Bitcoin (BTC) Price Cycles Weakening – The Next Bear Market Will Only Be a 67% Drop

Bitcoin (BTC) price has already reached the bottom of the current bear market, according to a new model of market cycles.

The new hypothesis tries to predict the bottom of the next cycle and assumes that each successive downward phase in the cryptocurrency market will be weaker. The bull market is also expected to be weaker. So are Bitcoin price cycles weakening?

Parallel to the cryptocurrency market, there is a market for cryptocurrency cycle models. They serve analysts and their followers to find patterns, rationalize and predict the price of digital assets.

They represent an attempt to look deep enough into the market to uncover the fundamental mechanisms that govern it and give a perspective on long-term price action.

In today’s analysis, Be[In]Crypto looks at the most popular models and examines whether Bitcoin price cycles are still an attractive narrative for investors.

In this context, we present a new, recently published model, according to which Bitcoin price cycles are weakening, and the next decline will be only -67% against the new ATH.

Bitcoin price cycles – repetitive psychology

Bitcoin price cycles are an attractive hypothesis, stating that the same phases of the cryptocurrency market are repeated over a sufficiently long period of time.

All of them together form a complete cycle, after the end of which another cycle begins. This gives a sense of order, harmony and the temptation to predict long-term price action.

The reference point for the Bitcoin price cycles hypothesis is the classic Wall St. Cheat Sheet, which combines the cyclicality of traditional markets with the phases of investors’ psychological reactions.

Besides, one of the main premises for the cyclical hypothesis is the repetitive nature of human psychology. Investors at any given point in the cycle are somewhere on the map of the spectrum of emotional states between extreme fear/depression and extreme greed/euphoria.

Wall St. Cheat Sheet / Source: ritholtz.com

Halving sets BTC price cycles

There are several leaders in the market for cryptocurrency cycle models. The most classic and natural for Bitcoin price is the model based on the halving rhythm.

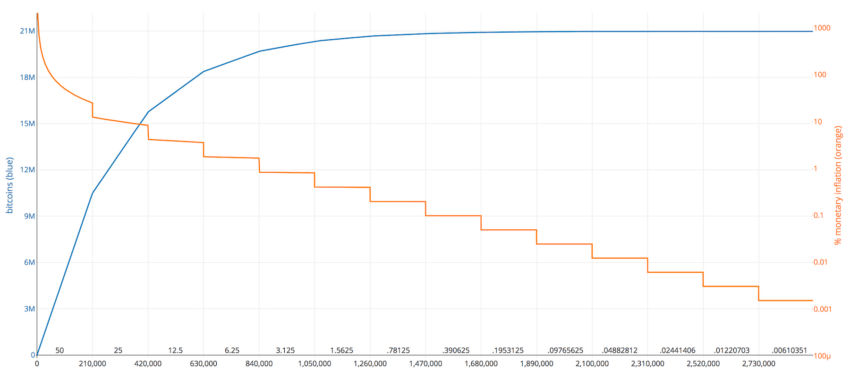

It assumes that Bitcoin price cycles are mainly determined by the event of halving the reward for mining a block of the network. The halving occurs once every four years or so, depending on the speed and efficiency of the entire network.

Source: buybitcoinworldwide.com

The idea is that a reduction in the amount of BTC awarded to miners for approving blocks triggers a supply shock that translates into an increase in price in the long term. That’s why some analysts believe the bull market begins a few months after halving.

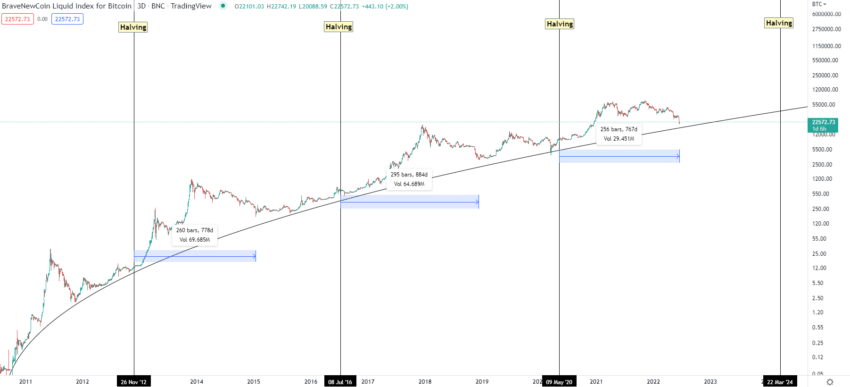

BLX chart by Tradingview

Stock-to-Flow and lengthening cycles

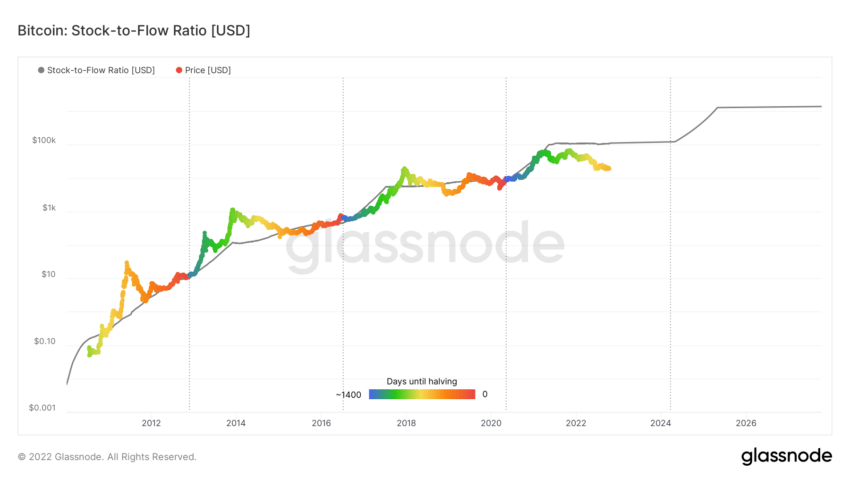

Another equally classic, though less popular today, model of Bitcoin price cycles is Stock-to-Flow (S2F) by pseudo-anonymous analyst PlanB.

It is built on the relation of the stock of any asset to its annual production (flow). The ratio between these two quantities is used to determine its scarcity. The greater the scarcity, the potentially higher the price.

Stock-to-Flow model / Source: Glassnode

The model has the advantage of being able to compare Bitcoin price to other assets and commodities, such as gold, diamonds, and real estate.

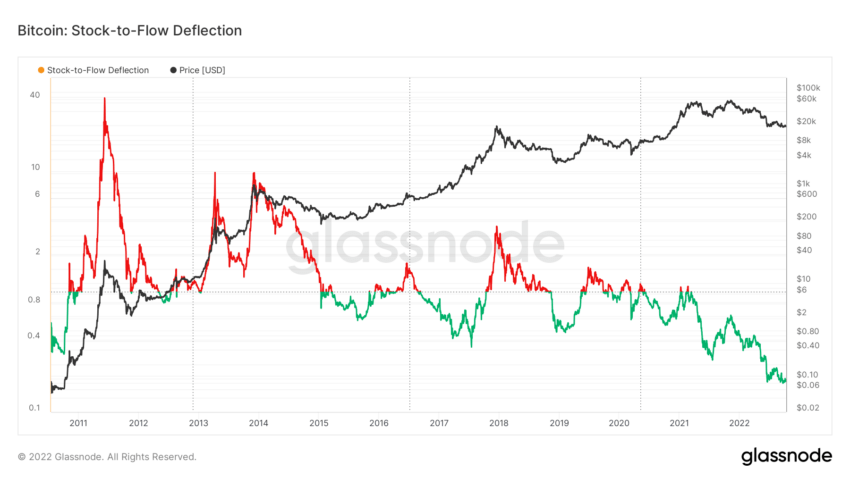

Unfortunately, the current degree of deviation of the BTC price from the predictions of the standard S2F model is so large that many admit that it can no longer be applied to Bitcoin cycles.

S2F Deflection / Source: Glassnode

One more popular model until recently was the hypothesis of Bitcoin lengthening cycles by Benjamin Cowen.

It assumes that each successive cycle lasts longer, yields lower returns on investment (ROI), and is not necessarily dictated by a halving rhythm. It has been popularized over the years, and historical data seemed to fit its assumptions well.

However, even here, the model does not seem to have withstood the reality of the sharp declines in the cryptocurrency market that occurred in May and June of this year.

According to the model, the current cycle should have had a much longer bull market phase, which, however, ended in Nov. 2021.

The analyst already admitted in May 2022 that his model “is dead.” Despite this, it seems that some of its components – such as ROI decline and logarithmic regression – still retain their long-term validity.

New model: Bitcoin’s increasingly weak cycles

The above three models and the Bitcoin price cycles they contain do not exhaust all the options and creativity of long-term analysts. Among many others, for example, one can mention the circular analysis for BTC price or the cyclicality models determining the legendary altcoin seasons.

Source: Twitter

The novelty of this model is the attempt to create an algorithm for accurately calculating the depth of declines during bear markets. The analyst does this not only for the current cycle but also tries to predict the next one, which is expected to occur in 2023-27.

According to his relatively simple algorithm (y = -97.5 + 3.7*x + 0.5*x^2), the bottom of the current cycle was already supposed to have been reached with Bitcoin price falling 74% from the all-time high (ATH). The bottom at $17,622 in June corresponds exactly to this value.

Next bear market likely only after BTC price hits $250,000

Interestingly, the model predicts that the next bear market will lead to a decline of just 67%. This is expected to occur after the Bitcoin price has previously risen to around $250,000.

According to the model’s estimates, the bottom of the next bear market would be somewhere in the range of $70,000 to $80,000. This would correspond to a re-test of the current Nov. 2021 ATH at $69,000.

All cycles to date, according to @StockmoneyL, form one big super-cycle in which progressive weakness is evident.

This weakening relates to both the depth of declines in a bear market and the height of increases in a bull market.

This view remains consistent with both the classic halving rhythm and some elements of Benjamin Cowen’s hypothesis of lengthening cycles.

Disclaimer: Be[in]Crypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Lisk

Lisk  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD