AirSwap Reviews: Peer-to-peer Token Trading DEX and Open Source?

AirSwap is a new cryptocurrency exchange from a US-based startup in the Decentralized Finance (DeFi) domain. The platform offers users the ability to trade relatively new crypto coins and platform-native tokens, making it an excellent choice for those looking for a unique trading experience. Unlike other exchanges, AirSwap provides features that go beyond those of both competing decentralized and centralized exchanges. This has made it a popular choice for those looking for a more streamlined approach to trading. Additionally, the platform’s native crypto token has garnered a lot of attention in the cryptocurrency community, further driving interest in the platform. AirSwap’s standout feature is its ability to allow users to trade Ethereum tokens directly with one another, which has made it a game-changer in the industry. Finally, if you’re looking to make informed trading decisions, you can take advantage of our Ethereum price prediction tool to help guide your investments.

What Is AirSwap?

AirSwap is a decentralized peer-to-peer cryptocurrency exchange that operates on the Ethereum blockchain. It allows users to trade cryptocurrencies directly with each other without the need for intermediaries or a centralized exchange. AirSwap is built on the principles of decentralization, privacy, and security.

The platform utilizes smart contracts to facilitate token swaps between parties. Instead of placing orders on a traditional order book, AirSwap uses a protocol called the Swap Protocol. This protocol enables users to signal their intent to trade and find counterparties through off-chain negotiation. Once the trading terms are agreed upon, the actual token transfer occurs on the Ethereum blockchain through a peer-to-peer atomic swap.

One of the key features of AirSwap is its focus on privacy. The platform does not require users to create accounts or provide personal information, enhancing anonymity and protecting user privacy. Additionally, AirSwap does not hold custody of user funds during the trading process, further mitigating the risk of theft or hacks.

AirSwap has its native ERC-20 utility token called AST, which can be used to access additional features and services within the AirSwap ecosystem. The token plays a role in signaling trade intent, creating liquidity pools, and incentivizing market makers.

How Does AirSwap Work?

AirSwap operates on the Ethereum blockchain and utilizes a decentralized protocol called the Swap Protocol. Here’s a step-by-step explanation of how AirSwap works:

- Intent to Trade: A user who wishes to trade a particular cryptocurrency token signals their intent to trade by broadcasting it off-chain. This intent is expressed by creating an order that includes the details of the desired trade, such as the token, the quantity, and any specific trading conditions.

- Indexer: employs an Indexer, which is a distributed network that helps users discover potential counterparties for their trades. The Indexer maintains an index of available orders and facilitates the matching of buyers and sellers.

- Order Matching: The Indexer helps connect traders who have compatible orders. It searches for the best matches based on the desired token, quantity, and trading conditions. This matching process occurs off-chain, allowing for efficient and scalable order discovery.

- Peer-to-Peer Atomic Swap: Once a suitable match is found, the traders engage in an off-chain negotiation to agree on the terms of the trade. They can communicate directly or through any chosen communication channel. This negotiation ensures that both parties are satisfied with the trade details.

- On-Chain Settlement: After the off-chain negotiation, the actual token transfer occurs on the Ethereum blockchain through an on-chain settlement process called a peer-to-peer atomic swap. Atomic swaps ensure that either the entire trade is executed, or none of it takes place, minimizing the risk of partial or failed transactions.

- Token Transfer: Using smart contracts on the Ethereum blockchain, the tokens are securely transferred from one party’s wallet to the other party’s wallet. The execution of the swap is transparent, verifiable, and irreversible once recorded on the blockchain.

- Privacy and Security: AirSwap prioritizes user privacy and security. The platform does not require users to create accounts or provide personal information, preserving anonymity. Furthermore, AirSwap does not hold custody of user funds during the trading process, reducing the risk of theft or hacks.

Features of AirSwap

AirSwap offers several features that distinguish it as a decentralized peer-to-peer cryptocurrency exchange. Here are some notable features of AirSwap:

- Decentralized Trading: operates as a decentralized exchange, allowing users to trade cryptocurrencies directly with each other without the need for intermediaries. This eliminates the reliance on centralized exchanges, reducing counterparty risk and promoting peer-to-peer transactions.

- Swap Protocol: utilizes the Swap Protocol, a decentralized protocol for trading ERC-20 tokens. The protocol enables off-chain negotiation and on-chain settlement, providing an efficient and secure trading experience.

- Privacy and Anonymity: prioritizes user privacy by not requiring users to create accounts or provide personal information. The platform allows users to trade while maintaining their anonymity, enhancing privacy and security.

- Non-Custodial Model: follows a non-custodial approach, meaning that it does not hold custody of user funds during the trading process. This reduces the risk of theft or hacking since users retain control of their tokens in their personal wallets until the trade settlement occurs on the blockchain.

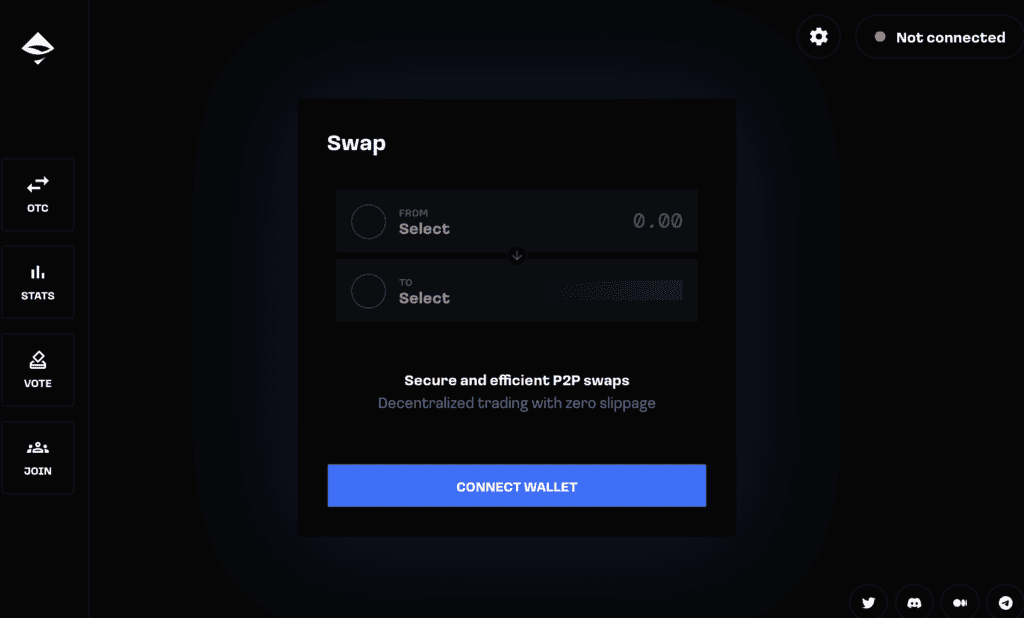

- User-Friendly Interface: aims to provide a user-friendly trading experience. The platform offers an intuitive interface that simplifies the process of creating, discovering, and executing trades. This makes it accessible to both experienced traders and newcomers to the cryptocurrency space.

- ERC-20 Token Support: primarily focuses on ERC-20 tokens, which are tokens built on the Ethereum blockchain. It supports a wide range of ERC-20 tokens, allowing users to trade various cryptocurrencies within the Ethereum ecosystem.

- AST Token and Incentives: has its native ERC-20 utility token called AST. The AST token plays a role in signaling trade intent, creating liquidity pools, and incentivizing market makers. AST token holders can participate in governance and decision-making processes within the AirSwap ecosystem.

- Community and Liquidity: has an active community of users and market makers who contribute to liquidity on the platform. Liquidity providers facilitate trades by offering tokens for trading, ensuring that there is sufficient depth in the market for smooth trading operations.

Services Offered by AirSwap

AirSwap primarily offers decentralized peer-to-peer cryptocurrency trading services. Here are the key services provided by AirSwap:

- Token Trading: enables users to trade ERC-20 tokens directly with each other. Through the platform, users can discover available trading pairs, negotiate terms, and execute trades securely and privately.

- Swap Protocol Integration: provides developers with the tools and infrastructure to integrate the Swap Protocol into their applications and platforms. This allows developers to incorporate decentralized token trading capabilities into their projects.

- AST Token Utility: AirSwap has its native ERC-20 utility token called AST. The AST token serves several purposes within the AirSwap ecosystem. It can be used to signal trade intent, participate in governance, access premium features, and incentivize market makers.

- Market Making: offers market-making services, allowing liquidity providers to contribute to the platform’s liquidity pools. Market makers can deposit tokens and help facilitate trades by offering competitive prices and improving overall trading liquidity.

- Developer APIs and Tools: provides a set of APIs, software development kits (SDKs), and developer tools that allow developers to integrate AirSwap functionalities into their applications, wallets, or decentralized finance (DeFi) projects.

- Wallet Integration: can be integrated with various cryptocurrency wallets, enabling users to access decentralized trading directly from their wallets. This integration provides a seamless and secure trading experience.

Pros and Cons

Pros:

- Decentralization: operates as a decentralized exchange, enabling direct peer-to-peer trading without relying on intermediaries. This decentralization reduces the risk of hacks, counterparty manipulation, and other vulnerabilities associated with centralized exchanges.

- Privacy and Anonymity: prioritizes user privacy by not requiring users to create accounts or provide personal information. This enhances privacy and protects user identities.

- Security: follows a non-custodial model, meaning it does not hold user funds during trades. Users retain control of their tokens in their personal wallets until the trade settlement occurs on the blockchain, reducing the risk of theft or hacking.

- User-Friendly Interface: offers a user-friendly interface that simplifies the trading process. The platform aims to be accessible to both experienced traders and newcomers to the cryptocurrency space.

- Developer-Friendly: provides developers with APIs, SDKs, and developer tools to integrate the Swap Protocol into their applications. This allows developers to incorporate decentralized trading capabilities into their projects and contribute to the ecosystem.

Cons:

- Limited Token Support: AirSwap primarily focuses on ERC-20 tokens within the Ethereum ecosystem. While this covers a wide range of cryptocurrencies, it may not support tokens from other blockchain networks.

- Lower Liquidity: Compared to large centralized exchanges, decentralized exchanges like AirSwap may have lower liquidity, which could result in wider bid-ask spreads and potentially impact trade execution.

- Reliance on Ethereum Network: AirSwap operates on the Ethereum blockchain, and as such, its performance and transaction speed are dependent on the scalability and congestion of the Ethereum network. During periods of high network congestion, transactions on AirSwap may experience delays or higher fees.

- Off-Chain Negotiation: The off-chain negotiation process used by AirSwap may introduce some complexities and require users to engage in direct communication or use additional communication channels to agree on trade terms.

- Market Volatility: Cryptocurrency markets are known for their volatility. While AirSwap provides a platform for trading, users should still be aware of the inherent risks associated with cryptocurrency investments and fluctuations in token prices.

AirSwap Fees

AirSwap has a unique fee structure that differs from traditional centralized exchanges. Here’s an overview of the fee components associated with using AirSwap:

- Trading Fees: AirSwap does not charge any direct trading fees to users. When executing a trade on AirSwap, there are no transaction fees or commissions imposed by the platform itself. This distinguishes AirSwap from many centralized exchanges that typically charge trading fees based on the transaction volume or maker-taker models.

- Gas Fees: As AirSwap operates on the Ethereum blockchain, users are subject to gas fees. Gas fees are required to pay for the computational resources and network fees associated with executing transactions on the Ethereum network. These fees can vary depending on the congestion of the Ethereum network at the time of the transaction and the complexity of the transaction. Gas fees are paid directly to the network miners and not to AirSwap.

AirSwap Security and Privacy

AirSwap prioritizes security and privacy to provide users with a secure and anonymous trading experience. Here’s an overview of AirSwap’s approach to security and privacy:

Security:

- Non-Custodial Model: AirSwap follows a non-custodial approach, which means it does not hold custody of user funds during the trading process. Users retain control of their tokens in their personal wallets until the trade settlement occurs on the blockchain. This reduces the risk of theft or hacking associated with centralized exchanges that hold user funds.

- Smart Contract Audits: AirSwap has conducted audits of its smart contracts to identify and address potential vulnerabilities. Audits help ensure the reliability and security of the protocol by detecting and addressing any potential security weaknesses.

- Emphasis on User Responsibility: AirSwap places responsibility on users to maintain the security of their wallets and private keys. Users are encouraged to follow best practices for securing their digital assets, such as using hardware wallets, keeping software and firmware up to date, and practicing good password management.

Privacy:

- No Account Creation: AirSwap does not require users to create accounts or provide personal information. This preserves user anonymity and privacy since no personal data is collected or stored by the platform.

- Off-Chain Negotiation: AirSwap employs an off-chain negotiation process to agree on trade terms between counterparties. This negotiation occurs outside the blockchain, enhancing privacy by keeping trade details confidential and not publicly visible.

- Direct Communication: During the off-chain negotiation process, users can communicate directly with each other or use any chosen communication channel. This enables private communication between traders and enhances privacy.

- Limited Data Exposure: AirSwap minimizes the exposure of user data by not holding custody of user funds or requiring personal information. This reduces the risk of potential data breaches or unauthorized access to user information.

Conclusion

AirSwap is a decentralized peer-to-peer cryptocurrency exchange built on the Ethereum blockchain. It aims to provide users with a secure, private, and user-friendly trading experience. By utilizing the Swap Protocol, AirSwap enables direct token trading between users, eliminating the need for intermediaries or centralized exchanges.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur