Two Catalysts Could Fuel Bitcoin Rally to $30,000, Says Crypto Strategist Michaël van de Poppe

Popular crypto analyst Michaël van de Poppe says he’s looking at two macroeconomic catalysts that could ignite a strong Bitcoin (BTC) surge to $30,000.

The crypto strategist tells his 664,200 Twitter followers that Bitcoin has been grinding up as of late and that a big bounce is in the cards.

“The odds of a relief rally have been increasing recently, and I think it looks good.

All need to be fueled by inflation dropping more than anticipated and the potential pause of hikes.

That will give the relief of Bitcoin towards $30,000ish.”

At time of writing, Bitcoin is changing hands at $17,435. A move toward Van de Poppe’s target suggests an upside potential of over 72% for BTC.

In an effort to combat high inflation, the Federal Reserve raised interest rates multiple times last year, taking the fed funds rate from between 0% and 0.25% in January 2022 to between 4.25% and 4.50% by December.

A high-interest rate environment is typically bearish for risk assets like Bitcoin and crypto as investors have to pay more in borrowing costs to fund new investments.

Meanwhile, a pivot in the Fed’s tight monetary policies could trigger an influx of investments into risk assets.

Van de Poppe also says he’s waiting for the release of the latest Consumer Price Index (CPI) print, which is slated for January 12th. Traders keep a close watch on CPI data to see whether inflation is on the retreat as it could pressure the Federal Reserve to reconsider its hawkish stance.

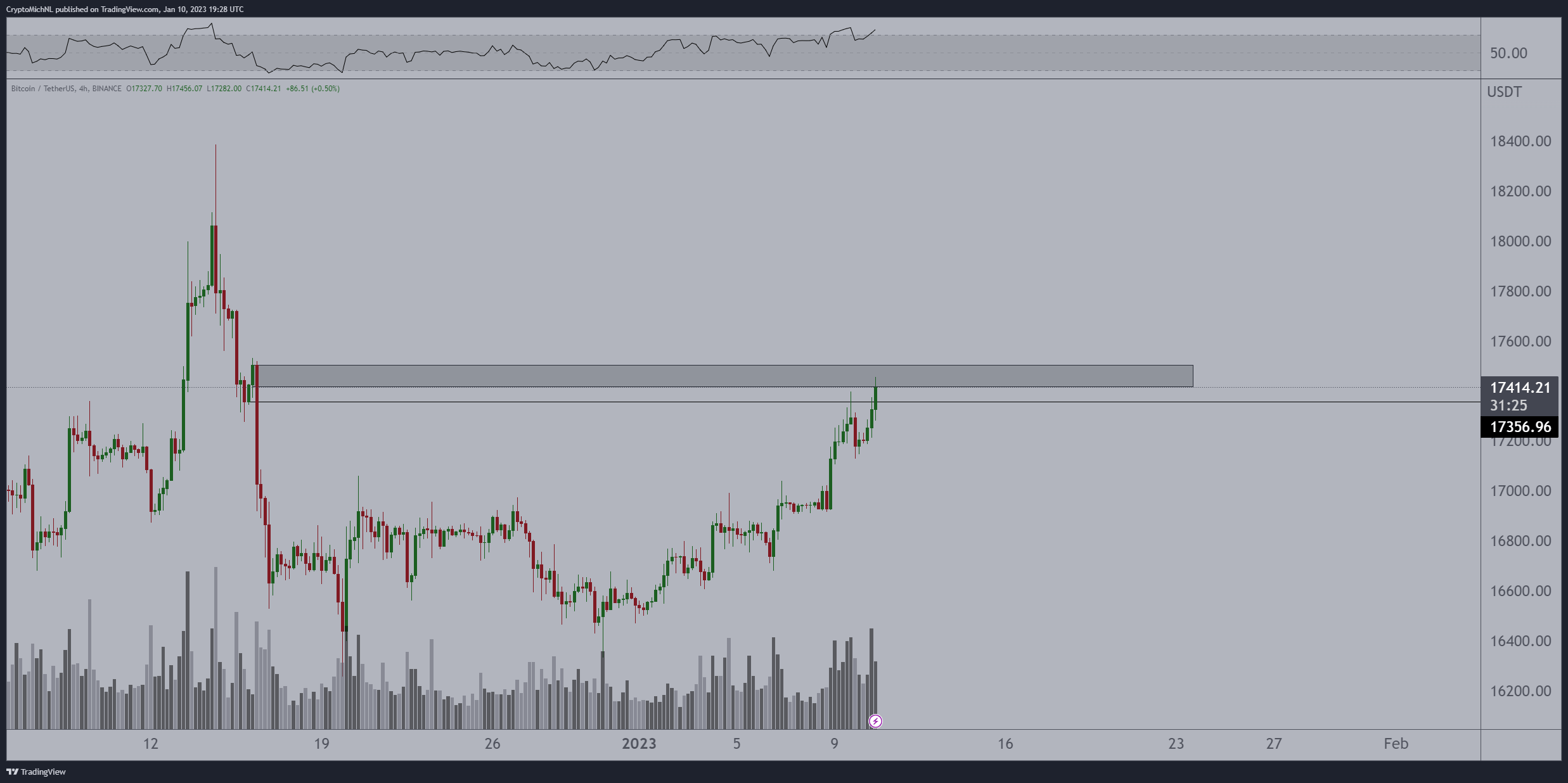

Looking closer at Bitcoin, Van de Poppe expects BTC to pull back before bulls can take out resistance around $17,500.

“Bitcoin did continue the rally and gets into resistance.

Doubt we’ll break out in one go, needs clear conviction in the coming 24 hours otherwise bearish divergence is possible.

Lower timeframe:

Needs to stay above $17,350 in order to continue rallying, otherwise fakeout.”

Source: Michaël van de Poppe/Twitter

Generated Image: Midjourney

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD