Bitcoin Price Rally Post Fed Rate Hike Could Gather Momentum, Here’s Why

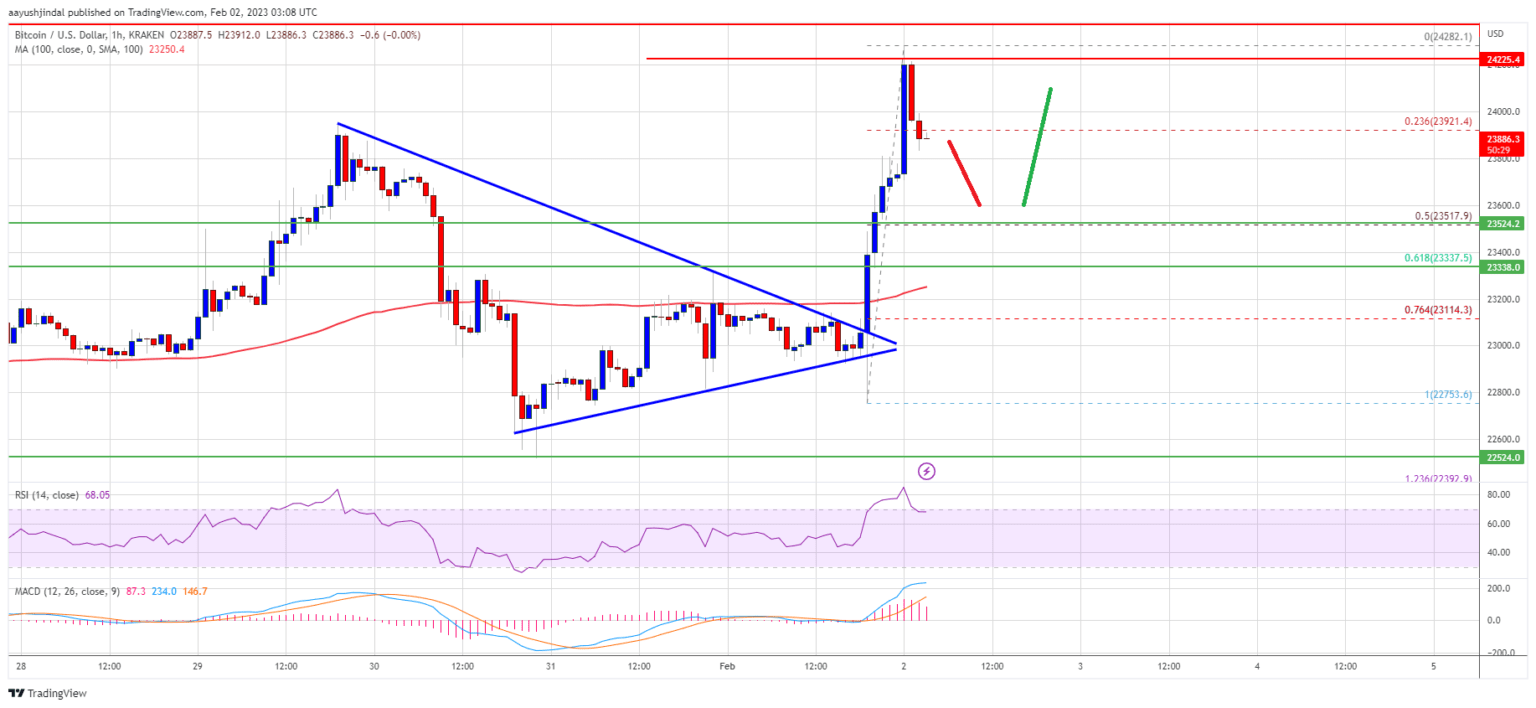

Bitcoin price is rising and gaining pace above the $23,500 resistance. BTC climbed to a new yearly high after the fed increased rates by 25bps.

- Bitcoin is up over 3% and there was a clear move above the $23,800 resistance.

- The price is trading above $23,500 and the 100 hourly simple moving average.

- There was a break above a major bearish trend line with resistance near $23,100 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could rally further if it stays above the $23,500 support zone.

Bitcoin Price Rips Higher

Bitcoin price formed a base above the $22,500 support zone. BTC started a fresh increase and was able to clear the $23,200 resistance zone. Later, the fed announced a small rate hike as expected, sparking bullish moves in btc.

The price gained pace for a move above the $23,500 resistance. There was a break above a major bearish trend line with resistance near $23,100 on the hourly chart of the BTC/USD pair. It even pumped above the $24,000 resistance zone and traded to a new yearly high at $24,282.

It is now correcting gains and traded below $24,000. There was a move below the 23.6% Fib retracement level of the upward move from the $22,753 swing low to $24,282 high.

Bitcoin price is now trading above $23,500 and the 100 hourly simple moving average. An immediate resistance is near the $24,100 level. The next major resistance is near the $24,250 zone. A clear move above the $24,250 resistance might send the price further higher.

Source: BTCUSD on TradingView.com

In the stated case, the price may perhaps rise towards the $25,000 level. The next resistance could be near the $25,500 level followed by $26,200.

Dips Attractive in BTC?

If bitcoin price fails to clear the $24,250 resistance, it could start another downward move. An immediate support on the downside is near the $23,650 zone.

The next major support is near the $23,500 zone or the 50% Fib retracement level of the upward move from the $22,753 swing low to $24,282 high. A downside break below the $23,500 level might send the price towards the $23,000 level. Any more losses might send the price to $22,500 in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $23,650, followed by $23,500.

Major Resistance Levels – $24,100, $24,250 and $25,000.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Nano

Nano  Enjin Coin

Enjin Coin  Status

Status  Ontology

Ontology  Hive

Hive  Waves

Waves  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  BUSD

BUSD  Numeraire

Numeraire  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur  HUSD

HUSD