Surprising Bitcoin (BTC) Price Spike Driven by Whales, Data Says

While the ongoing upsurge of cryptocurrency prices should be attributed to a group of factors, the enthusiasm of largest holders is definitely one of them.

Whales with 100+ Bitcoins (BTC) push price higher: Santiment

According to statistics provided by a top-tier crypto data tracker Santiment, a number of whales (largest holders) with 100-1000 Bitcoins (BTC) in on-chain wallets surged over last weeks.

? Amongst many of the foreshadowing metrics for this 2023 breakout was the rapidly growing amount of addresses holding 100 to 1,000 $BTC. Price pumps generally occur marketwide when whales accumulate #Bitcoin. The #1 asset in #crypto is +26% in two weeks. https://t.co/JMh83m3mIu pic.twitter.com/FiRTLIc3LB

— Santiment (@santimentfeed) January 14, 2023

Since the collapse of the FTX/Alameda ecosystem in early November 2022 and the devastating Bitcoin (BTC) price plunge below $16,000, BTC whales were aggressively accumulating.

Namely, Santiment data indexing mechanisms registered 416 new addresses with on-chain Bitcoin (BTC) balances below 100 and 1,000 coins.

As such, this crucial metric demonstrated a more than 3% increase over last painful weeks. During this period, the Bitcoin (BTC) price added 26%.

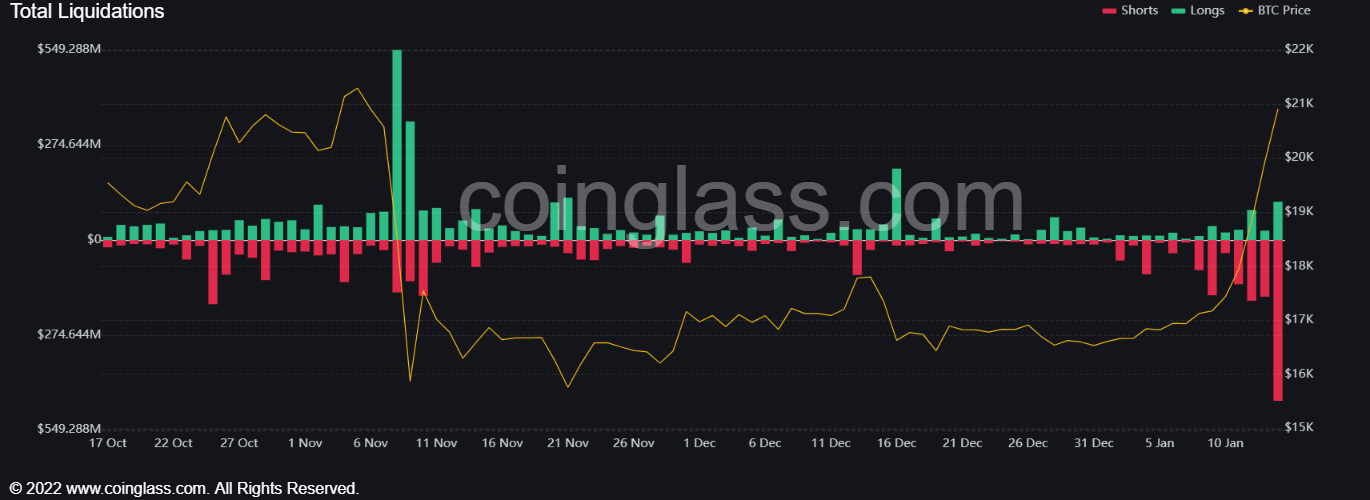

$1.2 billion in shorts erased in one week

As covered by U.Today earlier today, Bitcoin (BTC) and all major altcoins have demonstrated breathtaking growth in the last 24 hours. The orange coin reached its 10-week high at $21,095, while Ethereum (ETH) peaked at $1,564.

As a result, over $731 million in futures positions (mostly shorts) were liquidated. Over the last seven sessions, more than $1.21 billion in equivalent were lost by crypto bears, as per Coinglass (formerly Bybt) data.

However, these dynamics might be cruel for traders as volatility increases as well. The largest single liquidation of Jan. 14 so far happened to a Bitcoin (BTC) bull who lost $1.2 million on BitMEX in a XBTUSD long position.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD