Ethereum (ETH) Wave Count Suggests a Long-Term Bottom Has Been Reached

Ethereum (ETH) has nearly doubled in price since its June 18 lows. It is possible that a local bottom is in place.

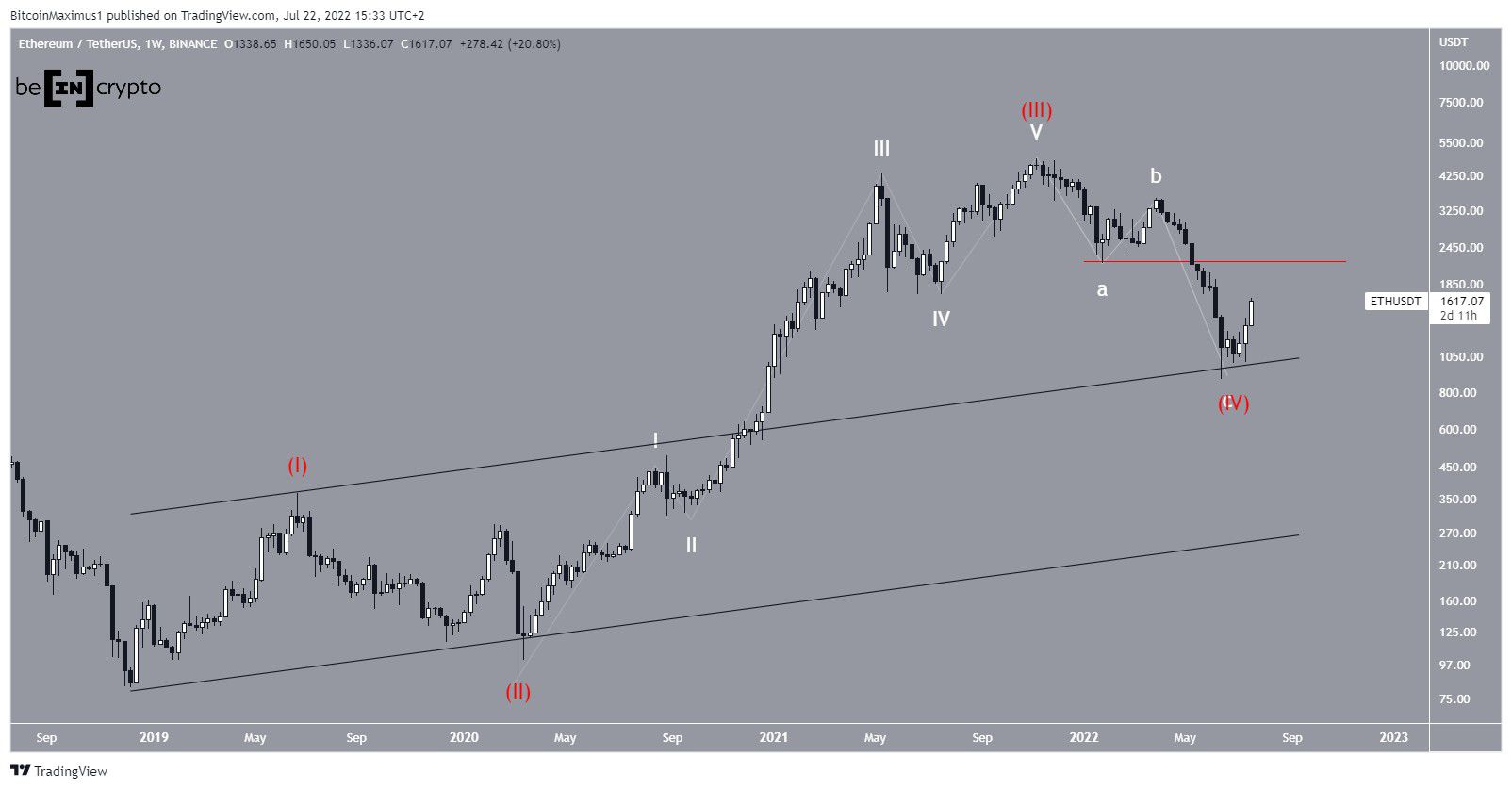

The most likely long-term count suggests that ETH completed a five-wave upward movement (white) between March 2020 and Nov 2021. Afterward, it seems to have completed an A-B-C corrective structure.

In the longer-term, the aforementioned increase was likely part of wave three (red), while the ensuing correcting part of wave four, which in turn developed into a fourth-wave pullback (red).

If the count is correct, the price has begun a new upward movement that will eventually lead to a new all-time high price. In order for the count to be confirmed, Ethereum has to move above the wave one low (red line) at $2,159.

ETH/USDT Chart By TradingView

Ongoing ETH breakout

The daily chart also provides a bullish outlook, since it shows that the price has already broken out from a descending resistance line that had been in place since April 5. Additionally, the daily RSI has moved above 50 (green icon), in what is considered a sign of bullish trends.

If the previously outlined count is correct, ETH is currently in wave one of a new five-wave upward movement (white). The sub-wave count is given in black.

The most likely area to act as the local top is between $2,230 and $2,540. It is created by the short-term 0.5-0.618 Fib retracement resistance area (black) and the long-term 0.382 retracement resistance.

ETH/USDT Chart By TradingView

Short-term movement

Finally, a closer look at the previously outlined sub-wave count shows that ETH is likely in wave three of a five-wave upward movement. So far, sub-wave three has had 1.61 times the length of sub-wave one, which is common in such structures.

As a result, a short-term drop could follow prior to the fifth and final sub-wave.

The possibility of a drop is also supported by the six-hour RSI, which has generated bearish divergence (green line)

ETH/USDT Chart By TradingView

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren