Bitcoin Had a Rough September. Here Are the Key Metrics to Watch Next

Bitcoin is about to close September at a double-digit loss relative to August. As market sentiment continues to deteriorate, the top cryptocurrency needs to hold onto a vital support level to avoid a major correction.

Bitcoin in Danger

Bitcoin is consolidating around the $19,000 support level. Market participants have taken note of the top crypto’s weak price action over recent weeks.

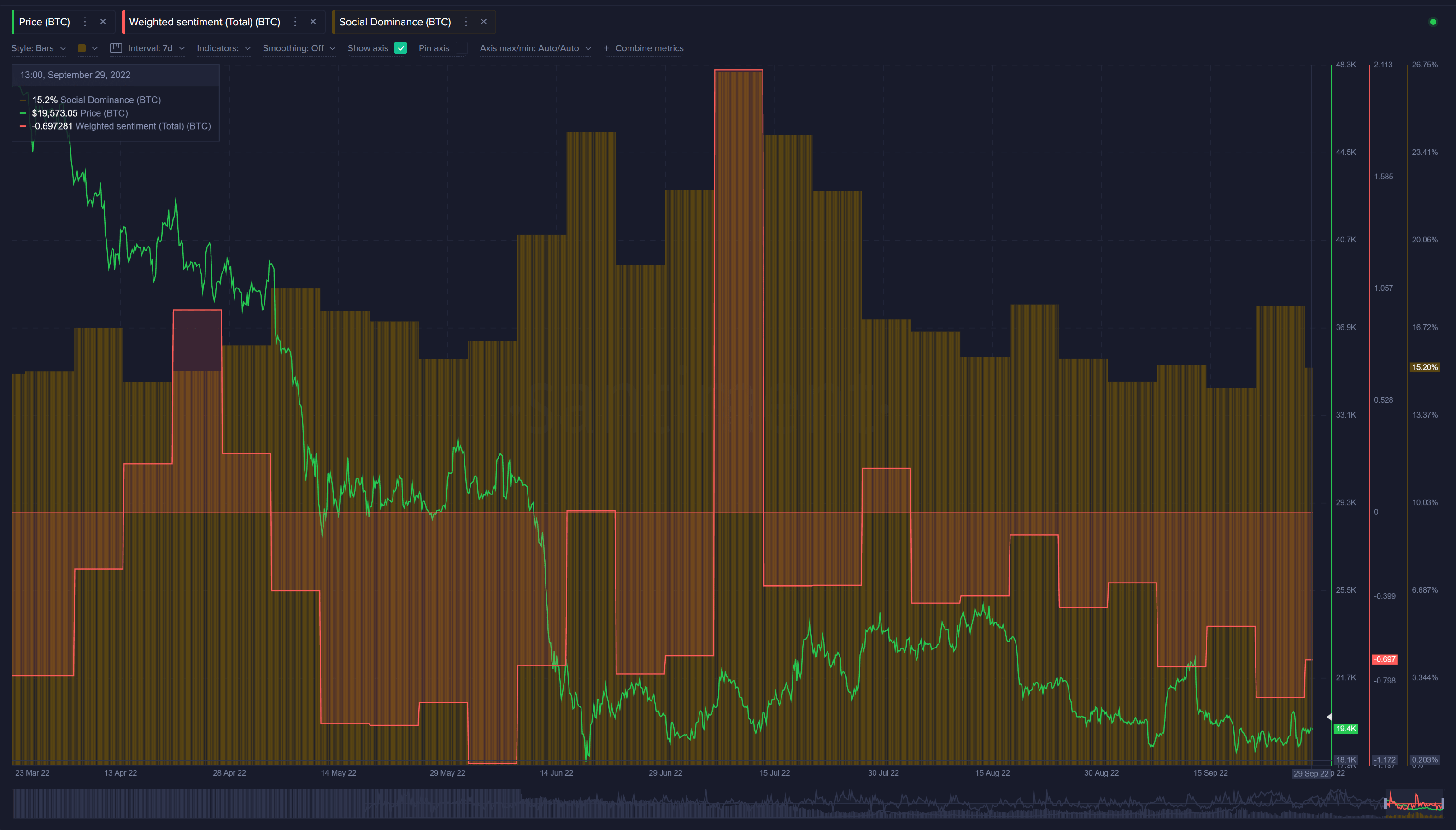

The market sentiment toward Bitcoin remains negative. Social data from Santiment shows a weighted sentiment score of -0.69, while talk of Bitcoin on social media sits below 20%, indicating that interest has waned.

Bitcoin social mentions (Source: Santiment)

Brian Quinlivan, Director of Marketing at Santiment, noted the trend in a September 30 recap report, pointing out that “the world remains in a very fragile place, and traders aren’t trusting much of anything to rise any time soon.” Crypto has suffered alongside other risk-on assets throughout this year amid soaring inflation rates, interest rate hikes, a global energy crisis, and market exhaustion off the back of the 2021 bull market.

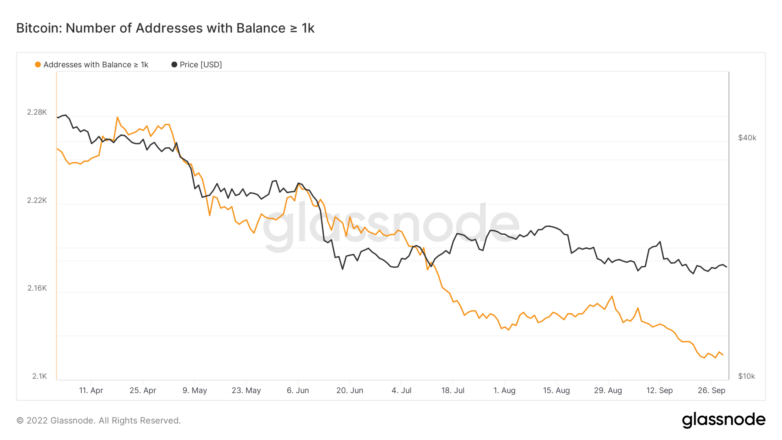

The declining interest in Bitcoin can also be seen from an on-chain perspective. According to Glassnode data, the number of addresses holding at least 1,000 BTC has remained steady at around 2,117 addresses over the past three days, following a sharp 26.75% decline. This market behavior suggests that prominent investors have lost interest in accumulating more coins.

The number of Bitcoin addresses holding more than 1,000 BTC (Source: Glassnode)

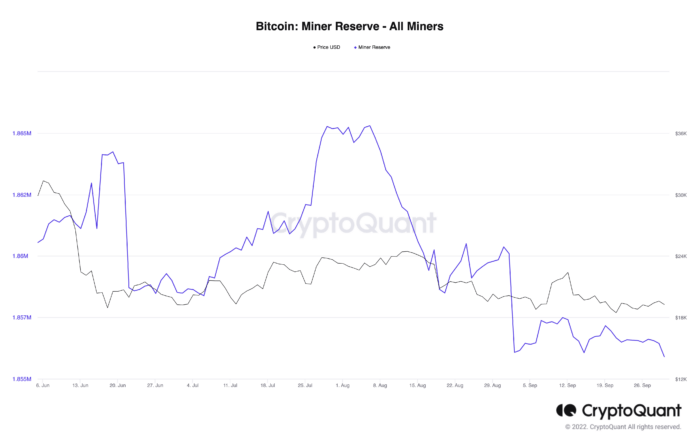

A similar trend is playing out with miners. According to CryptoQuant data, Bitcoin miners’ reserves have plateaued at 1.86 million tokens, holding around this level for nearly a month. The inactivity among miners follows a significant selloff in August.

Bitcoin Miners’ Reserve. (Source: CryptoQuant)

Despite the data showing a bleak outlook for the number one crypto, the number of new daily addresses created on the network hints that the top crypto could post a turnaround. The Bitcoin network is expanding, showing an uptick in retail interest since mid-July. The bullish divergence between network growth and the asset’s price points to a potential improvement in momentum in the future.

If network growth hits a higher high at a seven-day average of more than 417,000 addresses, the bullish narrative could be validated.

The number of new addresses on the Bitcoin network (Source: Glassnode)

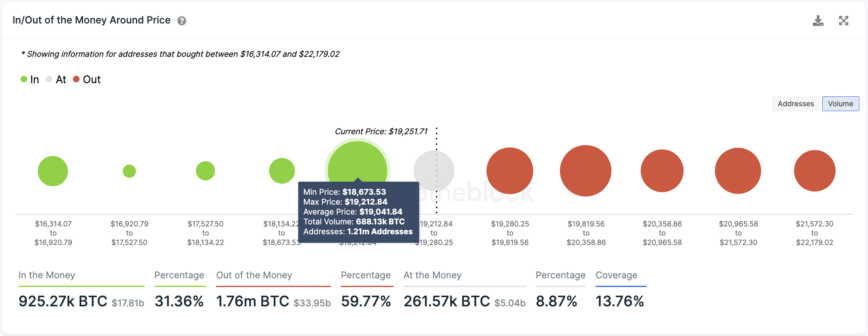

Transaction history shows that BTC established a critical support level at $19,000, where 1.21 million addresses purchased over 688,000 BTC. This demand wall must hold to prevent a steep correction. If it fails to hold this level, a selloff could ensue, potentially sending BTC to $16,000 or lower.

Bitcoin transaction history per IntoTheBlock’s IOMAP model (Source: IntoTheBlock)

IntoTheBlock’s IOMAP model shows that Bitcoin faces multiple areas of resistance ahead. The most considerable one sits at $20,000, where 895,000 addresses hold nearly 470,000 BTC.

It’s been a rough year for markets, and crypto hasn’t been spared in the fallout. While Bitcoin is now almost a year into a brutal bear market, several signs suggest that the pain may not be over. Even as new entrants join the top crypto’s network, the global macro picture, declining sentiment and miner interest, and recent price action hint that there’s no clear reason for the Bitcoin narrative to flip bullish anytime soon.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH. The information contained in this piece is for educational purposes only and is not investment advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Hive

Hive  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD