S Korean Regulator Launches Crypto Trading Platform Probe – Which Exchanges Are Involved?

South Korea’s top financial regulator, the Financial Services Commission (FSC), has begun a “comprehensive inspection” of the nation’s crypto exchanges.

Per Decenter, Financial Services Commission (FSC) specifically wants to probe the 20 trading platforms that do not have licenses to trade fiat KRW. The media outlet noted that this is “the first time” the FSC has conducted a “comprehensive inspection” of exchanges that do not operate in the fiat markets.

The outlet said it expected that the inspection will focus on anti-money laundering protocols.

Under South Korean law, exchanges can offer crypto-to-crypto trading services, provided they meet certain criteria. To obtain fiat-trading licenses, however, they must form partnerships with commercial banks.

These banks must provide all exchange users with real name-, social security number-verified accounts linked to their crypto wallets.

The “big four” crypto exchanges – Upbit, Bithumb, Korbit, and Coinone – have had such banking partnerships in place for several years. The remaining 21 South Korean exchanges, meanwhile, have been left to pursue banking deals with domestic banks. Thus far, only one of their number – Gopax – has been successful.

Which South Korean Exchanges Will Be Investigated?

The FSC stated that it would begin its probe with GDAC. This is one of the exchanges involved last year in the controversial delisting of the Wemix token – a coin created by the domestic gaming giant WeMade.

GDAC left observers stunned when it announced that it would be listing Wemix – just two hours after the “big four” announced they would be removing the coin from their platforms.

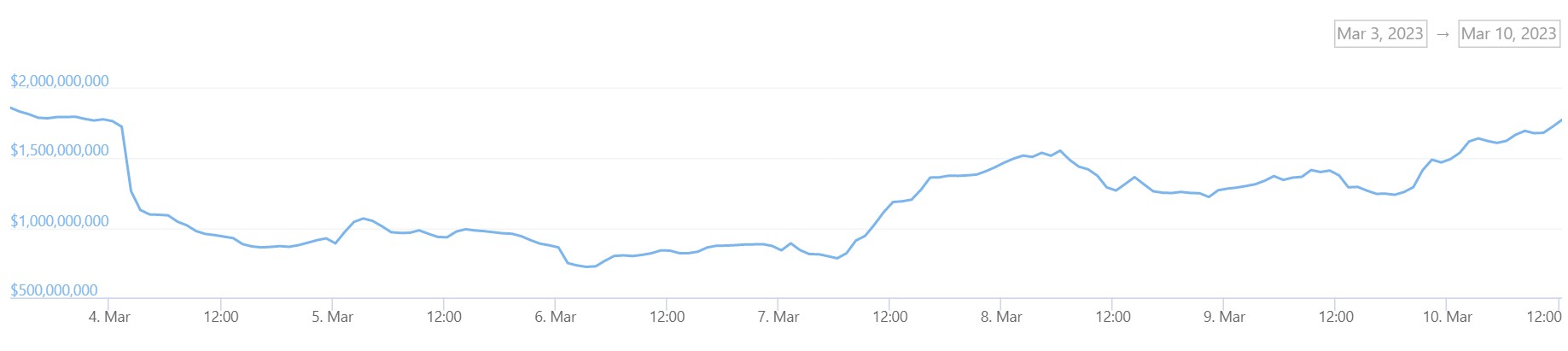

Trading volumes on South Korea’s market-leading Upbit crypto exchange over the past seven days. (Source: CoinGecko)

The media outlet stated that some insiders believe the FSC has decided to start its probe at GDAC for this reason.

But others appear to believe that the authorities “may have started” its investigation with the exchange ahead of a possible GDAC application to rejoin the KRW market. This would suggest that a behind-the-scenes deal may have been struck with a bank.

The media outlet reported that GDAC officials said they had not yet been informed about the date of the FSC visit.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond