Will Ethereum price take a break before $2,000?

- Ethereum price starts a new trading week at $1,571.

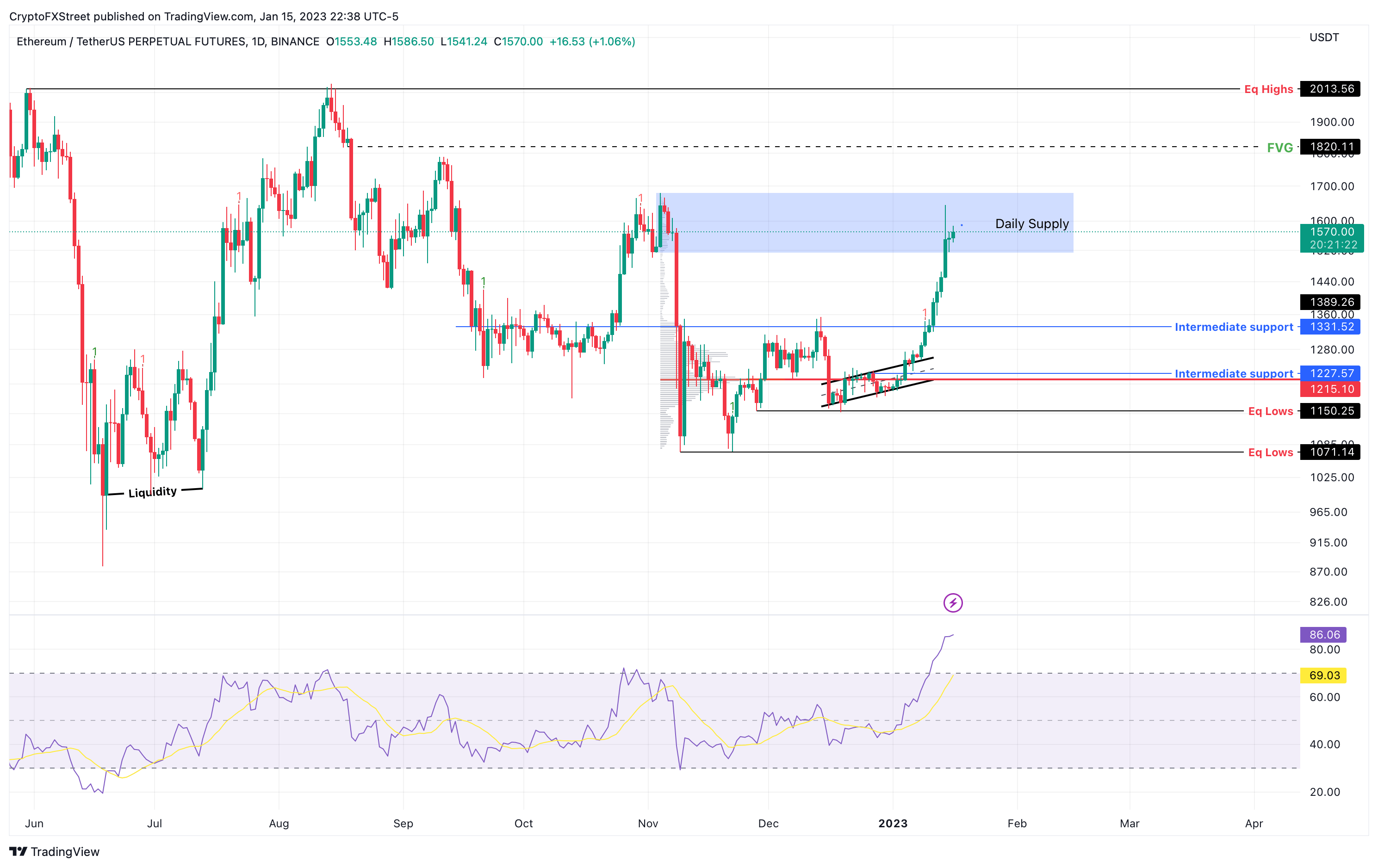

- RSI has hit levels last seen in August 2021, when ETH kick-started its rally to $4,900.

- Failure to overcome the $1,514 to $1,679 supply zone could result in a reversal.

Ethereum price stands tall after its two-week long rally without any signs of reversal. However, ETH is currently facing some significant hurdles that could trigger its reversal, so investors need to exercise caution.

Ethereum price at inflection point

Ethereum price has rallied 37% since January 1 and shows no signs of slowing down even as it pierces through a daily supply zone that extends from $1,515 to $1,679. This exponential move has Bitcoin to thank for initiating this run-up.

Furthermore, the speculation on Ethereum price is relatively higher compared to other altcoins due to the upcoming Shanghai hard fork. All-in-all, this rally was impressive but ETH bulls face a tough decision — overcome $1,679 and continue its rally or retrace due to exhaustion.

The Relative Strength Index (RSI) has extended into the overbought zone. The last time Ethereum price has such a huge spike in momentum was in August 2021, when ETH kick-started its ascent to $4,900.

Ideally, a retracement to stable support levels should occur before a further run-up. A confirmation of a pullback will occur if Ethereum price starts to form a local top in the aforementioned supply zone. In such a case, ETH will eye a retest of $1,820 and $2,013 hurdles, respectively.

ETH/USDT 1-day chart

While the bullish outlook does look apparent, investors need to exercise caution, especially after such a massive bear market rally. If Ethereum price produces daily candlestick close below $1,514, it will be the first sign of a reversal.

In such a case, if Ethereum price sets up a lower low below the said supply zone, it will add confirmation to the bullish exhaustion. This development should see ETH target the $1,331 support level, allowing bulls to recuperate for the next Ethereum price rally.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Ren

Ren