Bitcoin Gained 300% In The Year Before Last Halving – What Happens In 2023?

Bitcoin has already proven that it has the potential to deliver gains that are significantly stronger than ‘most think,’ as highlighted by market analyst Rekt Capital. Bitcoin (BTC) is facing a “bottoming candle” in 2023, but the BTC price action is still more than able to surprise the entire crypto market.

In a tweet on January 11, popular trader and analyst Rekt Capital predicted that BTC/USD might see a ‘decent upside’ movement in 2023.

Chart Shows Serious Bitcoin Upside Potential

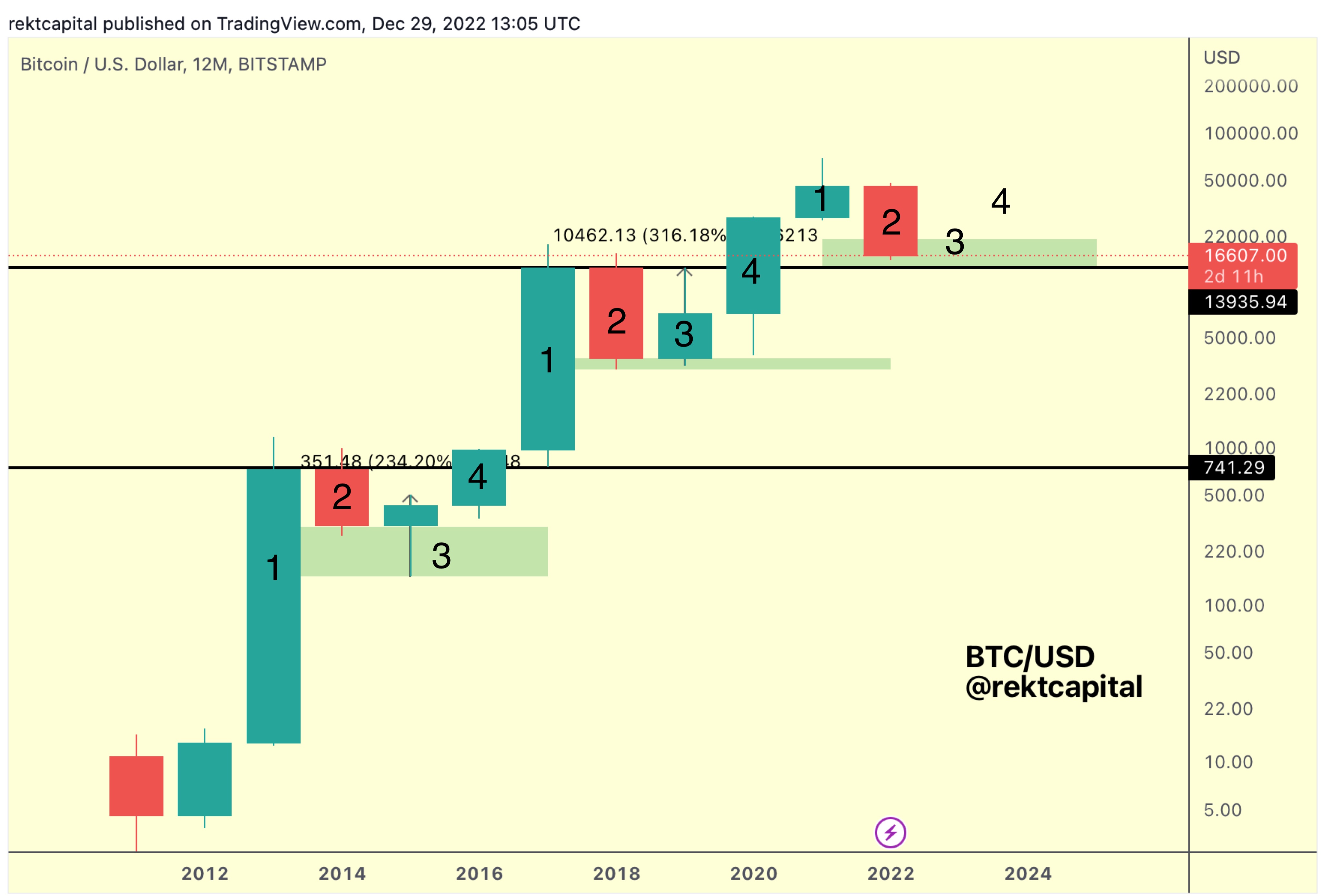

Analyzing Bitcoin’s 4-year market cycles around block subsidy halving events, Rekt Capital said 2023 is the deadline for the crypto’s next “bottoming candle.” With the next halving expected to happen in 2024, the coming 12 months should see a price floor, followed by a rally as the event gets nearer.

2024, therefore, forms the fourth candle in Bitcoin’s current cycle, and 2023 is the third. Rekt Capital said:

“Candle 3 is a Bottoming Candle in the BTC Four Year Cycle. But it can still generate decent upside.”

The scope for Bitcoin to take the market traders and investors by surprise is quite visible in the four-year cycle chart. He continued:

“Candle 3 in 2015 saw a +234% move. Candle 3 in 2019 saw a +316% rally.”

“Candle 3 in 2023 may see a stronger upside than most think.”

BTC/USD annotated chart. Source: Rekt Capital/Twitter

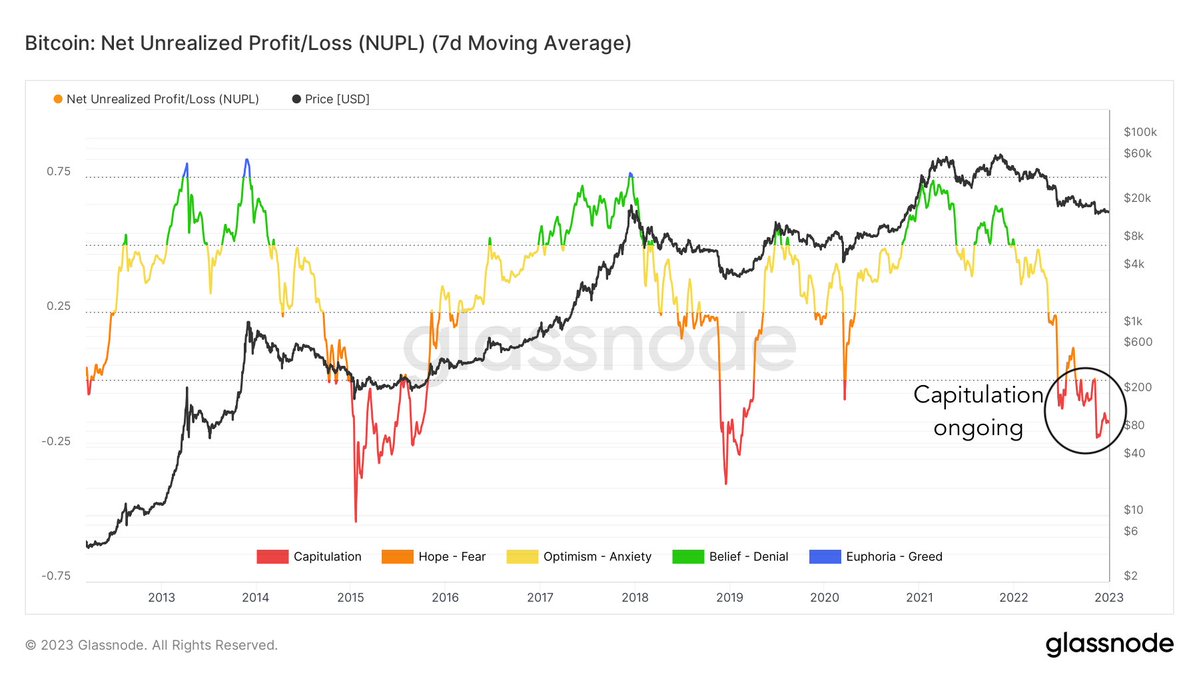

Several other on-chain observations have led market analysts and participants to similarly optimistic conclusions.

Among them, the ratio of unrealized losses that were held by BTC hodlers continues to create a “capitulation” phase, according to a dedicated indicator that monitors the status quo.

On January 11, the trading and analytics account Game of Trades wrote:

“These have been the most profitable times to accumulate Bitcoin. The net unrealized profit/loss is still in deep capitulation territory.”

Bitcoin net unrealized profit/loss ratio annotated chart. Source: Games of Trades/Twitter

2023 Macro Climate Echoes GFC, Warns Analyst

Taking into consideration the current macroeconomic environment, nonetheless, rising from ashes like a phoenix might demand a lot of luck when it comes to the suppressed crypto asset prices.

With the US Federal Reserve still raising interest rates as inflation subsides, worries now focus on the long-term policy implication.

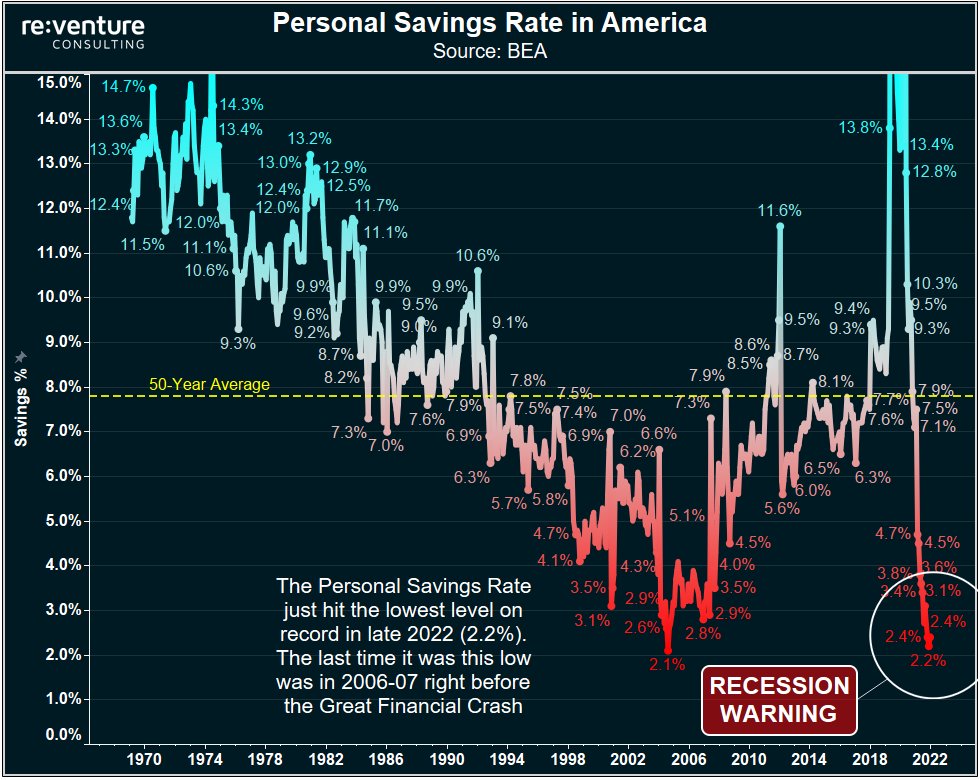

What could impact sentiment next, analysts like Reventure Consulting founder and CEO Nick Gerli believe that it is not inflation but deflation.

Commenting on a market chart of US savings trends, Gerli warned on January 10 that conditions were now ripe for a repeat of the 2008 Global Financial Crisis (GFC) in terms of recession. He said:

“The Savings Rate just collapsed down to 2.2%, the lowest level ever. This means Americans are running out of money. The last time it was this low was 2006-07. Right before GFC. Major Recession Warning. Expect a big decline in consumer spending in 2023.”

U.S. personal savings rate annotated chart. Source: Nick Gerli/Twitter

January 12 will see the first United States Consumer Price Index data release of 2023, and bets have already come in as to how Bitcoin will react.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Zcash

Zcash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  0x Protocol

0x Protocol  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren