ETH Price Unable to Break Rrange but Can Bulls Extend to $1,400? (Etherum Price Analysis)

Up until now, ETH has managed to remain above $1,200 despite the increased selling pressure, but the price clearly shows that the downward trend is weakening after the Merge. However, this doesn’t mean that bullish momentum is underway.

Technical Analysis

By Grizzly

The Daily Chart

ETH was supported by the ascending line (in green) again, and increased investor confidence prevented the price from closing below it. The chart currently shows no notable signs of bullish momentum as the sideways trend continues for a second week.

The first obstacle is to break $1,500. (in red). This resistance results from the descending line (in yellow) and the 100-day moving average line (in white) colliding. If the ETH can clear this hurdle, the path to $2000 will be clearer.

As long as Ethereum trades below $1,500, a retest of the green support is not ruled out. Closing below this level may take the asset to the next support level at $1,000.

Key Support Levels: $1240 & $1000

Key Resistance Levels: $1500 & $1800

Daily Moving Averages:

MA20: $1333

MA50: $1497

MA100: $1494

MA200: $1921

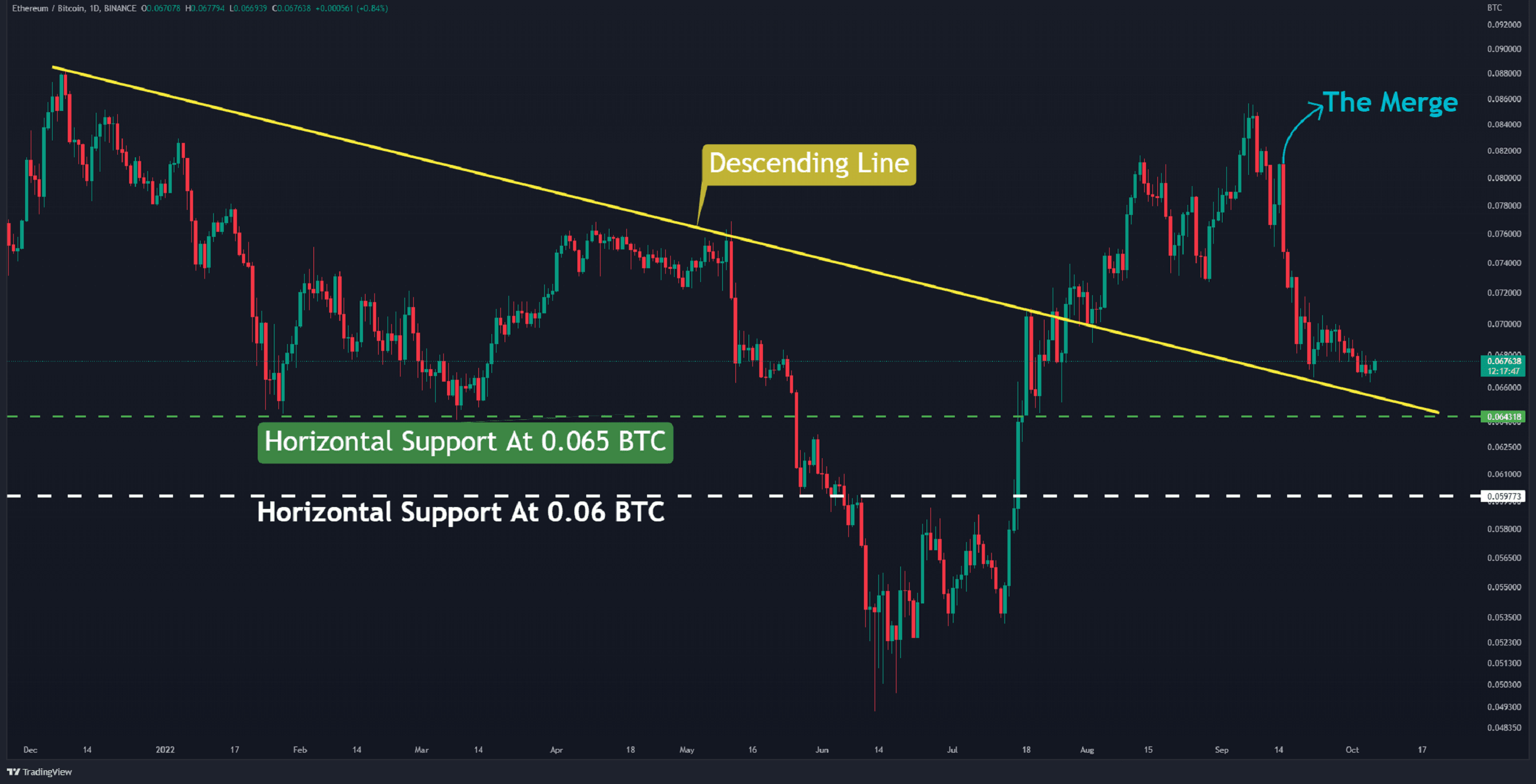

The ETH/BTC Chart

Against Bitcoin, the bears seem to be expanding the momentum, resulting in an 18% correction following the Merge.

This trend is likely to continue toward the horizontal level at 0.065 BTC (in green), which appears to be solid support. To even consider some sort of bullishness, the price would first have to start charting higher highs and higher lows.

Key Support Levels: 0.065 & 0.06 BTC

Key Resistance Levels: 0.073 & 0.08 BTC

Sentiment Analysis

Funding Rates

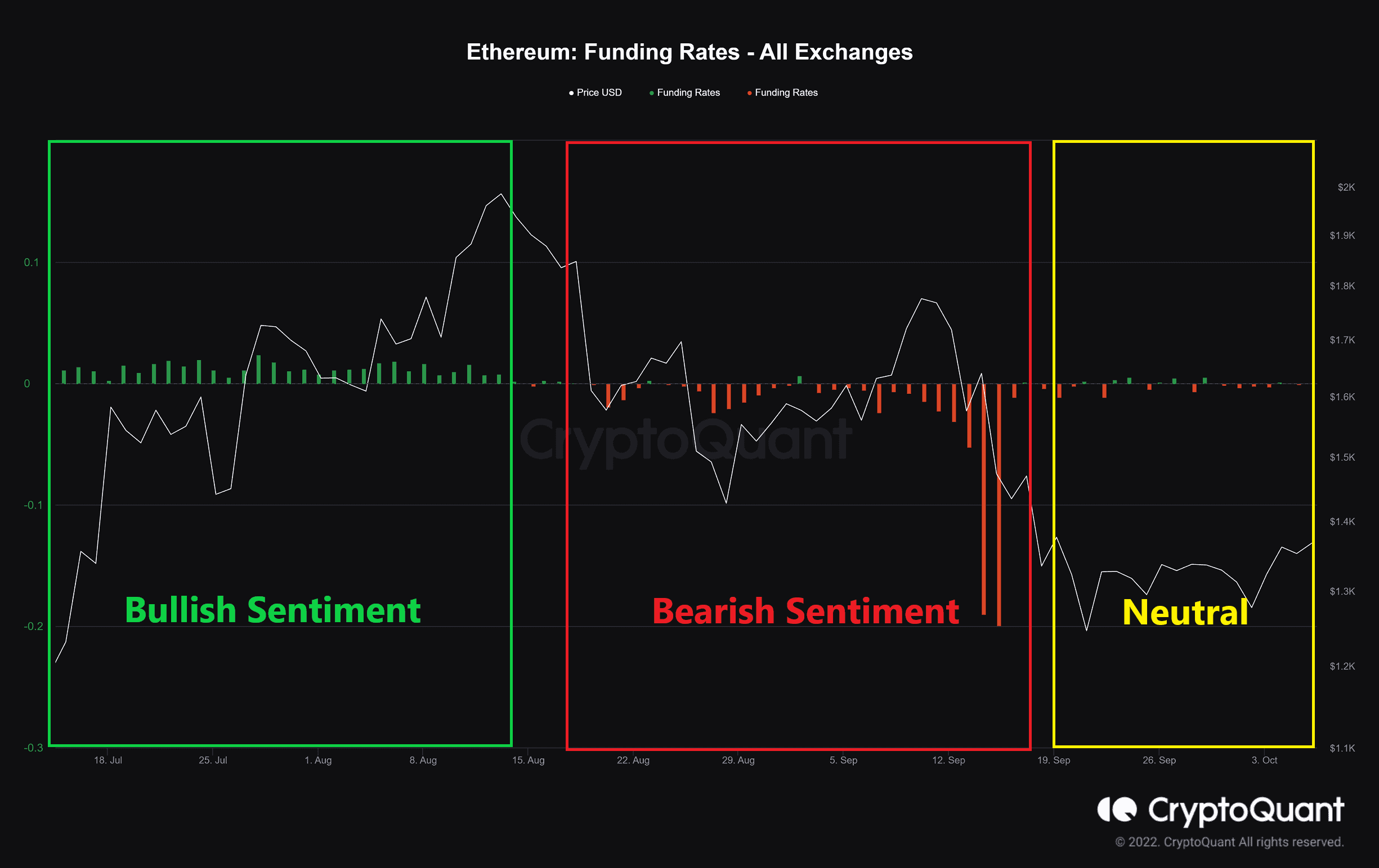

Definition: Periodic payments to traders that are either long or short, based on the difference between perpetual contract markets and spot prices.

Funding rates represent traders’ sentiments in the perpetual swaps market, and the amount is proportional to the number of contracts. Positive funding rates indicate that long positions are dominant and are willing to pay funding to short traders.

According to CryptoQuant data, there is still uncertainty among investors and traders in the derivative market. This overall doubt contributed to the establishment of the sideways trend stated in the technical analysis.

Bullish and bearish momentum rises when market sentiments, particularly in derivatives, align with the trend’s direction. Presently, this behavior is not visible.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Zcash

Zcash  Tether Gold

Tether Gold  IOTA

IOTA  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Dash

Dash  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  DigiByte

DigiByte  Lisk

Lisk  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy