Is Bitcoin’s Security at Risk? Experts Weigh In

Bitcoin (BTC) is recovering its bullish momentum after a short period of consolidation between $26,600 and $27,400. The largest cryptocurrency in the market seems poised to breach higher levels if it closes the month above $27,000.

Bitcoin’s potential to achieve new yearly highs and initiate a bull run is currently being discussed in the market. However, the security of the largest crypto by market cap is a less discussed topic.

Justin Bons, the founder of Cyber Capital, Europe’s oldest cryptocurrency fund and a full-time crypto researcher, has expressed concerns about certain factors that could significantly reduce Bitcoin’s network security.

Is Bitcoin’s Security Model Unsustainable?

According to a recent Twitter post by Justin Bons, he suggests that the sustainability of BTC’s security model and the current hash rate might not increase with its price.

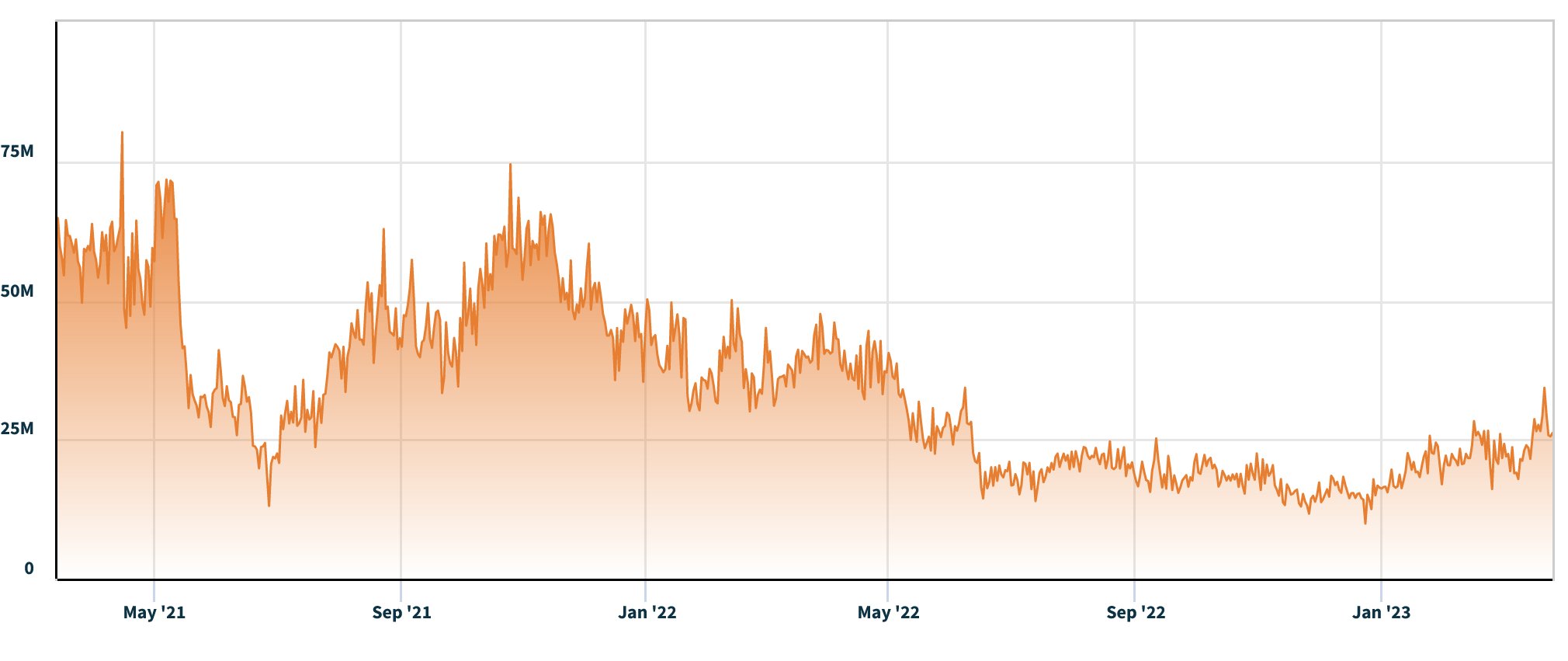

Justin Bons further argues that price drops and halvings (when the block reward for miners is reduced in half) result in exponentially lower security for the network. As seen in the chart below, Bons suggests that BTC’s security is lower than two years ago.

According to Bons, the chart shows Bitcoin miner revenue, specifically the block reward that miners receive for processing transactions and adding them to the blockchain. Bons clarifies that this differs from hash rate, a metric measuring the computing power used to mine Bitcoin blocks.

Bons further argues that the hash rate is not necessarily an accurate indicator of Bitcoin’s security, as the hash rate can increase while miner revenue decreases. This is because as hardware for mining improves and becomes more efficient, it costs less to produce the same number of hashes.

This means that even if the hash rate increases, it does not necessarily mean the network is more secure. Bons highlights the importance of considering multiple metrics when evaluating the security of Bitcoin’s network rather than relying solely on the hash rate.

For Bons, the cost goes into producing those hashes that ultimately secure BTC’s network, claiming that what matters most is the cost of “attacking” Bitcoin, which is not solely determined by hash rate.

What Are The Options For Bitcoin?

Bons further claims that as the block rewards for miners decrease over time, the network will increasingly rely on Bitcoin transaction (TX) fees to incentivize miners to secure the network.

If TX fees are not high enough, the author believes that the security of Bitcoin will decrease to a point where it becomes profitable for attackers to launch an attack, rendering the network insecure.

Bons suggests that if the security of Bitcoin’s network continues to decrease due to low transaction fees, two options may be left to address the issue.

The first option, according to Bons, would be to increase Bitcoin’s supply inflation by creating more Bitcoin beyond the 21 million that was originally intended. This would increase the circulation of Bitcoin and could help to incentivize miners to continue securing the network, even if transaction fees are low.

The second option would be to allow the network to come under attack with double-spending. This would be a serious security breach, allowing attackers to steal funds from other users on the network by spending the same Bitcoin twice. This would be the last resource and could result in a loss of confidence in Bitcoin’s security and value.

Overall, Bons suggests that BTC’s security model may not be sustainable in the long run and that changes may need to be made to ensure the network’s security and longevity.

Featured image from Unsplahs, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren