Bitstamp launches new lending product across crypto-friendly markets

Bitstamp, one of the world’s oldest crypto exchanges, today announced a new lending service in new European markets, as well as in Hong Kong and the United Arab Emirates.

The exchange’s lending product offers daily rewards and up to 4.4% APY, with no specific lock-up period. Lending is available for large-cap coins like bitcoin and ether, as well as Circle’s USDC and Tether’s USDT. Other cryptocurrencies available include XRP, BCH, LINK, LTC, and APE. Select customers have quietly been live on the platform since March.

Bitstamp has partnered with Tesseract, a Finnish lending firm that also offers a white-label platform. Borrowers on Tesseract’s platform must provide 100% collateral for stablecoin loans. The partnership uses a different legal entity to keep customer loans and assets separate from Tesseract’s other partners.

The product is only available in certain European countries — including France, Ireland, Italy, and Spain among others — as well as Hong Kong and United Arab Emirates. It is not available in the U.K. or U.S.

Jean-Baptiste Graftieaux, CEO of Bitstamp, said the exchange is «one of the most regulated» in crypto. The addition of a lending service to the platform will enable customers to «benefit from the evolution of crypto in a reliable and secure way,» he added.

«We’re re-building crypto lending from the ground up — shifting from the often opaque and mysterious world of crypto lending to being radically transparent and accessible.»

Bitstamp will run monthly lending performance reports as part of a push for more accessible lending. The reports will provide users with data and insights into product performance and risk. Metrics include lending portfolio performance and concentration, borrower risk profiles and collateral levels.

The exchange’s move into lending comes ten months after crypto lender Celsius’s collapse. The firm has since filed for bankruptcy, with CEO and co-founder Alex Mashinsky stepping down. In the intervening period, the crypto lending sector has suffered a host of casualties, with BlockFi filing Chapter 11 bankruptcy protection in November following the collapse of FTX.

Unsurprisingly, the regulatory environment in the U.S. has harshened. European markets continue to be seen as more welcoming by contrast, however, as noted by RockawayX’s Chief Growth Officer Samantha Bohbot on The Scoop this week.

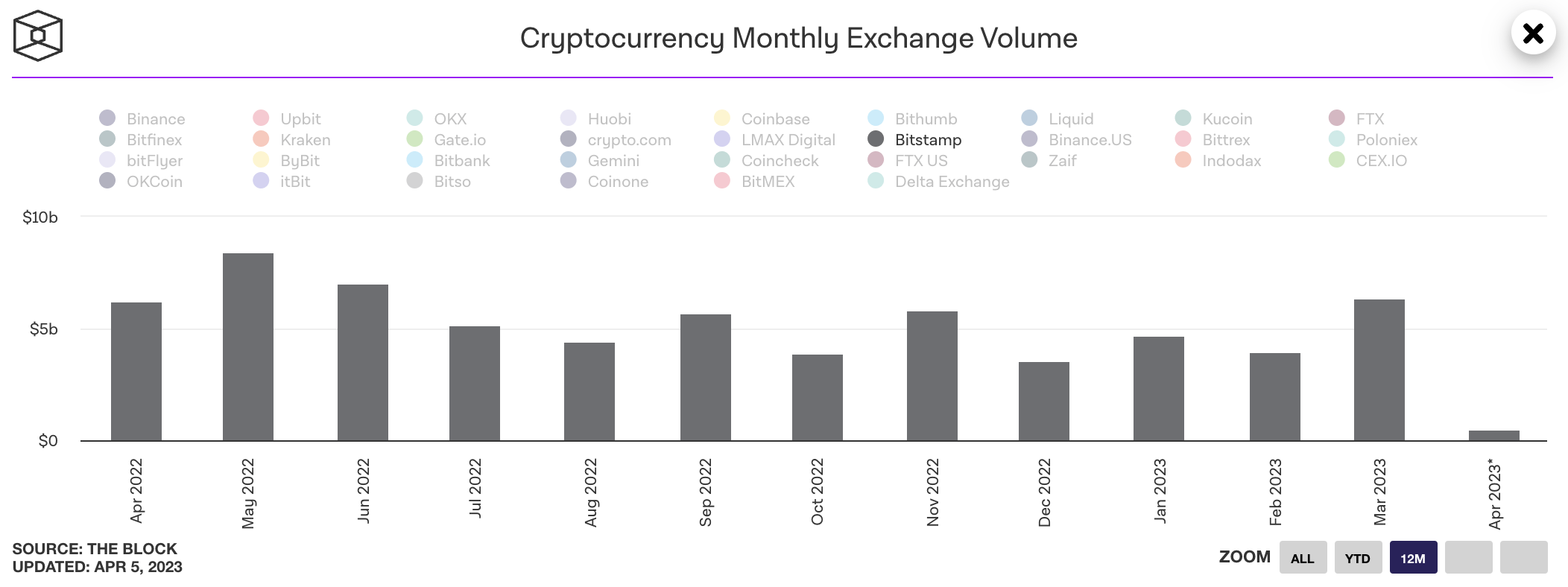

Bitstamp’s spot market volume fell over the last twelve months to $6.34 billion in March from $7.45 billion a year ago. At its peak in May 2021, the exchange clocked $39 billion in spot market volume, according to data from The Block Research.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Maker

Maker  Tether Gold

Tether Gold  Zcash

Zcash  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Decred

Decred  Ravencoin

Ravencoin  Synthetix Network

Synthetix Network  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Hive

Hive  Status

Status  Waves

Waves  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  NEM

NEM  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD  Energi

Energi