BTC Whales Can Impact BTC’s Price, According to Santiment

The blockchain analysis firm, Santiment, shared its latest insight in a Twitter post today. The insights examine the effect that Bitcoin (BTC) whales have on the markets.

According to the insights, BTC holders who own between 1,000 and 100,000 BTC are a good indicator of long-term price direction. The report added that investors and traders can develop a good understanding of what will happen to BTC’s price by analyzing whale behavior.

Given that BTC whales have been net sellers recently, it seems that the price of BTC will continue to decline or consolidate at the very least for the next 6-12 months. In addition, it will be important to watch what whales do in the $12,200 and $14,600 price range. Whales may begin accumulating BTC at these prices, which is indicative of a cycle bottom, the report added.

BTC is currently trading at $16,598.12 according to CoinMarketCap. This follows after a small 0.18% increase in price over the last 24 hours. Unfortunately, the market leader’s price movement is still in the red on the weekly timeframe and is down 1.43% over the last 7 days.

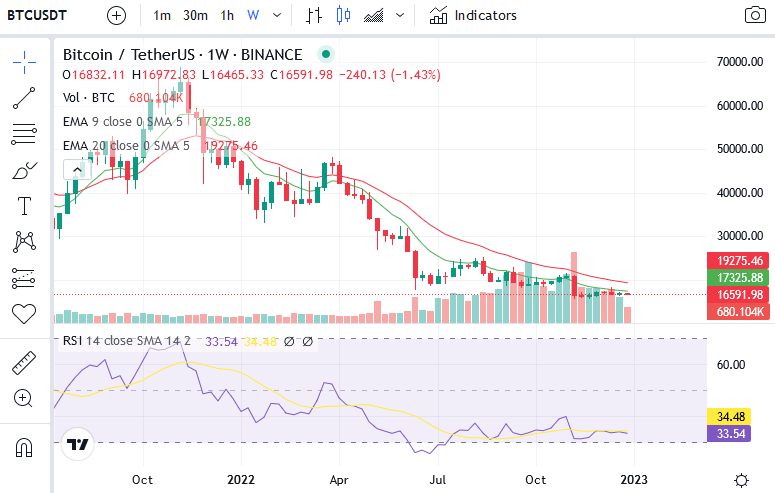

Weekly chart for BTC/USDT (Source: CoinMarketCap)

The price of BTC has consolidated on the weekly timeframe as it gradually makes a move towards the 9-week EMA line, which has maintained its role as a key resistance level in this bear cycle.

Technical indicators suggest that the market leader’s price is in limbo as interest in the crypto market is down. Firstly, the 9-week EMA and 20-week EMA lines are almost neutral and are parallel to each other. Secondly, the weekly RSI line has also leveled out at neutral for the last 5-6 weeks.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Tether Gold

Tether Gold  IOTA

IOTA  Theta Network

Theta Network  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Synthetix Network

Synthetix Network  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Decred

Decred  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  NEM

NEM  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Lisk

Lisk  Status

Status  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD  Bytom

Bytom