Bitcoin spikes on ‘soft-ish’ US inflation data before coming back down to Earth

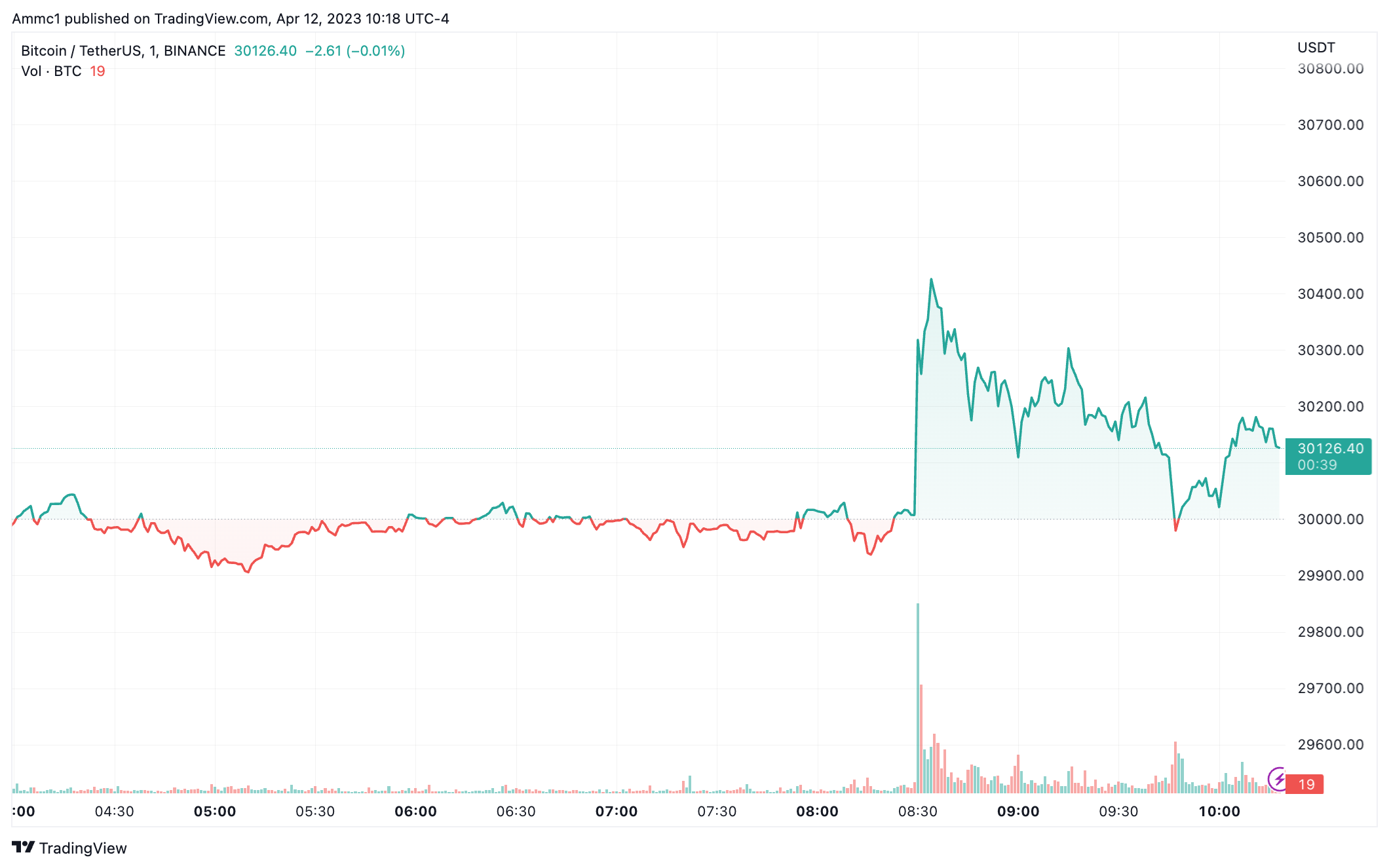

Bitcoin soared on the initial release of U.S. inflation data for March, but the price has since cooled off.

The leading cryptocurrency by market cap was trading at $30,126 by 10:18 a.m. EDT, up about 0.3% since the inflation release, according to Binance data via TradingView. Bitcoin traded around $30,450 just minutes after the release — which SoFi’s Liz Young, head of investment strategy, called «soft-ish.»

Stock futures pumped shortly after the release, while U.S. stock indices were slightly more subdued after the open, although still in the green. The S&P 500 is up 0.37%, while the Nasdaq gained 0.07%.

The market’s initial reaction to the inflation data might be ill-conceived, according to some analysts. Michael Brown, a market analyst at TraderX, said it might be folly to ignore the re-acceleration in core inflation back up to 5.6% year-on-year. The rise in core inflation is a sign of price pressures getting embedded and growing stickier, he added.

The Fed may well end hikes after May, Brown added, but any chance of cuts is unlikely given the central bank’s reluctance to let genie out of the bottle a second time, he concluded.

Michael Hewson, the chief market analyst at CMC markets, echoed this. «Markets drawing the wrong conclusions from today’s numbers, methinks, he said in response to Brown’s tweet.

Fed Funds futures pricing now shows a 67% probability of a 25 basis point increase at next month’s meeting, down from 73% this morning. The probability of a cut by July is 47%, according to CME’s FedWatch.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Monero

Monero  OKB

OKB  Dai

Dai  Ethereum Classic

Ethereum Classic  Zcash

Zcash  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tether Gold

Tether Gold  Stacks

Stacks  IOTA

IOTA  Theta Network

Theta Network  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Dash

Dash  Synthetix

Synthetix  Decred

Decred  Qtum

Qtum  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  DigiByte

DigiByte  Numeraire

Numeraire  Ontology

Ontology  Enjin Coin

Enjin Coin  Nano

Nano  Waves

Waves  Hive

Hive  Status

Status  Huobi

Huobi  Steem

Steem  Pax Dollar

Pax Dollar  Lisk

Lisk  BUSD

BUSD  Bitcoin Gold

Bitcoin Gold  OMG Network

OMG Network  NEM

NEM  Augur

Augur