As $ETH Price Falls, Raoul Pal Says 2-Year Risk/Reward Is Getting ‘Really Attractive’

On Saturday (August 20), as the ETH-USD trades around the $1,600 level, having fallen from around $1,900 at the start of the week, some $ETH HODLers are using this dip to buy more $ETH. One of those is investors is former Goldman Sachs executive Raoul Pal.

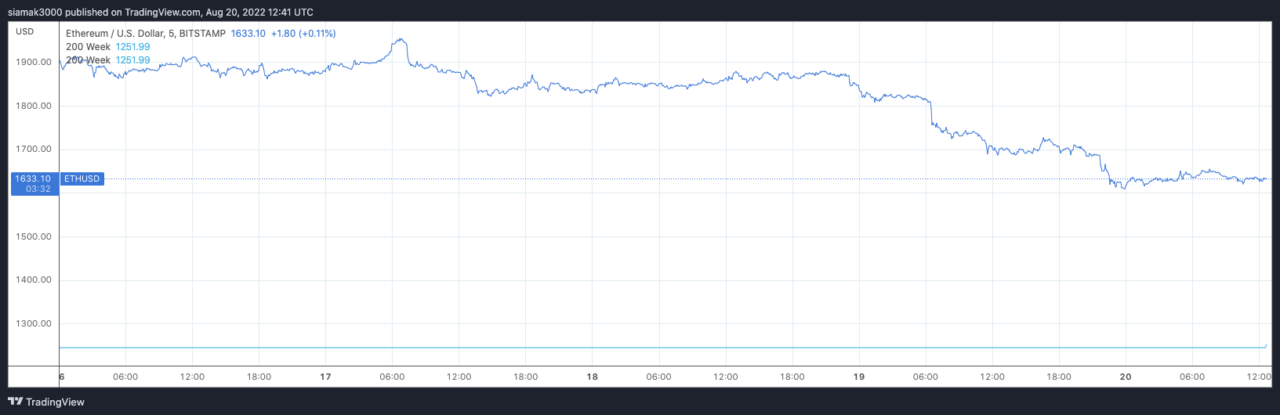

According to data by TradingView, on crypto exchange Bitstamp, currently (as of 12:41 p.m. UTC on August 20) ETH-USD is trading around $1,633, down 3.94% in the past 24-hour period.

Source: TradingView (5-Day ETH-USD Price Chart)

On Friday (August 19), Pal took to Twitter to say that although he does not expect the Ethereum price to reach “new lows” (i.e. go below the June 18 low of $902), there could be a “gut-check quick drop”; however, he also pointed out that for him “new lows” means that he will buy even more $ETH since even now he finds Ethereum’s “2-year risk/reward” quite attractive. Essentially, Pal believes that tat worst, $ETH could fall to the $800-$900 range, but the upside is much bigger since — as he has said in the past — he expects the $ETH price to reach $20,000 in the net couple of years.

Ah, the old cheeky pre-merge crypto shakeout I see… I don’t expect new lows but most likely a gut-check quick drop, but let’s see.

New lows = keep adding (for me) as 2-year risk/reward gets really, really attractive

50% downside vs possible 10x upside = 20:1 R/R#ETH #BTC

— Raoul Pal (@RaoulGMI) August 19, 2022

One popular crypto analyst who agrees with Pal’s view that Ethereum will outperform Bitcoin in the next few years is Ben Armstrong, who told his over 880K Twitter followers that he expects $ETH to have a higher market cap than $BTC by 2025:

2017: Ethereum outperformed Bitcoin

2021: Ethereum outperformed Bitcoin

2025: ThIs TiMe It WiLl Be DiFfErEnTYea it will be different. Because $ETH will have a higher market cap than $BTC in 2025

— Ben Armstrong (@Bitboy_Crypto) August 19, 2022

Image Credit

Featured Image via Pixabay

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Gate

Gate  Stacks

Stacks  Theta Network

Theta Network  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Holo

Holo  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Qtum

Qtum  Ravencoin

Ravencoin  NEM

NEM  Hive

Hive  Decred

Decred  Bitcoin Gold

Bitcoin Gold  Ontology

Ontology  DigiByte

DigiByte  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Status

Status  Nano

Nano  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond