Analysts Advise Ethereum Users to Avoid Transacting on Merge Day, Outline Numerous Risks

With Ethereum’s (ETH) Merge nearing, risks that the event could bring are increasingly being discussed, with crypto researcher Coin Metrics pointing to price discrepancies in DeFi protocols as one obvious danger, and advising users to refrain from transacting at all on the day of the Merge.

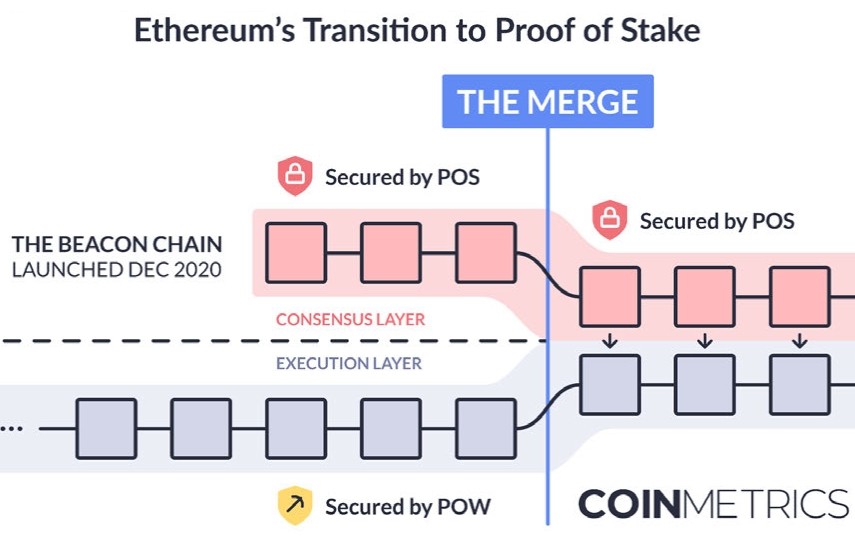

In a new report titled Mapping Out The Merge, Coin Metrics stressed that while the Merge overall will bring benefits to Ethereum, “a lot can go wrong in a network migration of this magnitude.”

As an example, the firm, which has been running its own validator nodes on Ethereum’s new Beacon Chain since 2020, said the mock Merge that took place on the Goerli testnet occurred twice on its nodes. “[This] could have been disruptive to uptime had it been the actual Merge,” the report added.

The Goerli testnet Merge took place in early August this year, and represented the final test run before the actual Merge is expected to happen sometime between September 10 and 20.

In the report, Coin Metrics went on to suggest that users should refrain from making transactions at all on the Ethereum network on the day of the Merge, given “the scope of factors that can hurt Ethereum’s uptime.”

Among the things that could go wrong, the report mentioned a change in block ordering on the chain, known as a “reorg.” If this were to happen, “a large set of transactions might be sent back to the mempool and get stuck,” the analysts warned, adding that this could cause “large disruptions in the network.”

Additionally, risks related to delays during the transition from the old proof-of-work (PoW) chain to the new proof-of-stake (PoS) chain are something users should be aware of. Analysts went on to explain that this can potentially lead to pricing discrepancies in DeFi protocols, decentralized exchanges (DEXes), and on-chain lending markets.

“While these may generate generous payouts in [Maximal Extractable Value — MEV], they could also negatively impact regular users,” the report pointed out, referring to the value validators can extract from users by reordering, inserting, or censoring transactions within blocks.

In conclusion, Coin Metrics said that despite all the risks, the Merge still marks a new chapter for Ethereum that could potentially bring “a host of exciting new scalability solutions” to the most popular smart contract network.

Source: Coin Metrics

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD