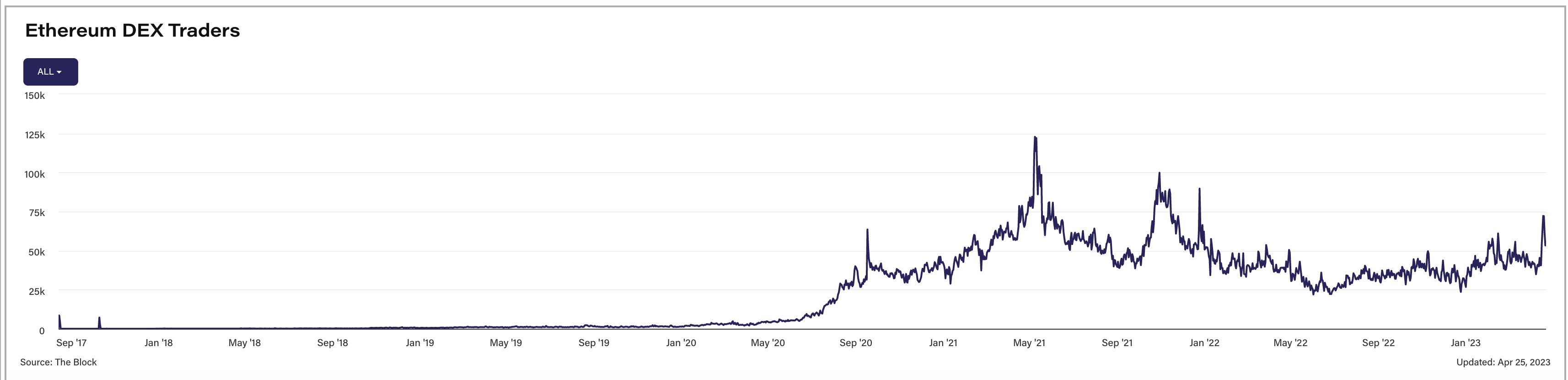

Ethereum DEXs attract most traders since 2021 as memecoin popularity soars

Ethereum-based decentralized exchanges witnessed a significant surge in trading activity last week as memecoins gained traction among crypto enthusiasts.

On April 19, the number unique traders on Ethereum DEXs hit 72,000 — a level not seen since the end of 2021 — according to data from The Block Pro Dashboard.

Unique traders on Ethereum-based DEXs spiked to highs not seen since 2021. Source: The Block Pro

Memecoin frenzy

Memecoins have been enjoying a mini boom recently. The «Pepe the Frog»-themed token pepe, for example, saw an extraordinary surge short-term, skyrocketing by over 266 times in just four days. The team behind the coin seemed to have enticed users to forsake popular dog-themed tokens like dogecoin and shiba inu in favor of the popular internet frog meme.

«A spectacular price increase made people rush into memecoins like pepe, wojak and chad — all having a daily volume of $10 million to $100 million,» said Simon Cousaert, director of data at The Block.

The prices of said memecoins have severely decreased since then, creating a feast for MEV bots. Short for Maximal Extractable Value, MEV is a technique that involves manipulating transaction sequencing to capitalize on profitable on-chain trades — such as arbitrage and re-ordering of transactions. «The activity of inexperienced traders caused hugely profitable opportunities for MEV bots,» Cousaert said.

As The Block reported last week, an MEV trading bot operator who goes by «jaredfromsubway» spent over $1.1 million on Ethereum network fees and earned about $700,000 in profits front-running tokens and memecoins.

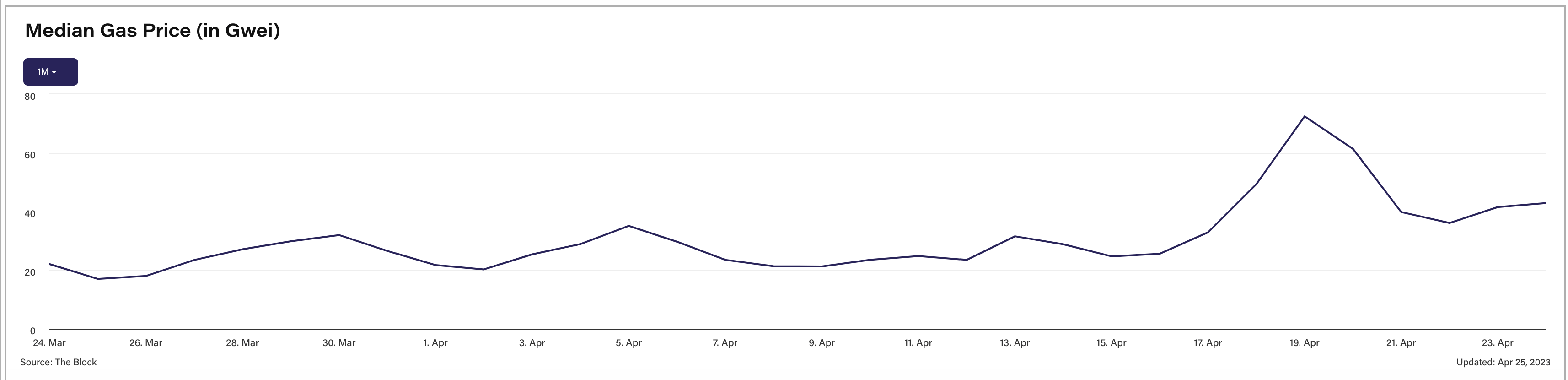

The increased DEX trading activity also led to a surge in Ethereum gas fees to around 73 gwei on April 19, now down to about 43 gwei. (A gwei is one-billionth of one ETH.)

The median gas price on Ethereum also surged last week. Source: theblock.pro

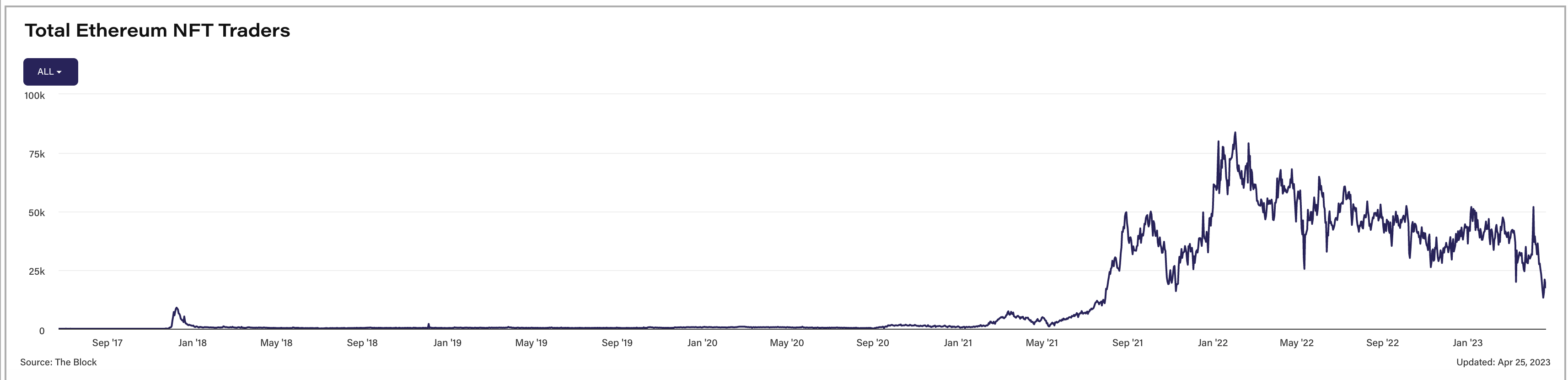

NFT traders on Ethereum have declined

While traders on Ethereum DEXs surged last week, the number of NFT traders has declined to lows not experienced since July 2021.

«Generally, the NFT market has slowed down. Floor prices are dropping. Starbucks didn’t sell out its latest collection. The hype around Blur seems to be dying down a little. And, also, gas prices were high, which may deter people from trading,» Rebecca Stevens, a data research analyst at The Block explained.

The total number of Ethereum NFT traders has been in steady decline. Source: The Block Pro

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  Stellar

Stellar  Zcash

Zcash  LEO Token

LEO Token  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD