A tale of two countries, the IMF, and Bitcoin

Argentina had to accept an anti bitcoin clause for an IMF bailout. El Salvador was told to drop bitcoin, but refused. Which country did better?

Argentina accepts anti-crypto clause for bailout

Back in March 2022 Argentina was given a $45 billion bailout by the International Monetary Fund. The bailout was sorely needed given that Argentina was about to default on its debts.

However, a surprising clause was inserted into the deal. This meant that Argentina needed to take a tough anti-crypto stance henceforth. According to Fortune.com, the Economy Minister Martín Guzmán and the central bank president Miguel Pesce were both obliged to sign a letter of intent in which it was laid out how cryptocurrencies would be discouraged in order to “prevent money laundering” and “to further safeguard stability”.

At the time the previous month’s inflation figure was recorded at a distinctly unhealthy level of 52.3%, and therefore Guzmán said that the bailout deal would help the country to avoid “a profound monetary and inflationary stress that would derail Argentina’s economic recovery and have consequences on poverty,” as reported by Al Jazeera.

Roll forward a year later, and the March inflation figure for Argentina has been announced at 104.3%. Argentinian citizens have seen the value of their purchasing power reduce by 100% over the course of just one year.

Did the IMF know that this would likely be the case? And did the most influential world financial organisation do its best to stop Argentinians from fleeing their currency into Bitcoin in order to protect themselves?

El Salvador says no to IMF

Also in the American continent, but in Central America, is the small country of El Salvador. Now far more prominent in the world thanks to its adoption of Bitcoin as legal tender, El Salvador has made many enemies due to its pro-Bitcoin stance.

In a report from January 2022, at a roughly similar time as Argentina was preparing for its bailout, a BBC article stated that the adoption of Bitcoin had led to “large scale protests” and that there were “fears it would bring instability and inflation” to the country.

The IMF was scathing of the decision, warning President Bukele of the many risks that Bitcoin could bring to the country, and threatening that it would now be difficult for El Salvador to be granted any more loans. The IMF urged the El Salvadoran government to remove the legal status for Bitcoin.

El Salvador is flourishing

More than a year has passed since the furore over El Salvador’s decision. The President and his government held firm and the results so far have been highly encouraging.

According to the World Bank, GDP growth for El Salvador has climbed abruptly since 2020.

Source: World Bank

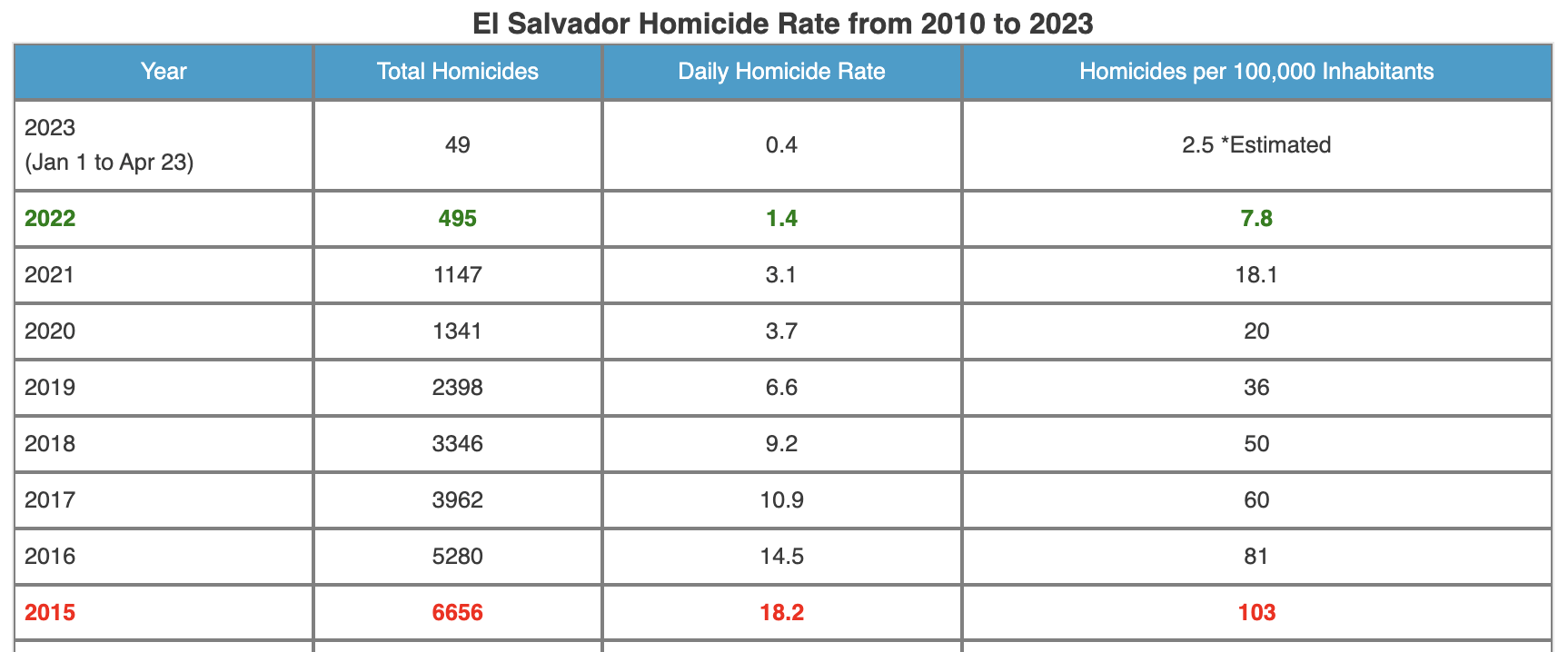

In addition, the homicide rate has declined to an estimated 2.5 for 2023, from a high of 103 back in 2015.

Source: https://elsalvadorinfo.net/homicide-rate-in-el-salvador/

El Salvador’s holdings of Bitcoin are still under water by around 30%, but going by Bitcoin’s halving cycles, the country might expect to be in a net profit in the next year or so.

And finally, El Salvadoran citizens overseas have the option to send money home via the Bitcoin rails instead of utiising usurious agencies such as Western Union, to say nothing of being able to start actually saving their wealth, instead of having it eaten away by inflation etc.

Argentinian citizens, on the other hand, are seeing their wealth evaporate. Bitcoin is a decentralised store of value outside the reach of greedy financial agencies and over-controlling governments, so it would perhaps behove Argentinians to put at least a part of their wealth into this asset.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD