‘ADA Whale’ Says Cardano is Likely to ‘Have Its Ethereum Moment’ in Next Bull Cycle

Pseudonymous Cardano ($ADA) influencer “ADA whale” (“cardano_whale” on Twitter) explained why he believes that the people’s “favortie chain” is likely to “thrive” in the next bull cycle.

On 15 March 2022, “ADA whale” explained why he is so bullish on Cardano:

2/Cardano stats to set the scene:

> TVL 1M +69%, 7d +21%

> Transactions 4x YoY (150k)

> NFT vol ~$1m/day

> Block prod pools: 1,200

> Projects building: 517

> Reddit subs 694k (55% Eth, 350% Σ Sol+Avax+Terra)

> Self-funding last round, votes / projects funded: 257,000 / 269

— ADA whale (@cardano_whale) March 15, 2022

Since then, the Vasil upgrade has taken place, and number of projects being built on Cardano has gone from 517 to 1,122, which is an increase of 117%.

Every Friday, we publish our weekly #Cardano development update. So for the lowdown on what IOG’s dev team has been working on last week, head on over and take a look?https://t.co/EUL3Nvxk56

— Input Output (@InputOutputHK) October 21, 2022

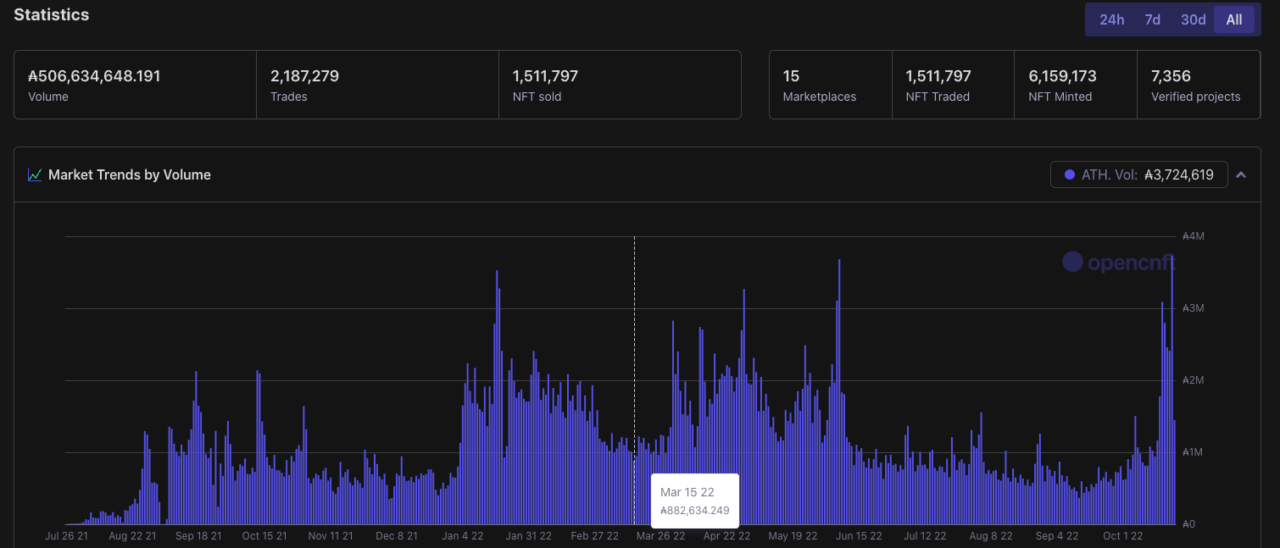

As for Cardano’s 24-hour NFT trading volume, since 15 March 2022, it has gone from 882,634 ADA to 3,724,619 ADA (which is the all-time high and it was reached on 21 October 2022), meaning an increase of 332%.

Source: OPENCNFT.IO

On 16 June 2022, “ADA whale” said that once the current bear market is over, Cardano will be one of the fastest blockchains and it will have a very rich ecosystem.

Post crypto recession, Cardano will be one of fastest chains w space for growth (L1+L2), have its own stable coin eco, dapps/dexes built by pro teams with capability not found elsewhere, will further grow in NFT prominence, see real world strategy start paying dividends. Just fax

— ADA whale (@cardano_whale) June 16, 2022

On 13 August 2022, he explained what category of investors are Cardano’s target audience.

A bet on Cardano is also a bet that the majority of potential users that aren’t onboarded yet will look for something that’s roughly in between Bitcoin and the most on the edge famous-for-DeFi L1 protocols (the ones that get hacked all the time). We welcome the normies

— ADA whale (@cardano_whale) August 13, 2022

On 15 August 2022, “ADA whale” pointed out three ways in which Cardano is better than other layer 1 Proof-of-Stake (PoS) blockchains.

Many have their heads in the sand about it, but Cardano so far has done security, staking and decentralisation of block production better than any other PoS protocol I can think of. Takes a bit of time, but no reason to think it won’t be same for DeFi, scaling and governance imo

— ADA whale (@cardano_whale) August 15, 2022

On the same day, the popular Cardano influencer/educator explained why Cardano’s TVL ($51.73 billion, as of 10:45 a.m. UTC on October 22) is currently relatively small:

– No VC involvement, which prop up and game TVL on solunavax

– No borrow/lending till Vasil (Liqwid, Aada etc)

– No stable coins till Vasil

– No synthetics till Vasil

– Staking yield as hurdle rate,

not perceived to being beaten by DeFi based yield

– Bear mkt / depressed ADA px— ADA whale (@cardano_whale) August 15, 2022

Anyway, earlier today, “ADA whale” said that he expected Cardano to really shine in the next bull cycle once “DeFi, NFTs and community activity” are really “exploding” since currently institutional investors seem to be losing interest in layer one “L1”) blockchains, which should create a vacuum that will enable Cardano (with its very loyal and passionate community) to “thrive”.

Underlying driver to this is while instis will continue to love “blockchain”, they’re imo souring on L1 cryptos. Aptosui will be an abysmal failure, that money won’t be back for a bit, creating a vacuum for a ppl’s favourite chain to thrive. Once instis return its fait accompli

— ADA whale (@cardano_whale) October 22, 2022

Image Credit

Featured Image via Pixabay

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Dash

Dash  Ontology

Ontology  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur