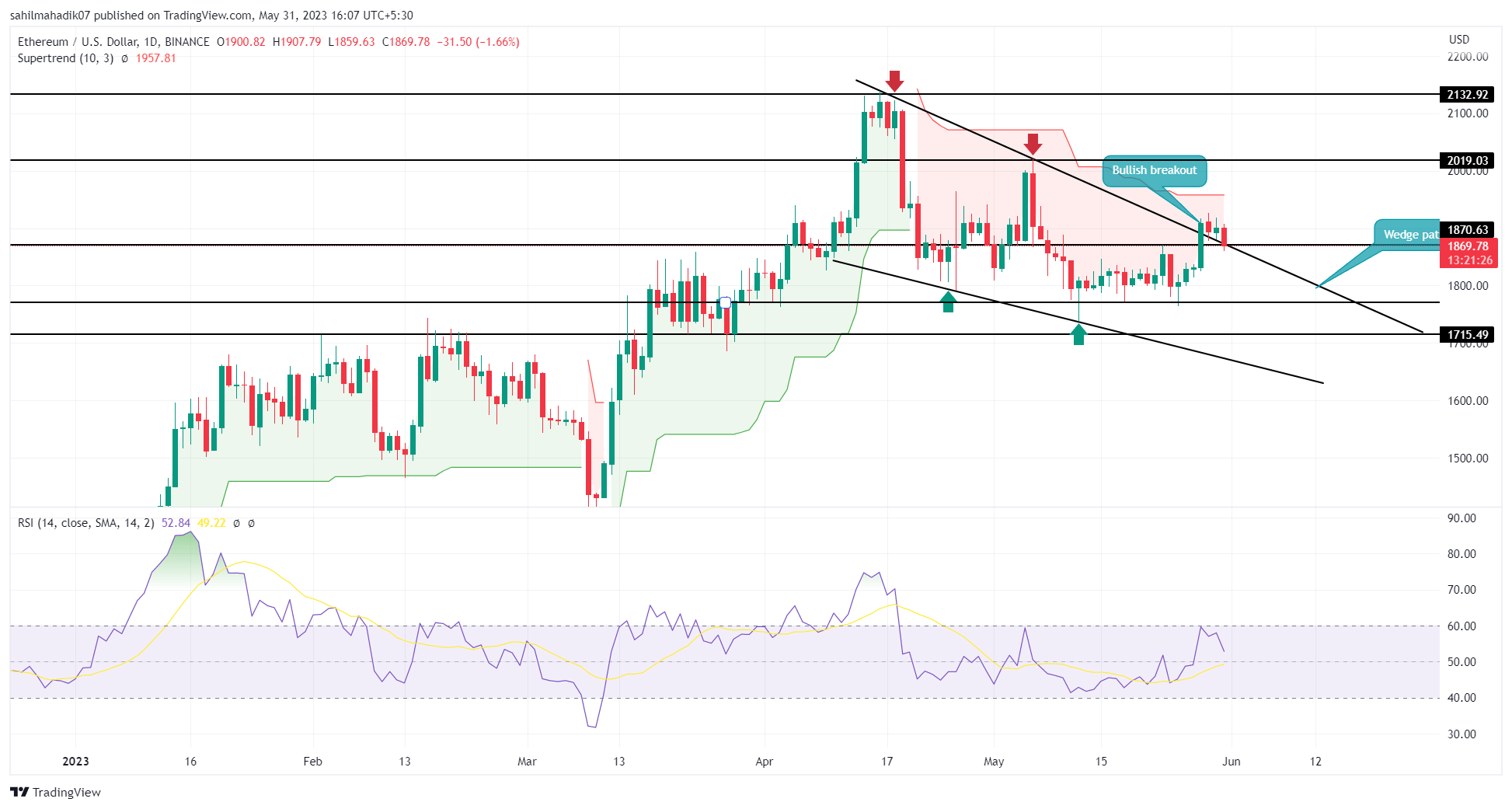

Ethereum Price Analysis: Bull Trap Puts $ETH Price at Risk of Major Correction; Sell or Hold?

Ethereum Price Analysis: On May 28th, a significant uptick in the crypto market allowed the Ethereum price to clear the downsloping resistance trendline of the wedge pattern. This development was a sign of buyers’ attempt to retake trend control and lead a sustained recovery. However, the price is struggling to sustain above the breached trendline which could lead to a fake breakout scenario and a potential downfall.

Also Read: Crypto Market Selloff: Here’s Why Bitcoin, Ethereum Price Falling Today

Ethereum Price Daily Chart

- The Ethereum price retests the recently reclaimed trendline to check whether prices can sustain higher levels or not.

- A breakdown below the downsloping trendline will hint at the resumption of the prior correction phase.

- The intraday trading volume in Ether is $6.2 Billion, indicating a 34% gain.

Source- Tradingview

Currently, the Ethereum price trades at the $1871 mark with an intraday loss of 1.58%. The long red candle printed shows a breakdown attempt from the recently reclaimed trendline, indicating the sellers have not thrown the towel yet.

However, a candle closing below the combined support of $1870 and a downsloping trendline will create a bull trap scenario and intensify the selling pressure in the market. Any downfall below the trendline will continue to liquidate the aggressive buyers and their forced sell order could give another boost to downward momentum.

The post-breakdown fall could plunge the ETH price to 1770, followed by $1715-1700.

Conversely, if the coin price shows sustainability above the trendline by the day’s end, the uptrend potential for Ethereum mentioned in our previous article remains intact.

Will Ethereum Price Lose $1800 Mark Again?

A potential breakdown below the aforementioned trend will bring the market sellers back to the ETH price. The breached trendline will again act as a significant resistance to short sell and more likely plunge the price to the next crucial support zone of $1770.

- Relative Strength Index: The daily RSI slope reversal from the 60% mark reflects a lack of buyers’ strength to maintain a strong momentum rally.

- Supertrend: The red film projected in this indicator highlights the overall market trend remains bearish.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Tether Gold

Tether Gold  IOTA

IOTA  Theta Network

Theta Network  Zcash

Zcash  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Zilliqa

Zilliqa  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  NEM

NEM  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Lisk

Lisk  Status

Status  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD  Bytom

Bytom