Analyst Says Bitcoin (BTC) in Very Early Bull Market As Technical Pattern Forms – Here’s His Outlook

A widely followed crypto analyst says the largest crypto asset by market cap is in the first inning of its next bull market.

Pseudonymous crypto trader Rekt Capital tells their 345,800 Twitter followers that Bitcoin (BTC) is in the early stages of a bull run.

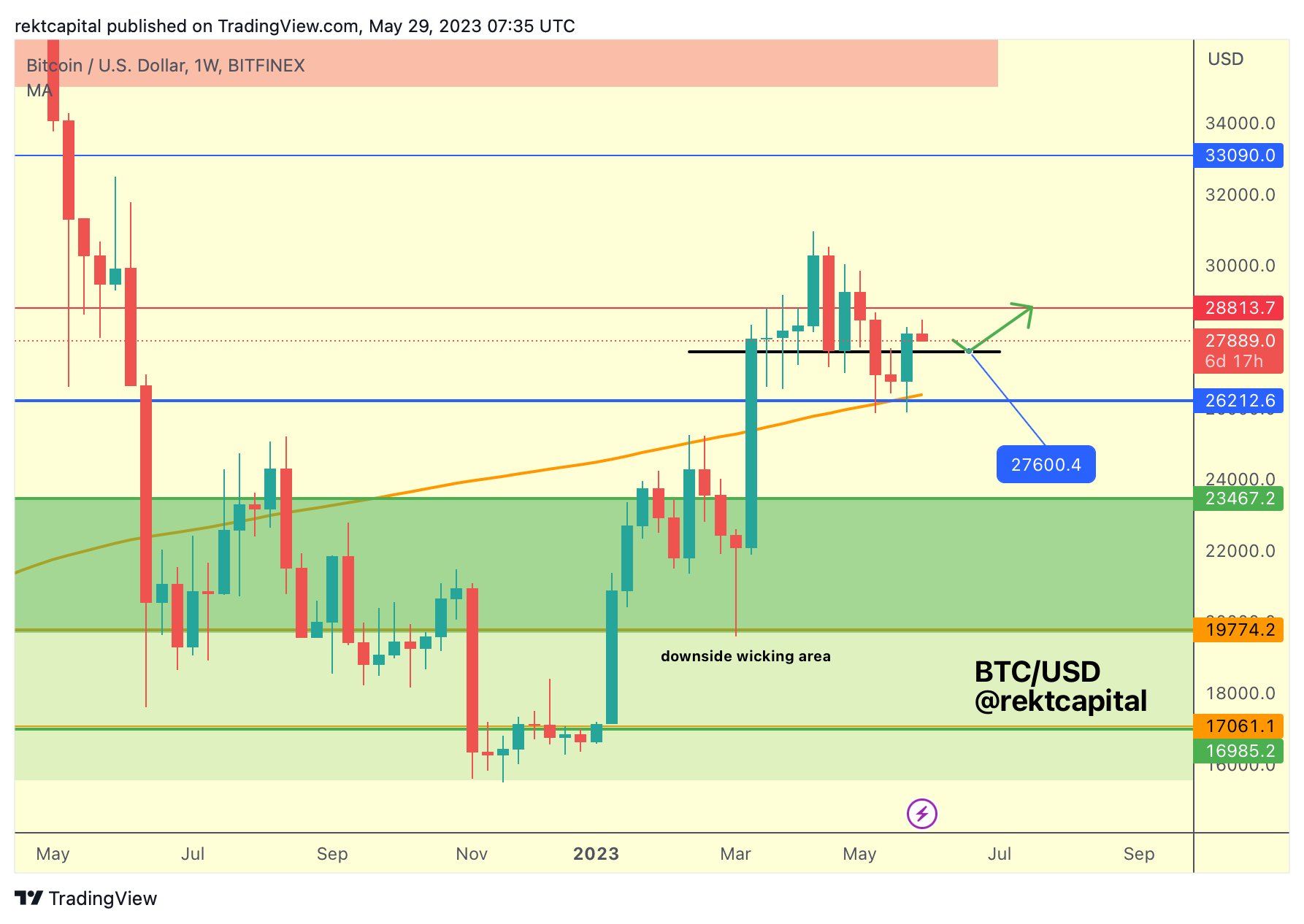

Further contextualizing their claim, Rekt provides a chart detailing BTC breaking out of a falling wedge pattern and then retesting the upper boundary of the wedge to confirm the pattern.

“BTC has Weekly Closed right at the Falling Wedge resistance or just above it

Either way, BTC may be set for a dip to retest the top of this Falling Wedge as support

Successful retest would confirm the Falling Wedge breakout.”

Source: Rekt Capital/Twitter

A falling wedge breakout is a technical analysis pattern that is used to identify potential bullish reversals in an asset’s price. The pattern is characterized by a series of lower highs and lower lows that form a wedge-shaped pattern on the chart. As the pattern progresses, the distance between the highs and lows decreases, which indicates that the selling pressure is weakening. When the price breaks out of the upper trend line of the wedge, it’s traditionally considered bullish.

Rekt Capital also says that BTC had a “great” weekly close, with its candle closing just above the $27,000 level.

“Now that’s a really good BTC Weekly Close

BTC lost ~$27,600 as support two weeks ago and now has positioned itself for a retest/reclaim of this same level

Dip into black would be healthy and successful retest there could position BTC for a revisit of ~$28,800″

Source: Rekt Capital/Twitter

Zooming out, Rekt says that in the last several months, BTC has crossed above a long-term downward resistance that formed in late 2021. The analyst says Bitcoin is now in a bullish trend, at least for the medium to long term.

“BTC’s outlook in the mid-to-long-term is bullish”

Source: Rekt Capital/Twitter

BTC is worth $27,627 at time of writing, down 0.6% in the last 24 hours.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  Stellar

Stellar  LEO Token

LEO Token  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  BUSD

BUSD  Ontology

Ontology  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD