SBF shilled FTX risk model to FDIC chairman Gruenberg prior collapse

Before crypto exchange FTX and its founder Sam Bankman-Fried (SBF) got tied down around allegations of misappropriation of users’ funds, SBF was among the most influential crypto entrepreneurs. Long before FTX collapsed, an allegedly leaked email exchange with a top regulator shows SBF’s intent to get the exchange federally regulated.

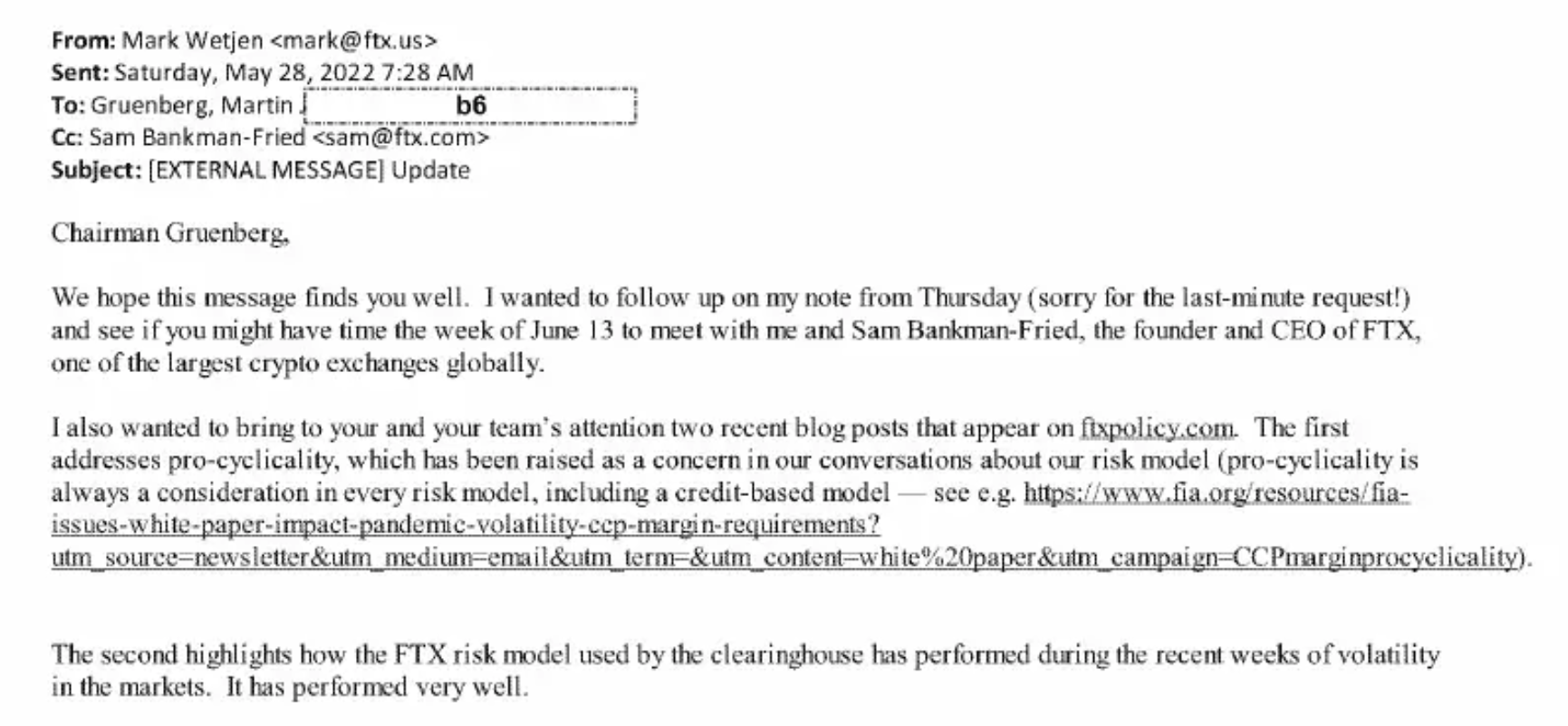

On May 28, 2022, nearly six months before FTX filed for bankruptcy and SBF resigned as the CEO, Federal Deposit Insurance Corporation (FDIC) Chairman Martin Gruenberg received an invitation to meet SBF on June 13, 2022, Washington Examiner reported. The email was mediated by former CFTC Commissioner Mark Wetjen, who joined FTX US as the Head of Policy and Regulatory Strategy in Nov. 2021.

Sam Bankman-Fried’s meeting invitation to FDIC Chairman Martin Gruenberg. Source: Washington Examiner

In the latter half of the email, Wetjen told Gruenberg that FTX is in the “unusual position of begging the federal government to regulate us.” He further added:

“We have an application before the CFTC that lays out for the agency how to do so. All the CFTC has to do is approve it. Once the CFTC does, the others will follow — the other major US exchanges also have CFTC licenses.”

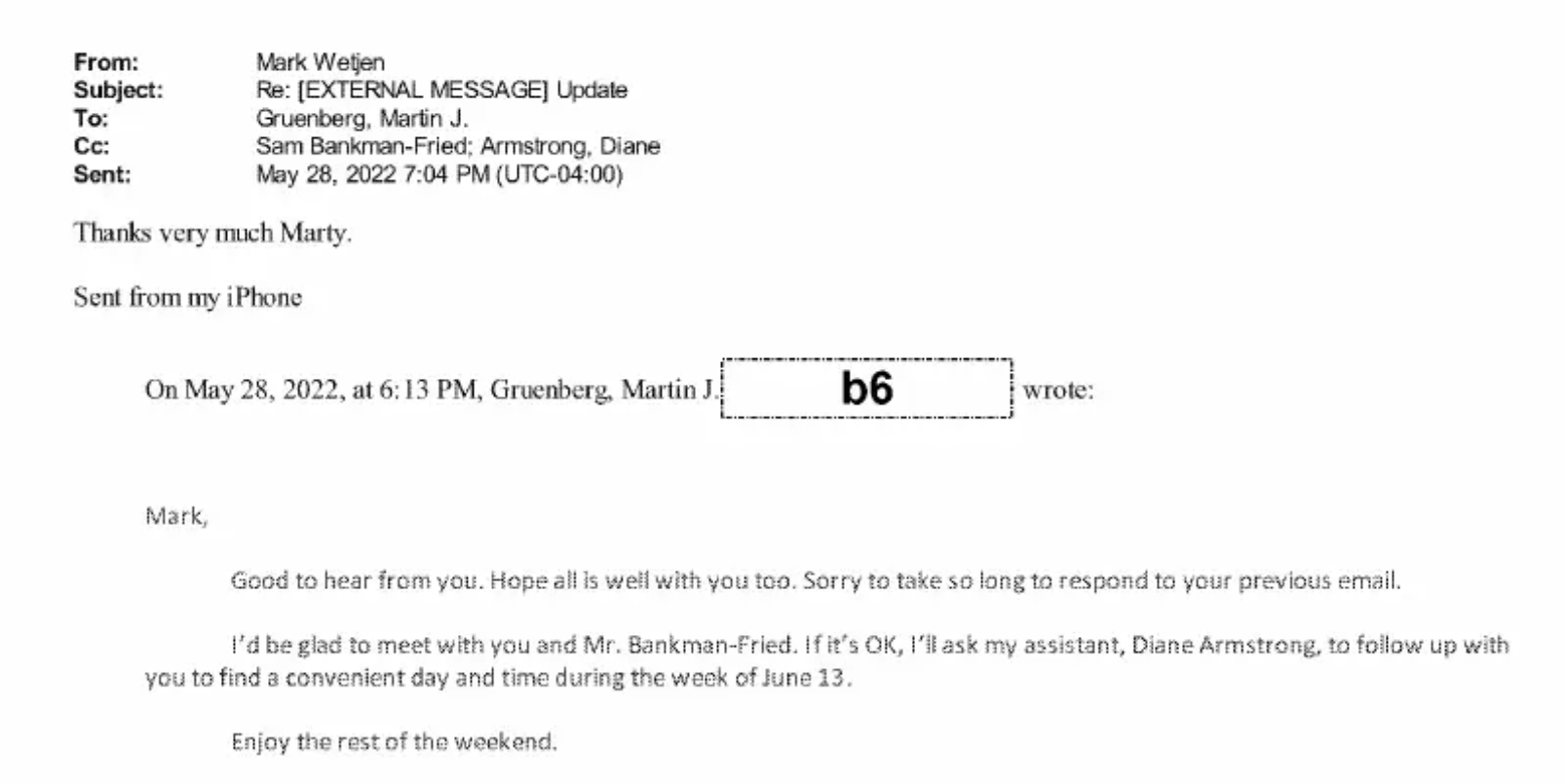

In response to the SBF’s request, Gruenberg agreed to meet the duo, as shown in the leaked email below.

FDIC chairman Martin Gruenberg accepts Sam Bankman-Fried’s meeting invitation. Source: Washington Examiner

Following the collapse of FTX, SBF’s political ties were uncovered amid parallel investigations. An FDIC spokesperson confirmed that the FDIC chairman met SBF as part of “routine courtesy visits with leaders of financial firms and institutions.”

Related: Sam Bankman-Fried to propose revised bail package ‘by next week’

Alongside federal investigations, FTX’s new management started conducting internal investigations to track down missing funds.

Sharing the FTX Debtors’ press release just issued: https://t.co/r7PlneGSXF

— FTX (@FTX_Official) March 16, 2023

Recent court documents revealed that SBF and five other former executives of FTX and Alameda Research received $3.2 billion in payments and loans from FTX-linked entities. SBF reportedly received the lion’s share of the funds at $2.2 billion out of the lot.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  Zcash

Zcash  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  DigiByte

DigiByte  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD