Ethereum’s Neutral Fear and Greed Index Sparks “Buy the Dip” Mentality

According to recent data, the Ethereum Fear and Greed Index is 52, indicating that investors are now neutral towards Ethereum, neither too bullish nor highly pessimistic. This level represents a balanced market attitude, indicating that Ethereum is steady and not suffering substantial price or demand volatility.

Due to the stability, ETH prices have fluctuated over the previous 24 hours between $1,962.57 and $1,792.46, respectively. As of press time, bullish momentum has effectively boosted the ETH price by 0.35% to $1,883.83.

ETH’s market capitalization and 24-hour trading volume increased by 0.31% and 93.09%, respectively, to $226,776,192,817 and $17,123,560,030, suggesting a “buy-the-dip” mindset among investors who perceive the present price level as a chance to amass more ETH.

ETH/USD 24-hour price chart (source: CoinMarketCap)

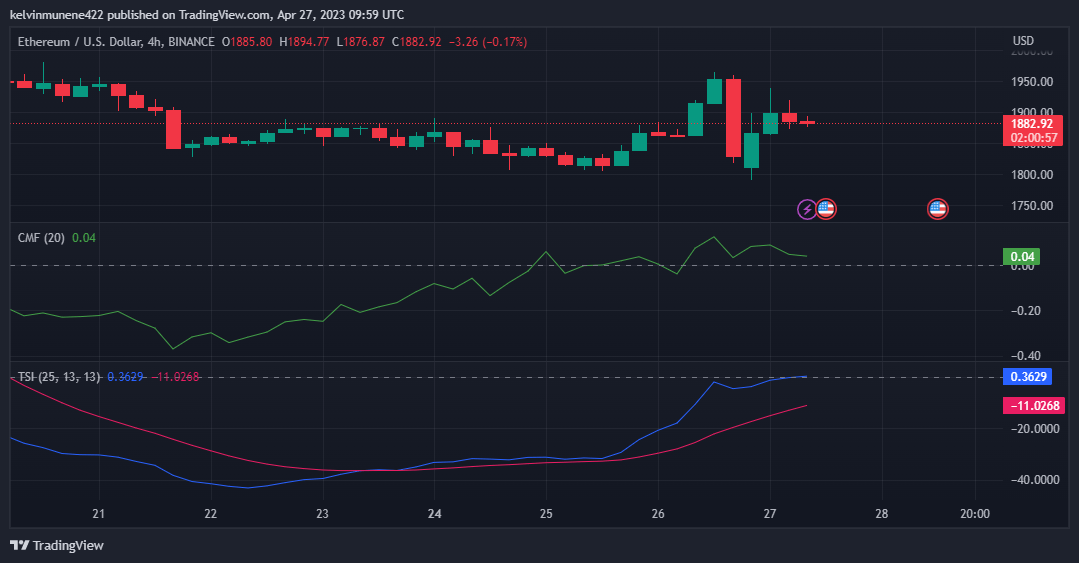

The Chaikin Money Flow score of 0.04 indicates that the bullish momentum in ETH is modest, and purchasing pressure is insufficient to support a significant price gain. If the CMF goes below the “0” line, it may suggest a negative trend and a possible price decline, while a score over 0.05 may indicate a strong bullish momentum and an upward price movement.

The bullish momentum is growing, with a Know Sure Thing rating of 0.4449 and rising northwards as it moves out of the negative zone, suggesting a likely higher price movement in the near future.

This level indicates that the CMF trend is improving and that purchasing pressure is building, indicating a good buying opportunity for traders.

ETH/USD chart (source: TradingView)

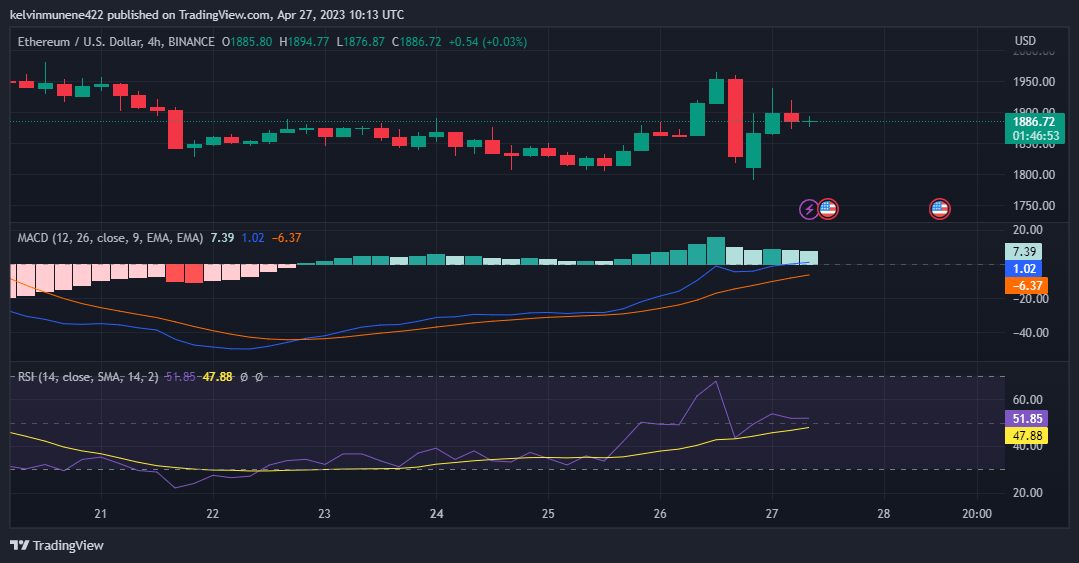

With a value of 0.67, the MACD line has just shifted into the positive region, suggesting that ETH bullishness is gathering strength, signaling a likely increase in the price of ETH.

If this pattern continues, it may draw additional purchasers to the market, increasing demand for ETH and perhaps pushing its price even higher.

This bullish trend may continue soon, with a Relative Strength Index rating of 51.04. The RSI suggests that the present price is not yet overbought and that there is still a possibility for an additional upward rise before a possible pullback.

ETH/USD chart (source: TradingView)

ETH shows balanced sentiment and modest bullish momentum, presenting buying opportunities. MACD and RSI indicators suggest a likely price increase soon.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren