Data Shows Binance Is Now the New Leader of Derivatives after FTX

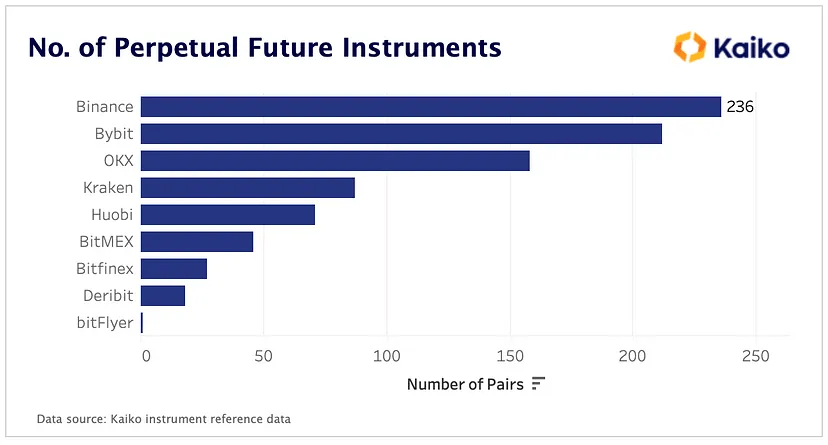

According to a blog post by Kaiko, an institutional-grade crypto market tracker, the Binance exchange has taken over from FTX as the market leader in the perpetual futures space, with the most number of pairs offered.

Kaiko stated this point in a recent bulletin analyzing the current state of the global crypto market. The market tracker claims FTX was on the frontier of derivative contracts until its demise last November, but Binance now occupies the position with 236 listed pairs.

While Bybit and OKX are within close range of Binance, other exchanges such as Kraken, Huobi, and BitMex are far behind, offering fewer than 100 perpetual futures instruments.

Source: Kaiko Blog Post

Furthermore, the institutional market tracker discussed other metrics for trading Bitcoin (BTC) perpetual contracts, such as Open Interest (OI). It noted that OI for derivative contracts remained relatively stable at around 280k BTC last week even though the volatility of the Bitcoin market surged to its highest levels since the FTX collapse.

Contextually, Open Interest refers to the total number of outstanding derivative contracts, such as options or futures, awaiting settlement. The fact that OI remained steady despite increased volatility suggests that traders made no significant changes to their positions during the week.

However, according to Kaiko, Open Interest is still down 17% relative to November 2022. Commenting on macro trends, the market tracker stated that crypto has been decoupling from traditional assets in 2023 as macro headwinds subside and crypto-specific events increasingly drive the market. Bitcoin trades at $25,042.58 after seeing an over 15% increase in the past week.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Ren

Ren