ETH Needs to Break This Level to Attempt a Shot at $2K Again (Ethereum Price Analysis)

August’s monthly candle closed in the red. However, it was a month filled with volatility where the bulls dominated the market until the middle of the month and managed to record a high of $2031. At that point, bears intercepted and pushed the price towards $1420.

In any case, all eyes are now on September as we enter the month when the Merge is expected to take place.

Technical Analysis

By Grizzly

The Daily Chart

In the daily timeframe, buyers appeared strong this week. They managed to reclaim the 100-day moving average line (in white) and then clear the descending line resistance (in yellow). However, the bearish structure is still valid since Ethereum failed to form a higher low and higher high.

The resistance zone in the range of $1720-$1750 (in red) is critical. A break and close above it would confirm the trend reversal. If that plays out, a rally towards $2000 becomes more probable. On the other hand, the support at $1,420 is expected to prevent considerable declines towards the downside.

Breaking one of these two levels would determine the future direction. Additionally, highs and lows must be carefully monitored.

Key Support Levels: $1420 & $1300

Key Resistance Levels: $1720 & $2000

Daily Moving Averages:

MA20: $1653

MA50: $1640

MA100: $1505

MA200: $2140

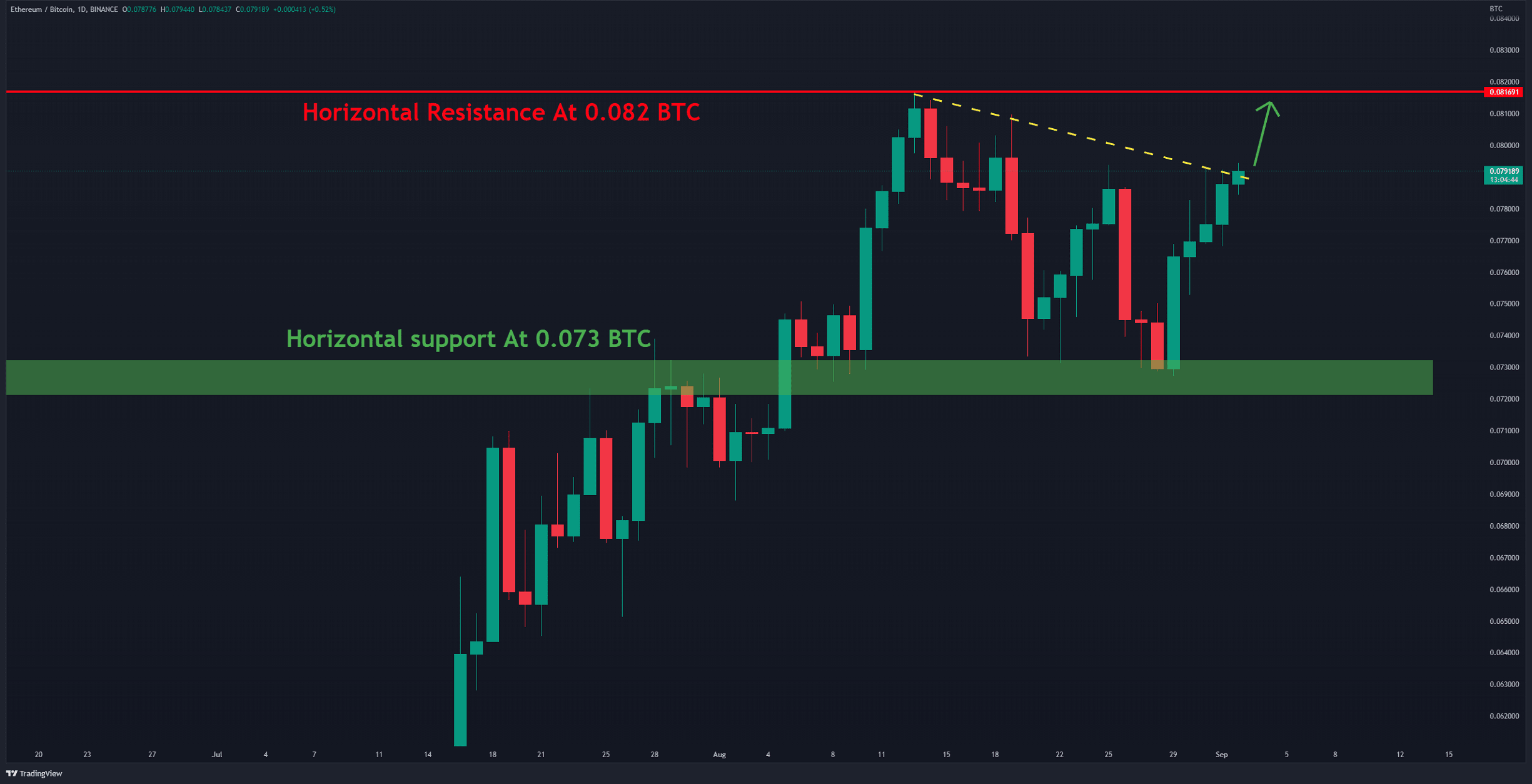

The ETH/BTC Chart

Against Bitcoin, the cryptocurrency is struggling with the descending resistance line (in yellow). After the bulls defended the horizontal support at 0.073 BTC ( in green), they also managed to push the price by 9%.

The recent bullish leg seems to have the necessary strength. This highlights the possibility of retesting the horizontal resistance at 0.082 BTC (in red). It’s important to keep an eye on how ETH performs as the Merge closes in.

Key Support Levels: 0.0.073 & 0.065 BTC

Key Resistance Levels: 0.082 & 0.088 BTC

On-chain Analysis

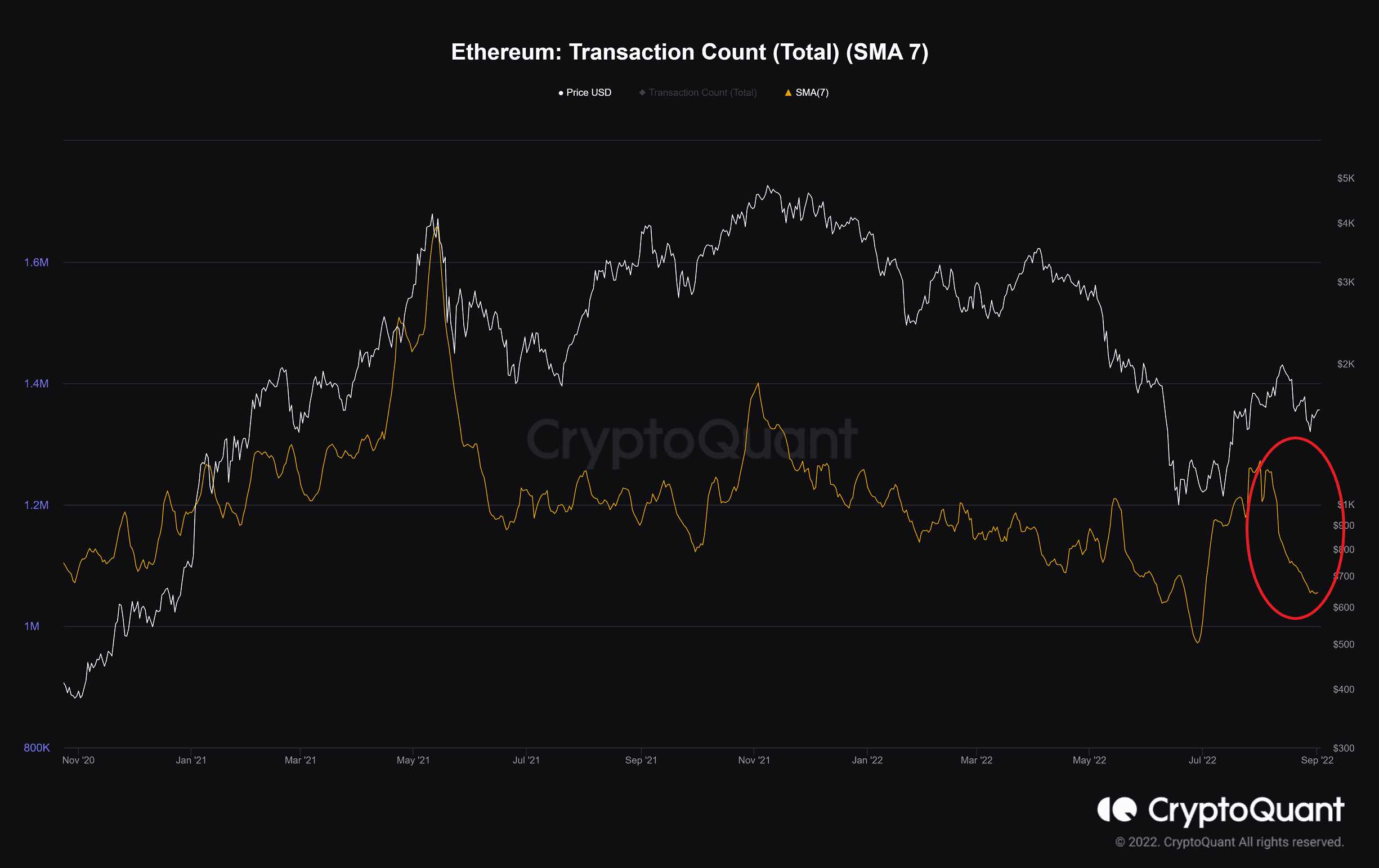

Transaction Count (SMA 7)

Definition: The total number of successfully executed transactions

Contrary to the positive signs that can be seen in the price chart, on-chain activities are showing a different picture. The number of active addresses and transactions on the network has decreased sharply in the last month.

Price increases are often accompanied by increased activities on the network, as experienced in the July uptrend. Therefore, this divergence can be interpreted as a sign of potential worry.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Numeraire

Numeraire  Siacoin

Siacoin  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond