BTC’s Drop Correlated With a Lack of Whale Interest: Santiment

The crypto market leader, Bitcoin (BTC), has seen its price drop 1.58% over the last 24 hours according to the crypto market tracking website, CoinMarketCap. At press time, BTC is changing hands at $16,618.67.

After establishing a daily high at $16,895.28, BTC’s price has since declined to its current level. BTC’s 24-hour low sits at $16,608.18. Meanwhile, the daily trading volume for BTC has risen 34.41% – taking the total volume for the day to $16,752,177,832.

Santiment, the blockchain analysis firm, tweeted this morning that BTC’s ranging prices have a lot to do with declining whale interest.

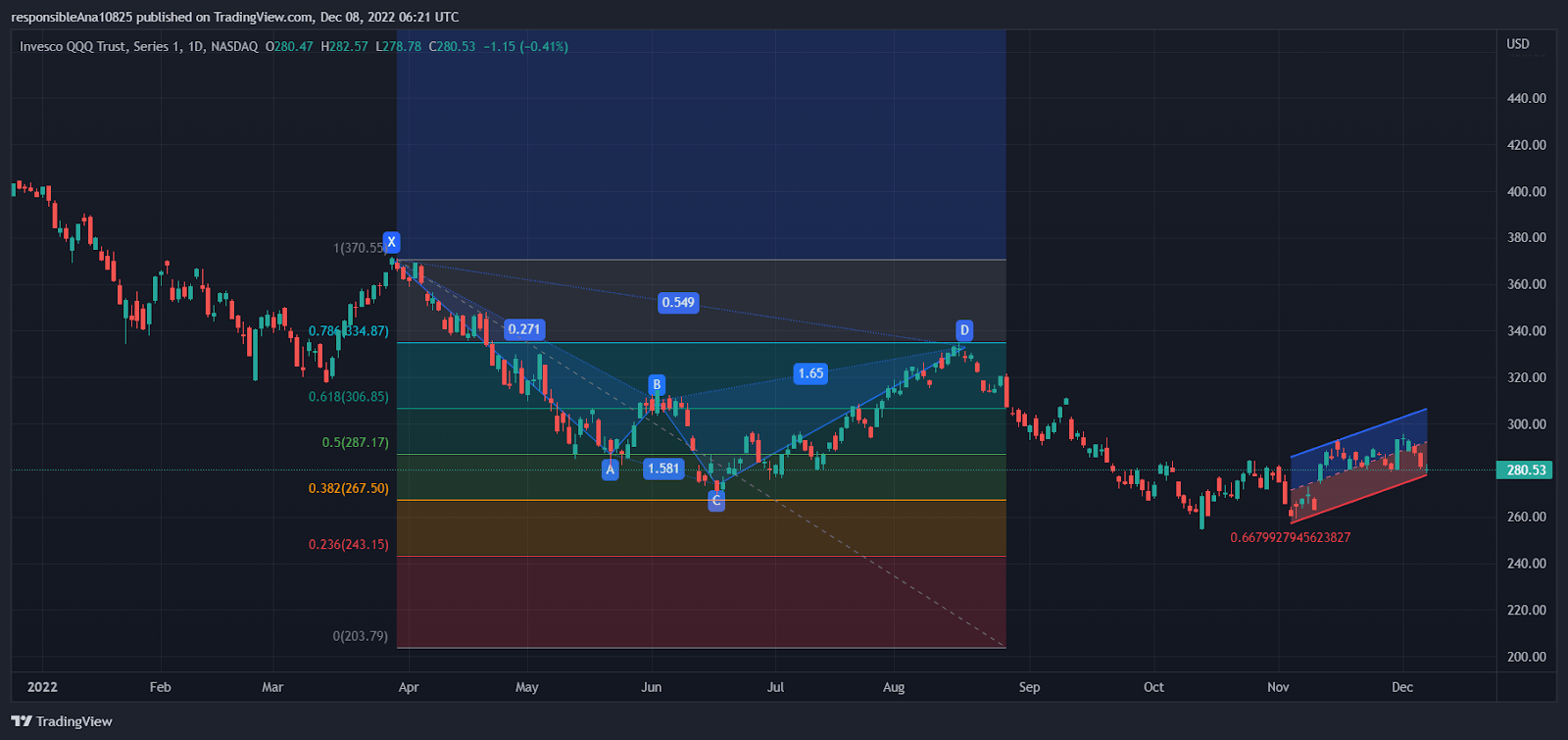

Whale interest for BTC Source: Santiment

According to the chart shared by Santiment, the price of BTC and $1M+ valued whale transactions are closely correlated. The tweet concluded that a continued slide in BTC’s price and a spike in whale interest will be a historic bullish signal that investors and traders need to keep note of.

Daily chart for BTC/USDT Source: CoinMarketCap

The price of BTC has dropped below the 9-day and 20-day EMA lines after a failed attempt at breaking above the two lines in the last 48 hours. BTC’s price has been in a narrow consolidation channel between $16,564.94 and $16,952.00.

Technical indicators on BTC’s daily chart suggest that bears still have a slight upper hand. The first bearish technical indicator is the relative positions of the 9 and 20-day EMA lines. Currently, the 9-day EMA line is positioned below the 20-day EMA line. In addition to this, the 9-day EMA line is breaking away below the 20-day EMA line.

The daily RSI line is also positioned below the daily RSI SMA line and is sloped negatively toward oversold territory.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur