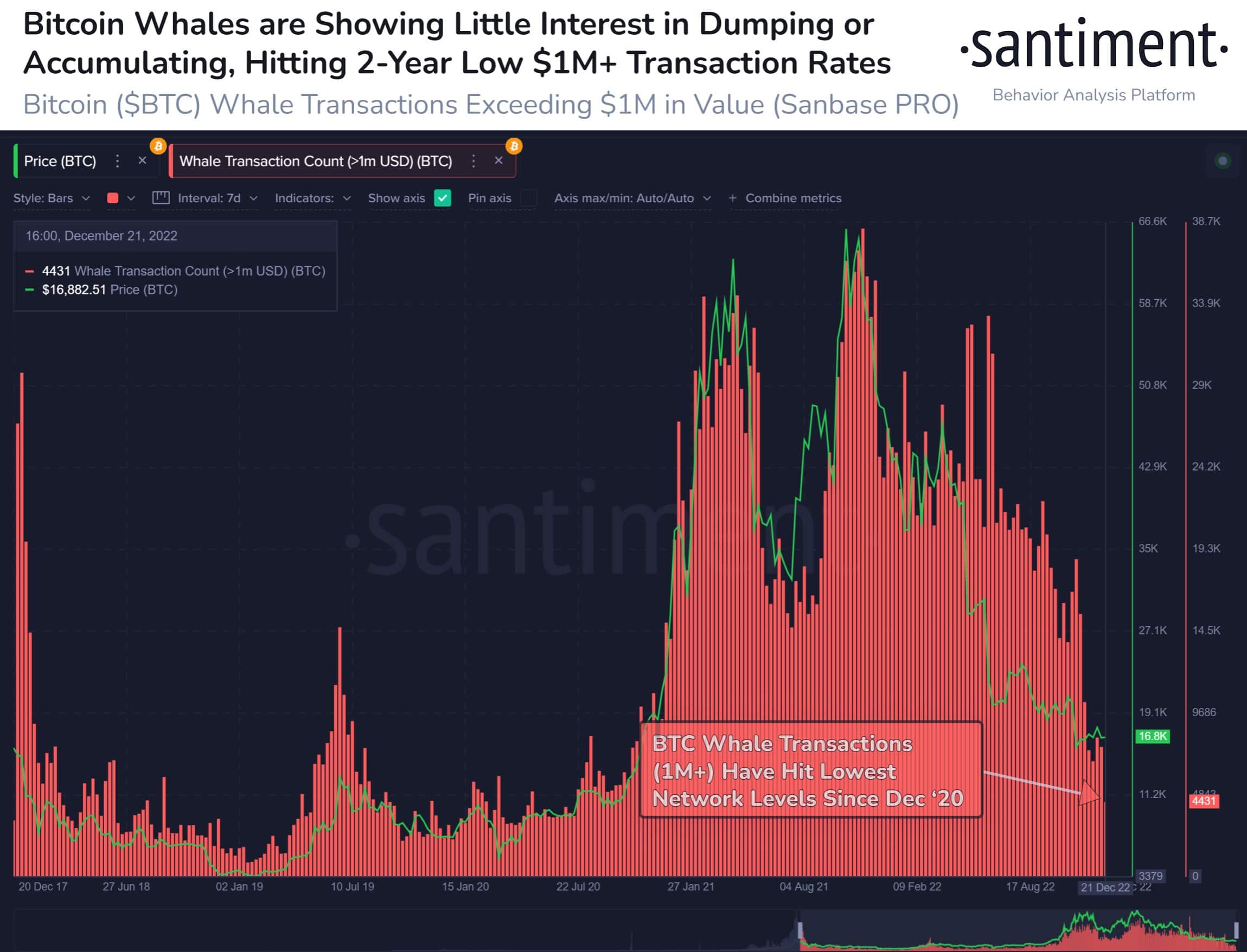

Bitcoin’s $1 million value transactions have touched a two-year low and whales have been showing very little interest in either dumping or accumulating Bitcoins. On-chain data provider Santiment noted:

Bitcoin’s ranging prices have a lot to do with declining whale interest. This chart illustrates how closely $BTC and $1M+ valued whale transactions correlate. If prices continue sliding and a spike occurs, this would be a historically #bullish signal.

Courtesy: Santiment

This scenario is true not only for big whales but even for mid-sized whales. The total number of large transactions on the BTC network with values greater than $100,000 has just touched a new yearly low of 8040 transactions. It clearly reflects the low whale and institutional activity on the BTC network.

Low Investor Interest in Buying Bitcoin

Along with the whale activity, other on-chain data shows that investors’ interest in buying BTC has also been declining. Citing data from IntoTheBlock, crypto analyst Ali Martinez reported:

“Data from @intotheblock shows the number of new addresses created on the $BTC network has been trending down. It has decreased by 8.16% in the past seven days. This network activity suggests that investors aren’t interested in buying #BTC at the current price levels”.

Courtesy: IntoTheBlock

The Bitcoin Price Volatility has touched a new all-time low and thus it’s been difficult to predict in which direction the BTC price will move. Crypto analyst Ali Martinez explains: “Bitcoin sits between two significant supply walls. One at $16,600 where 1.46 million addresses hold 915K BTC and the other one at $17,000 where 1.27 million addresses hold 730K $BTC. A sustained move outside of this area will likely determine the direction of the trend”.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  Stellar

Stellar  Zcash

Zcash  LEO Token

LEO Token  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Tezos

Tezos  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Pax Dollar

Pax Dollar  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD