Ethereum (ETH) Retains Strong Demand as Shapella Upgrade Looms

ETH price appears to have stagnated in the past week as developers gear up for the Shappela upgrade. However, Ethereum’s on-chain fundamentals remain strong despite growing media FUD. Will the resilient whales be able to hold firm?

Growing network usage and whale accumulation have sustained demand for Ethereum as network upgrade nears. ETH could now approach the upcoming network upgrade in a strong position.

Daily Usage Remains Steady on Ethereum

Ethereum (ETH) delivered a weaker growth performance in Q1 with a 49% return, which pales in contrast to Bitcoin’s 70%. This has been attributed to the uncertainty surrounding completing the ETH2.0 Proof of Stake transition, which began last September.

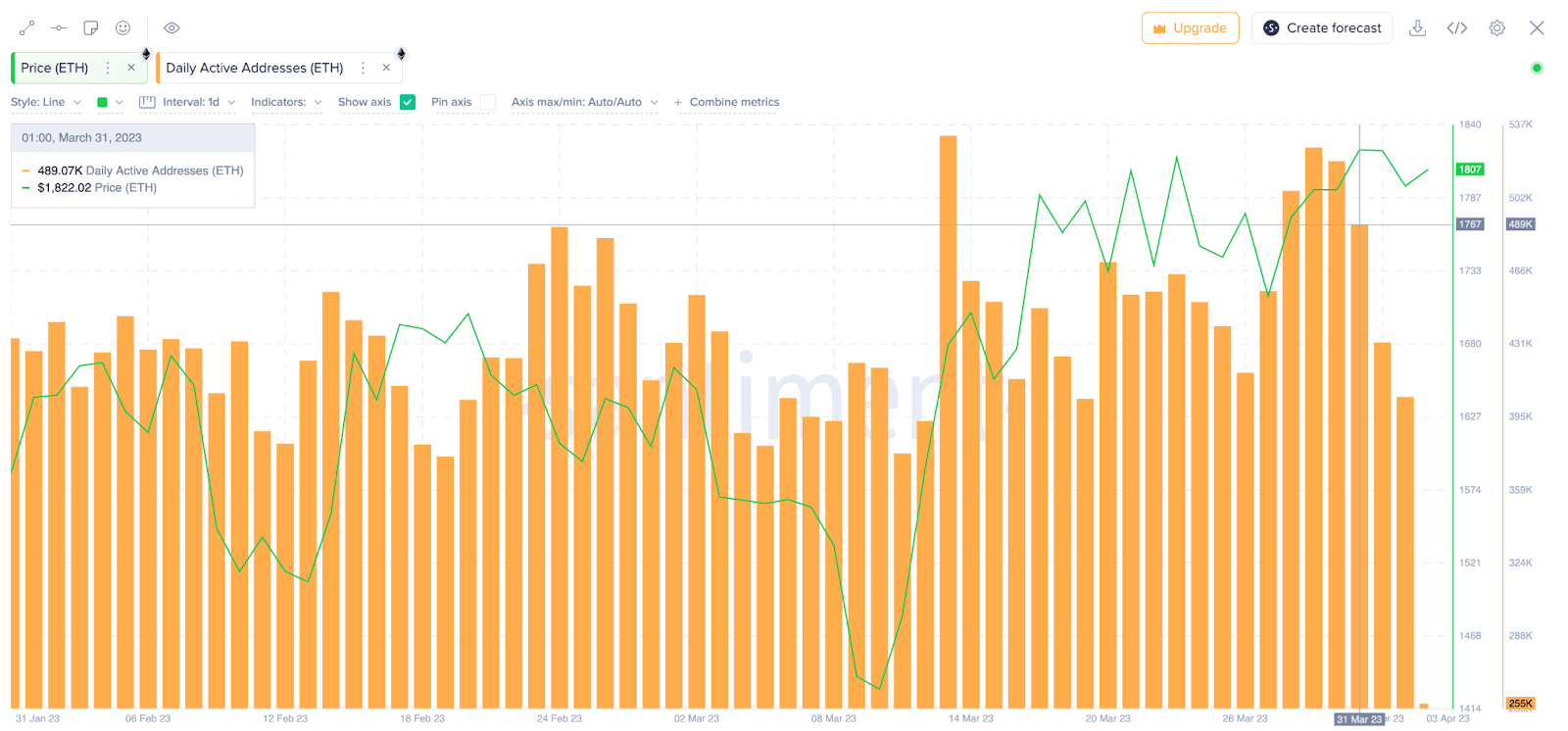

However, Ethereum’s fundamental on-chain metrics remain solid despite the negative media spotlight. Among other factors, the rising values of daily active users have driven up demand for ETH in recent weeks.

As reported by Santiment, the number of addresses interacting on the Ethereum network in March 2023 has increased considerably compared to February. On March 4, Ethereum’s daily traction hit a local of 377,000 addresses. By April 1, it had surged above 431,000.

Ethereum (ETH) Daily Active Addresses, April 2023. Source: Santiment

Increased daily usage typically indicates growing adoption and demand for Ethereum-based decentralized applications. This could drive up the price of ETH and keep investors confident about long-term network value.

Ethereum’s daily usage has remained above 400,000 active addresses in the last 30 trading days. If this level of traction is sustained, ETH could approach the upcoming network upgrade unscathed.

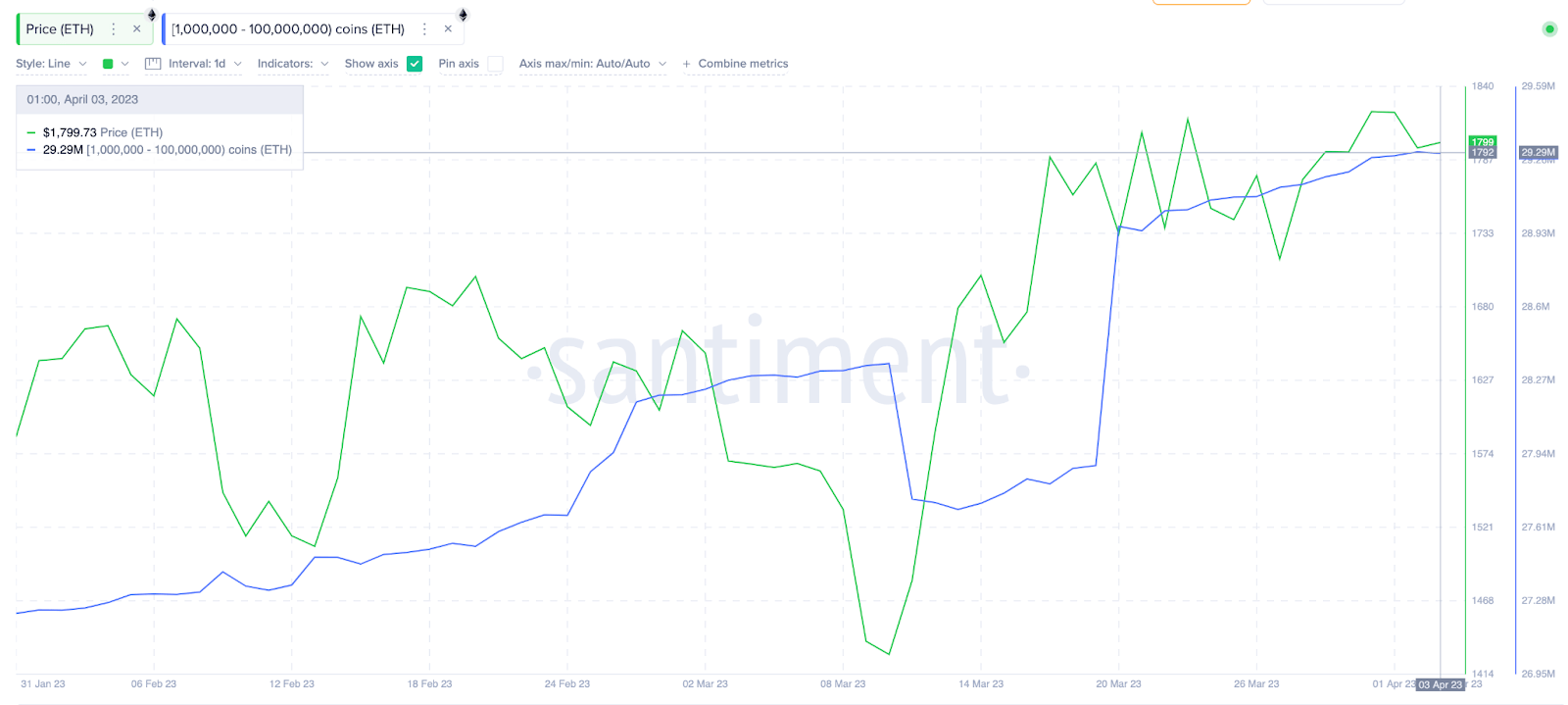

Another on-chain metric that validates this bullish outlook is the recent bullish accumulation pattern observed among Ethereum’s largest whale cohort.

The historical data shows that the buy/sell pattern of whales holding balances of 1 million to 10 million ETH appears highly correlated to price action. And according to the Santiment chart below, these whales have entered a mild-accumulation trend lately.

Between March 19 and April 3, the 1 million to 100 million whale cohort has added 1.4 million ETH worth $2.5 billion to their holdings.

Ethereum (ETH) Whales Accumulation, April 2023. Source: Santiment

When crypto whales accumulate coins, it significantly drives up demand and, ultimately, the underlying asset’s price. It could also influence the sharks and other retail investors to become bullish themselves.

In summary, if Ethereum smart contract network can sustain high daily usage and whales continue to fill up their bags, ETH can garner enough steam to overpower the bears in the coming days and weeks.

ETH Price Prediction: Setting Sights on $2,000

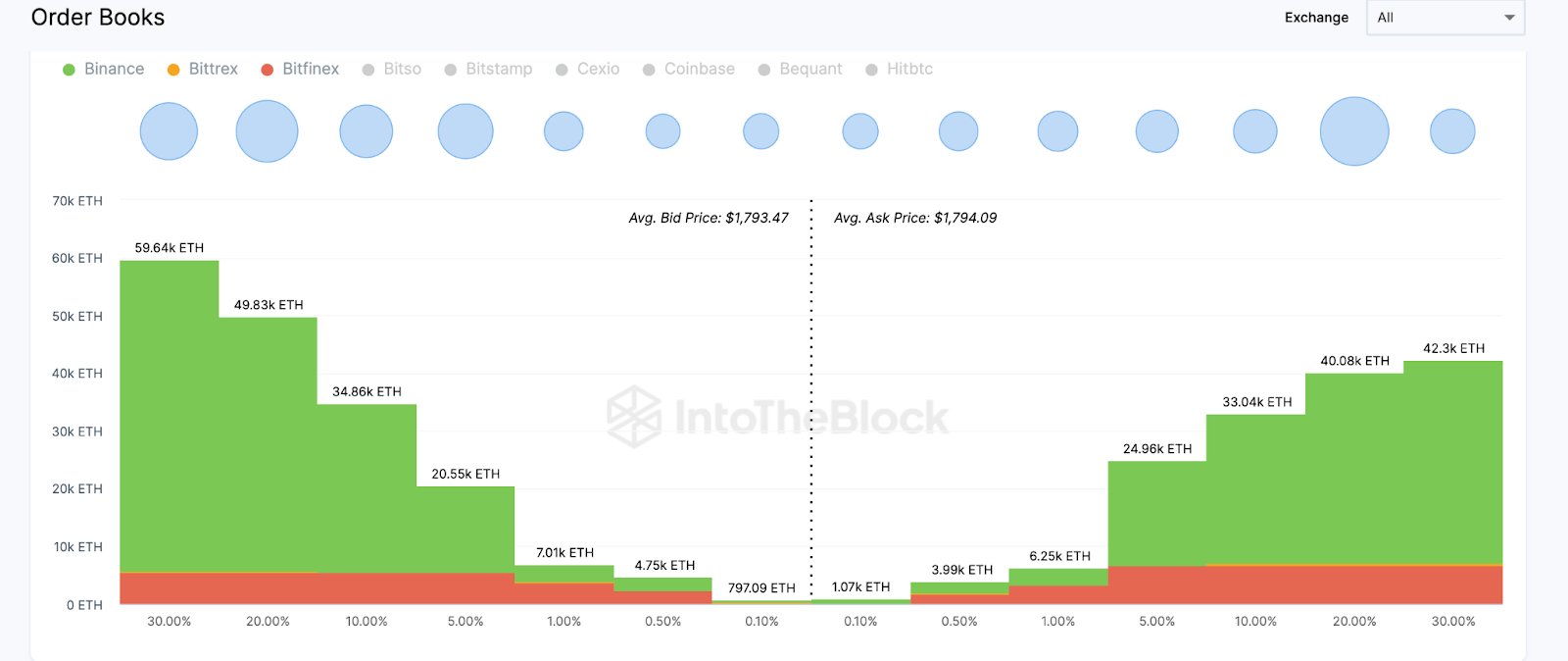

The aggregate order books of top exchanges show that demand for Ethereum far outweighs supply around the current prices. Ethereum could be set for an upswing in the coming weeks.

IntoTheBlock’s Exchange market depth chart below shows that Ethereum could reach $1,893 before hitting a 25,000 ETH sell wall. But if the bulls push beyond that mark, ETH can rally toward $2,163. At this resistance, Ethereum could hit another considerable sell-wall of 40,000 ETH.

Ethereum (ETH) Aggregate Exchange Order Books. April 2023. Source: IntoTheBlock

Conversely, the bears can negate the bullish stance if ETH falls below the current 5% support zone, around $1,715. But the 20,000 ETH buy wall at that zone will offer formidable support.

However, if the support cannot stop the slump, ETH can drop toward $1,500. Around the $1,500 mark, another cluster of bulls will be looking to buy the dip to the tune of 50,000 ETH.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren