Ethereum (ETH) Price To Crash Following U.S. CPI Data?

The price of Ethereum (ETH) is experiencing massive instability around $1,490, as the monthly pivot for February is also experiencing severe pressure. As lower highs continue to be established, the bearish squeeze is becoming increasingly apparent. Additionally, several on-chain factors point to ETH being on the verge of a price meltdown, which would occur in the event that the macroeconomic data comes out to be unfavorable.

U.S. CPI Data Acting As Catalyst

In recent days, the cryptocurrency market has been in a state of turmoil, with Ethereum going through a huge price correction that has caused its value to decline from a high of $1,710 to a low of $1,460 in the past 11 days. The behavior of Ethereum whales can have a substantial impact on price corrections, despite the fact that market factors can also play a vital role.

According to statistics collected on the Ethereum blockchain, during this 11-day period, whales who had between 100,000 and 1,000,000 ETH sold or redistributed around 350,000 ETH, which was worth $560 million. The sharp price decline that the cryptocurrency witnessed may have been considerably impacted by this large exodus of the asset.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

When it comes to macroeconomic data like the U.S. CPI data, if inflation stays the same or even increases, there will be a tendency toward selling ETH. Traders should be mindful of one thing despite the fact that markets may still believe that a decline is likely to occur at some point. Every ten years, the inflation basket and indicators undergo small but significant changes in order to more precisely reflect real inflation.

This modification already adds a little bit more weight to several headline aspects such as food, apparel, and technology, all of which did not show any indications of cooling down and are even pointing to a higher value due to the fact that they are pointing to a higher valuation. Without taking into account the real figures, the inflation number is then adjusted so that it will at the very least remain unchanged or will barely climb higher. You should anticipate a knee-jerk reaction with a knife-through-butter move at $1,440, which is the location of both the 55-day and the 200-day Simple Moving Averages (SMAs), before price movement dives deeper towards $1,243, which is close to the bottom from February 2021.

Ethereum (ETH) Price Action

Moreover, as per prominent crypto analyst, Rekt Capital, the ETH price is eyeing a further drop which is close to embracing its earlier multi-month downward trend.

$ETH is getting close to retesting its multi-month downtrend#ETH #Crypto #Ethereum https://t.co/P2sv8xK30l pic.twitter.com/YkIxq6ngS3

— Rekt Capital (@rektcapital) February 13, 2023

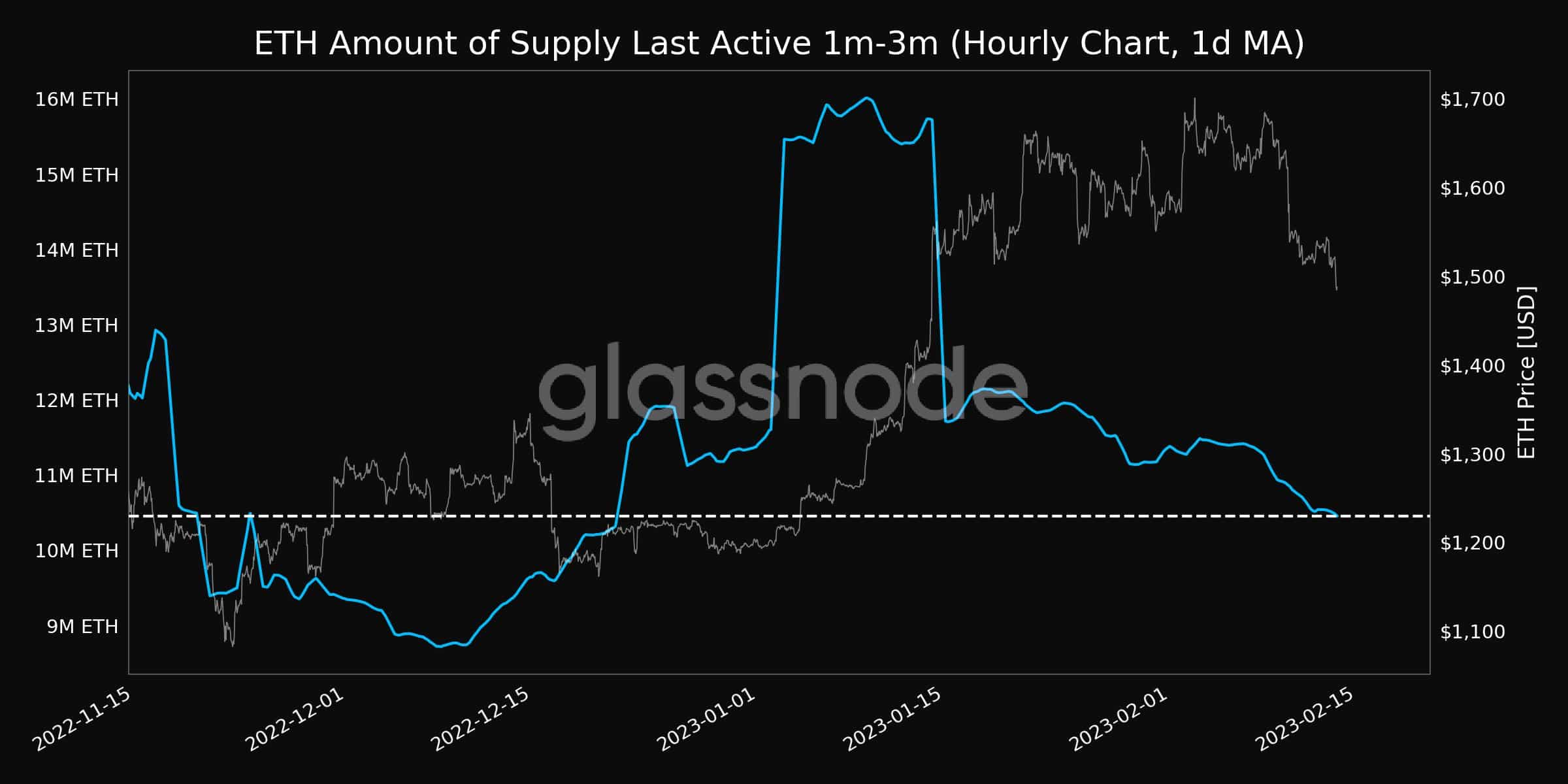

In addition, Glassnode notifies that the amount of supply of the last active 1m-3m (1d MA) just reached a 1-month low of 10,456,635.485 ETH. This signifies the fading trust in the altcoin supremo for the time being which might indicate towards acting as a catalyst to the fall in price.

As things currently stand, the price of Ethereum (ETH) is currently trading at $1,487 which represents a decrease of 3% over the past 24 hours, in contrast to a decline of 9% over the last seven days.

Also Read: Rich Dad Poor Dad Author Predicts “Valentine Day Massacre”, Another Crypto Crash?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD