Ether Futures See Unusually High Liquidations as Funding Rates Point to Bearish Sentiment

Futures tracking ether (ETH) have racked up almost $140 million in liquidations over the past 24 hours with a key metric suggesting traders are turning bearish on the asset’s near-term growth as they focus their attention on the contracts before Ethereum’s Merge next month.

Liquidations occur when an exchange forces a trader’s leveraged position to close because of a partial or total loss of margin, or funds set aside to keep the trade open.

According to Coinglass data, liquidations on bitcoin futures hovered at $54 million over the same period, with other major cryptocurrencies, such as solana and avalanche, seeing just over $3 million. Bitcoin futures usually have the highest liquidations in the futures markets owing to their popularity and liquidity.

Ether’s recent popularity suggests there’s currently higher interest for that market in the absence of a notable catalyst for bitcoin. In the past month, weekly trading volumes on spot ether have surpassed those of spot bitcoin for the first time, data from research firm Kaiko show.

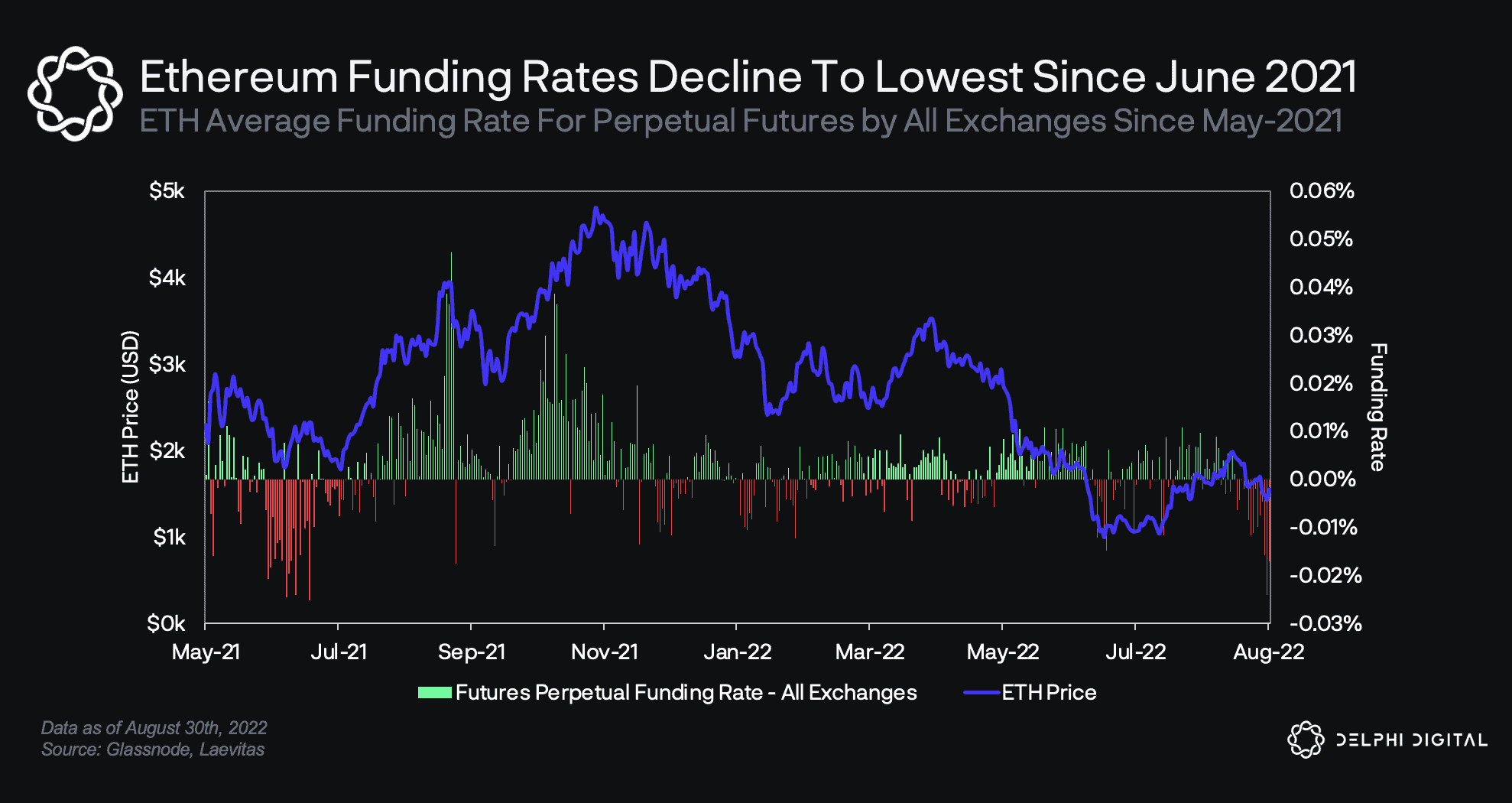

Negative funding rates, however, may also indicate that traders are hedging their spot ether holdings by shorting the asset using futures. This allows traders to protect losses in case ether prices fall while receiving the proposed ether proof-of-work tokens (ETHPOW) at the time of the Merge. But rates have turned and remained negative for over two weeks, suggesting higher demand from traders to remain short on ether contracts.

Some traders say broader equity markets have more of an impact on ether prices than technical catalysts like the Merge.

“Looking at the charts of both ether and Nasdaq 100, one gets the impression that there may be a strong correlation between the two contracts since the beginning of the year,” Daniel Kostecki, director at financial services firm Conotoxia, told CoinDesk in a Telegram message. He noted that poor sentiment in traditional equity markets may be driving prices of ether more than “the anticipation of the Merge.”

“It seems that it may now be difficult for both ether and other cryptocurrencies to break this correlation,” Kostecki said.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Gate

Gate  Theta Network

Theta Network  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Siacoin

Siacoin  Qtum

Qtum  Ravencoin

Ravencoin  Hive

Hive  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Decred

Decred  DigiByte

DigiByte  Ontology

Ontology  Huobi

Huobi  Nano

Nano  Waves

Waves  Status

Status  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond