Up 25% in 7 Days, This Crypto’s Next Move Deserves Your Attention

Among other cryptocurrencies, the price of Ethereum (ETH) in 2023 has continued to demonstrate impressive strength in the broader crypto market. In spite of the fact that some market participants may still be skeptical, there is a chance that ETH may surge significantly based on the technical factors currently favoring the second-largest cryptocurrency by market cap.

Ethereum’s Key Price Levels

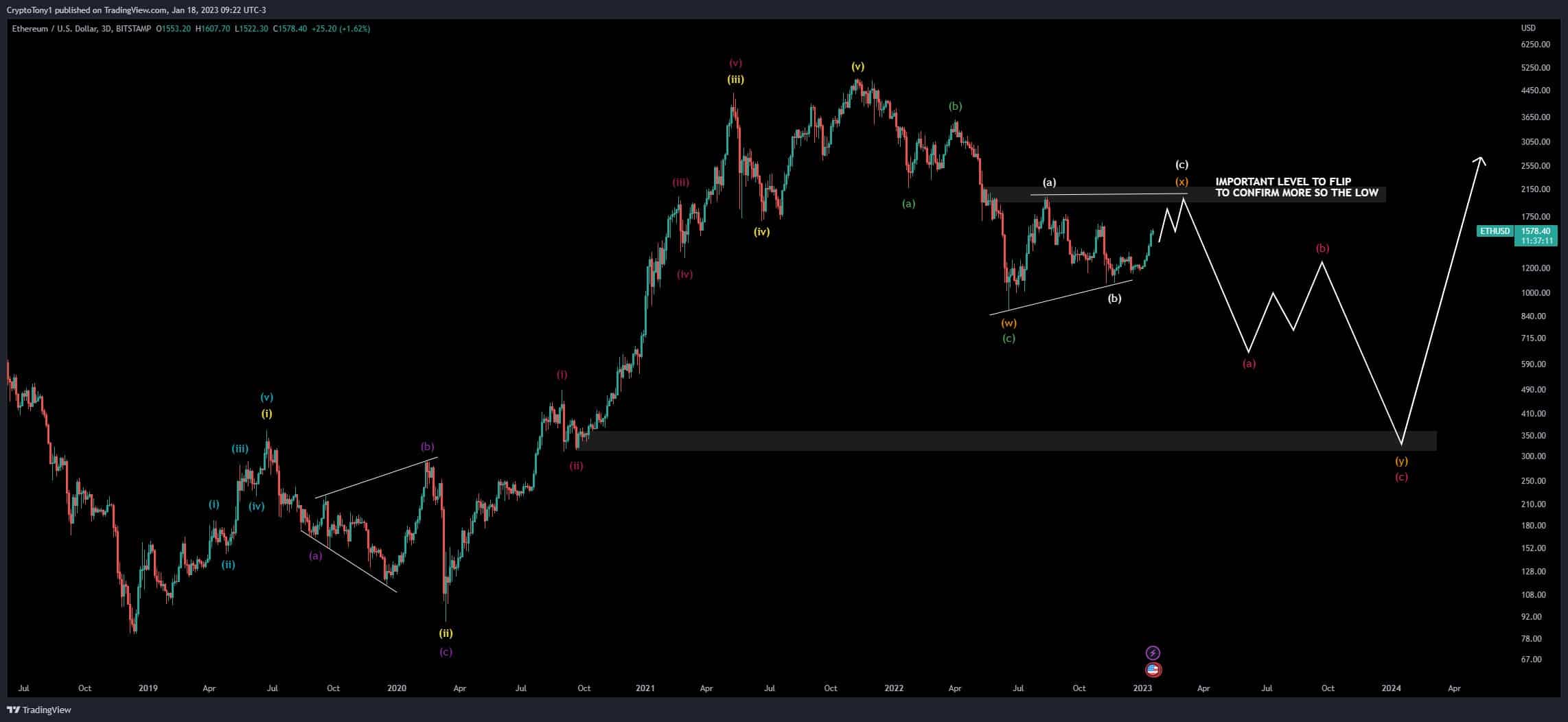

The ETH price has delivered nine consecutive days of green daily candles, demonstrating significant market vigor. Since ETH had its most recent halt at around $1,197, the newly discovered uptrend has recovered 25% of the market value that investors had lost. However, according to a well-known crypto analyst Crypto Tony, the price range of $2,250 – $2,500 determines a key level for ETH. Breaching these price levels will validate a price bottom for further uptrend.

He goes on to say that the decline in the price of Ethereum will greatly depend on the state of the stock market and global economics for the remainder of this year. Additionally, the Relative Strength Index (RSI), an indicator that is used to evaluate the underlying power of market participants, demonstrates that the price of ETH is in severely overbought conditions near the level of 90. In January 2021, when Ethereum momentarily marked $1,300 and established a new all-time high, the RSI read 90 for the last time.

Factors Driving ETH Price

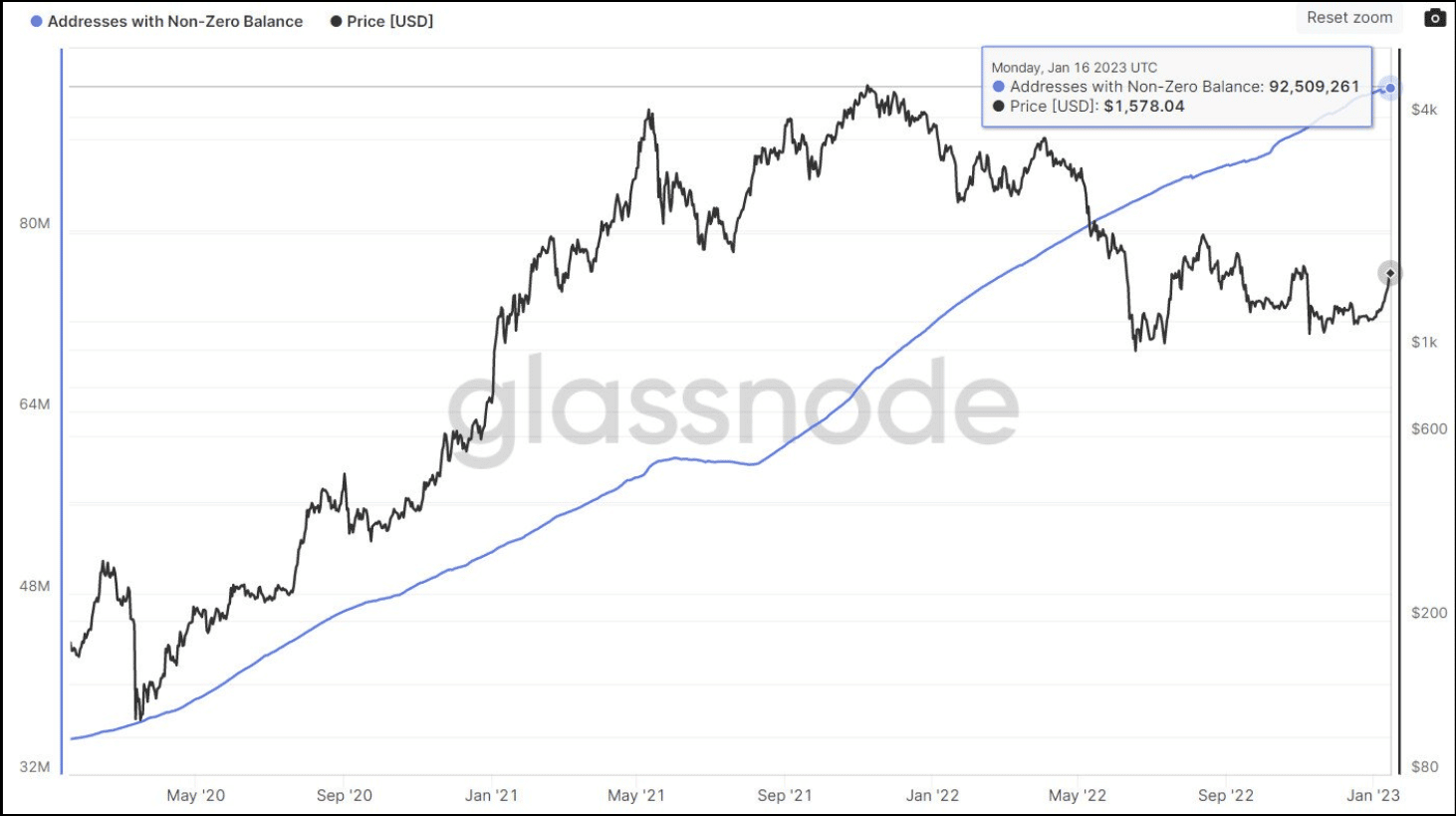

On Monday, the number of Ethereum addresses that have a balance greater than zero reached a new all-time high of 92.5 million, breaking the previous record set on Friday. It does not appear that the bear market of 2022, which ended in the closure of one of the world’s formerly largest cryptocurrency exchanges in November, had any effect on the growth in the number of addresses that have a balance greater than zero.

Read More: Bitcoin Bulls Need to Clear This Key Level For BTC Price To Rally

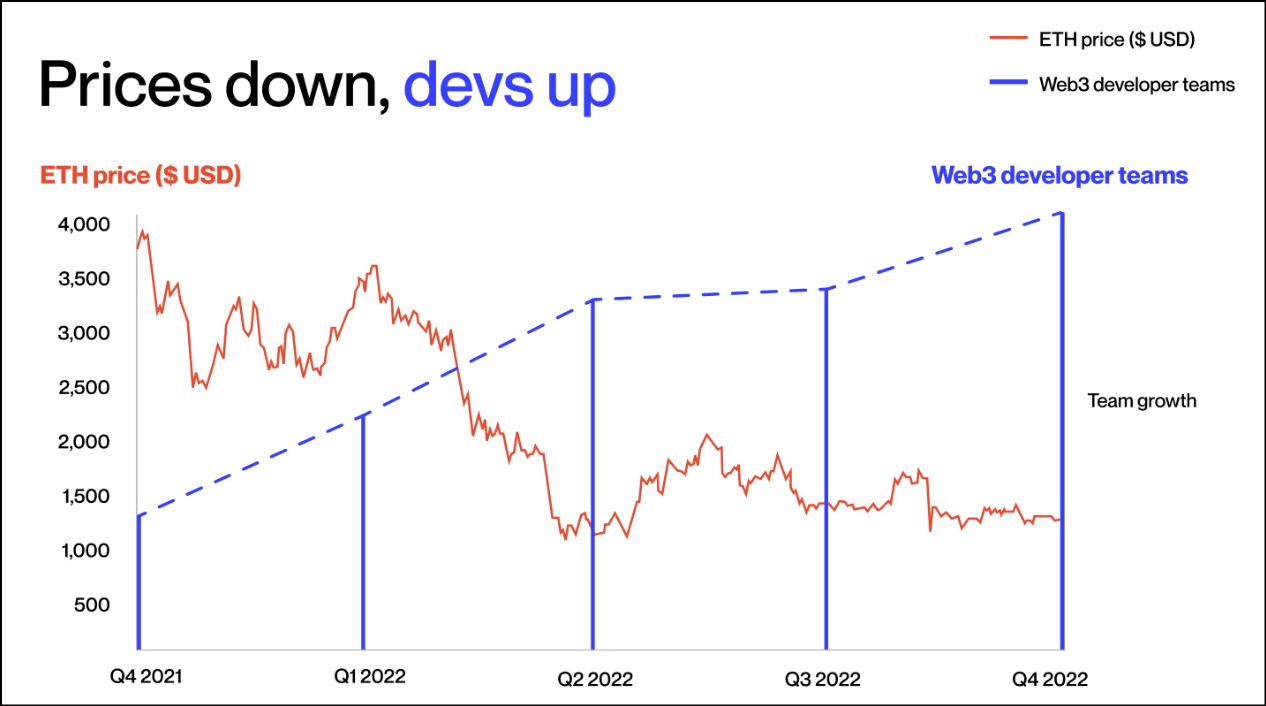

In addition, according to a report recently published by the blockchain software development firm Alchemy, the number of smart contracts implemented on the Ethereum mainnet increased by an astounding 300% in 2022. And, in spite of the bear market of 2022, smart contract deployment growth essentially matched the rate of growth experienced in 2021. At the end of Q4 2022, 4.6 million smart contracts were active on the Ethereum blockchain, according to the research.

As things stand, the price of Ethereum (ETH) is currently being traded at $1,598. This represents an increase of 0.96% in the past 24 hours, in contrast to its 19.76% jump during the last seven days, as per CoinGape’s crypto market tracker.

Also Read: Crypto Fraudster Charged In $4.5 Bn Bitcoin Theft Lands New Marketing Job

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Zcash

Zcash  Tether Gold

Tether Gold  IOTA

IOTA  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Dash

Dash  Enjin Coin

Enjin Coin  Qtum

Qtum  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  DigiByte

DigiByte  Lisk

Lisk  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy