Will “The Merge” Be A Buy The Rumor Sell The News Event For Ethereum?

Ethereum is coming into heavy resistance north of $1,900 as the cryptocurrency attempts to push further into previously lost territory. Today, ETH core developers announced a tentative date for the upcoming “Merge” event set for September 15 to 16, 2022, which could bolster bulls’ attempts to climb higher.

Related Reading: Bitcoin aSOPR Fails Retest Of Historical Bull-Bear Junction

At the time of writing, Ethereum’s (ETH) price trades at $1,888 with 3% profits in the last 24 hours and a 17% profit in the last week.

“The Merge” is the event that will complete Ethereum’s migration to a Proof-of-Stake (PoS) consensus. It’s one of the most highly anticipated events in the space due to its implications for the price of ETH, and one of the main reasons why the bullish momentum could extend in the coming months.

Analyst Michaël van de Poppe said the following on “The Merge”, its short-term implications for the crypto market, and why ETH’s price could continue to see bullish momentum:

Honestly, Ethereum is the actual asset that is carrying the markets, as some FOMO is starting to get some grip on the markets with the merge and ETH 2.0 coming up. Through that, expecting to see $ETH continue towards $2.5K and $BTC towards the $30K region in the coming month.

Some market participants are wondering if “The Merge” will operate as a “buy the rumor, sell the news” event. In other words, whether Ethereum will rally into September only to see a sharp decline after the hype around the event mitigates.

As NewsBTC reported earlier, the market is showing signs that could support this theory. In particular, the lack of accumulation from large investors, and Bitcoin lagging behind the rest of the crypto market.

Traders might be more confident about a potential sustainable price action if Bitcoin and Ethereum move in tandem with support from whales. In the meantime, uncertainty will remain king.

What Could Push Ethereum Higher Before “The Merge”

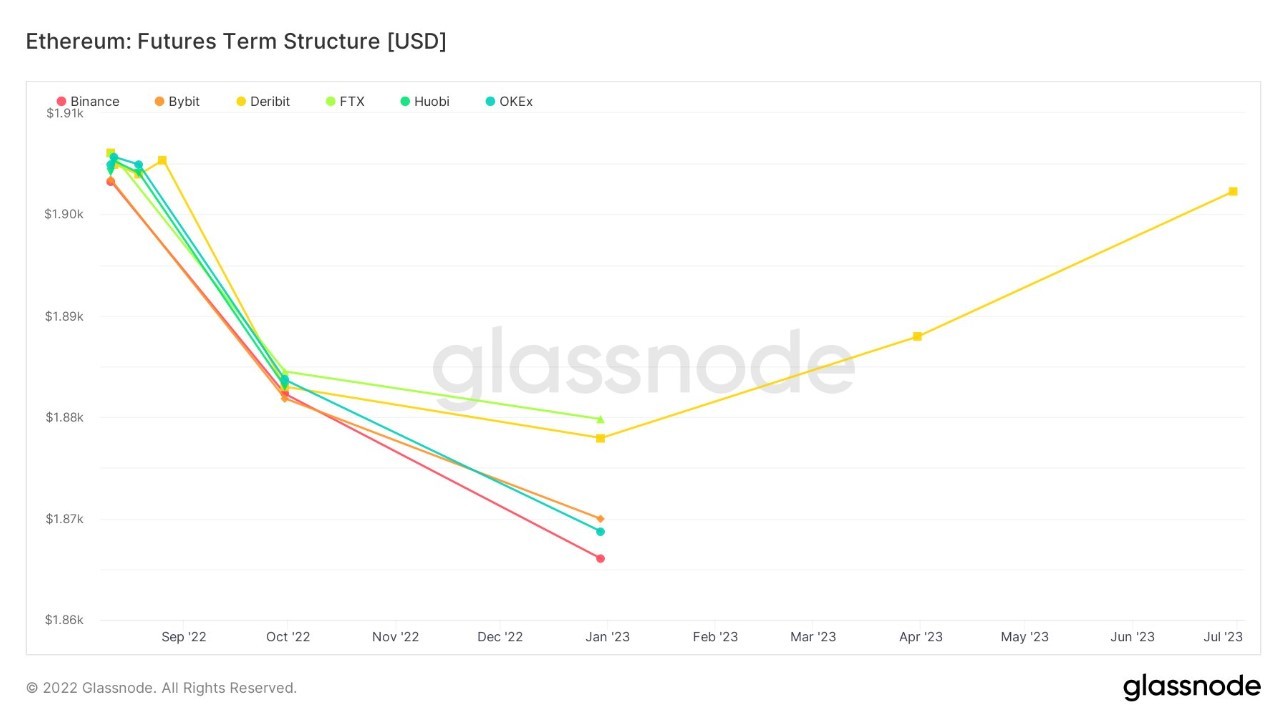

Former CEO at BitMEX Arthur Hayes shared a shift in dynamics for ETH futures contracts. The price of these investment instruments have been lagging the spot market.

Related Reading: Market Sentiment Shoots Up As Bitcoin Eyes $25,000

Hayes speculated that this is happening because there are a lot of traders hedging their position before “The Merge”. If the event is successful, and institutions have taken a neutral long position on Ethereum with retails increasing their buying pressure, a chain of events could contribute to a more bullish continuation for the price of Ethereum:

(…) the pressure is on the buy side, and market makers are short futures and must go long spot. A reversal of their positioning pre-merge. This is a positive feedback loop that leads to higher spot prices should the merge go smoothly on Sept 15th. If you believe the merge is going to succeed, then this is yet another positive structural reason why $ETH could gap higher into the end of the year.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD  Bitcoin Diamond

Bitcoin Diamond