Analyst Benjamin Cowen Predicts Ethereum (ETH) Move in May – Here’s His Outlook

Closely followed crypto analyst Benjamin Cowen says that Ethereum (ETH) is heading toward a big move in about three months.

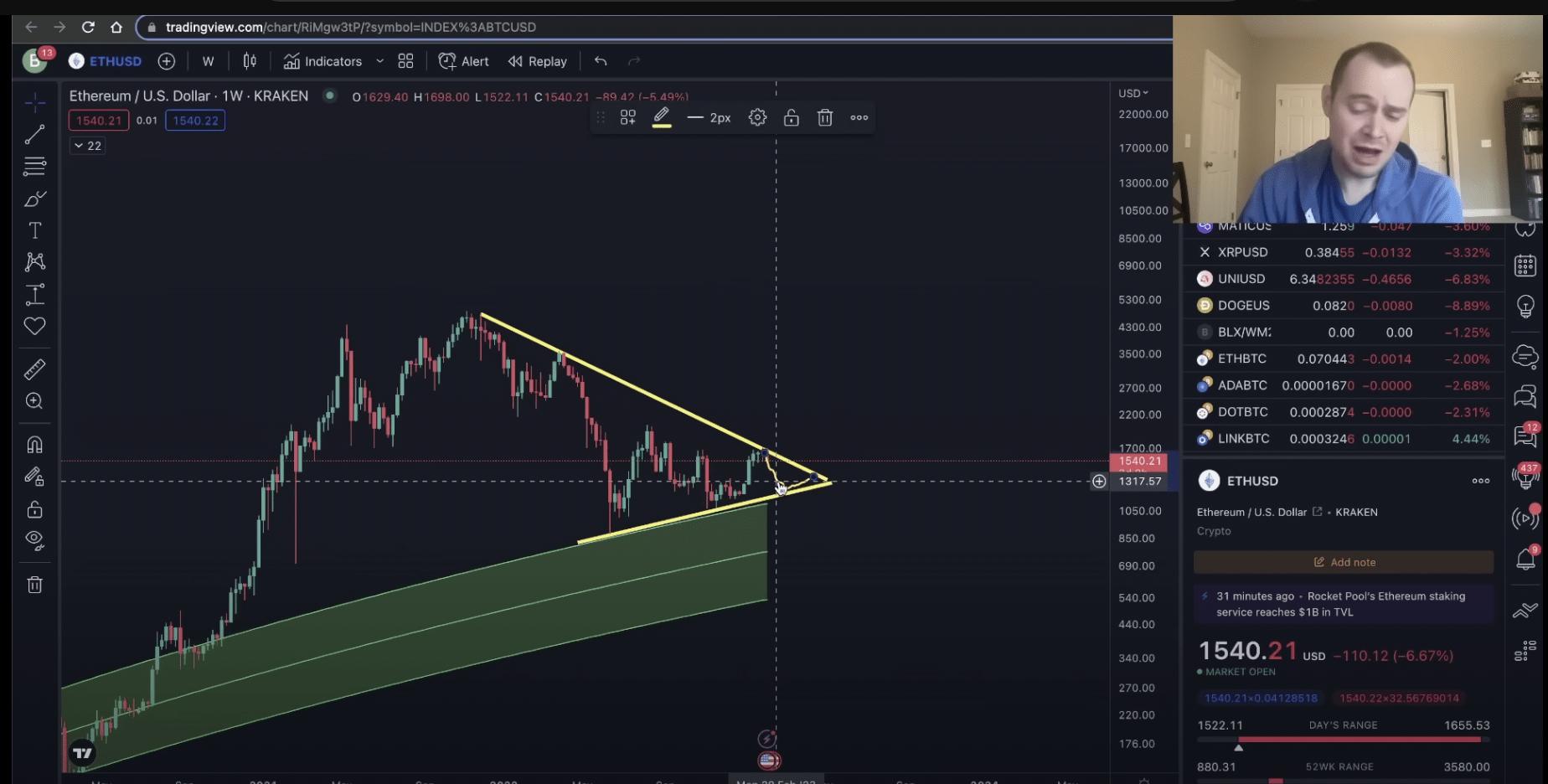

In a new strategy session, Cowen tells his 784,000 YouTube subscribers that ETH is trading within a large wedge pattern that could lead to a breakout by May of this year.

Cowen says that to the downside of the wedge is what he thinks is the “deep value” zone for Ethereum, between the $600 to $1,000 price range.

“Eventually, it’s going to have to break out one way or another because this is sort of coming to an endpoint by May. So I would expect us to either break to the upside or the downside by May. Of course, you guys know my opinion, I would prefer to see it go home to the regression line [or] regression trendline because that’s ultimately where I think the deep value can be found in the same way it was found over here in 2018, the same way it was found in 2020. So I think that’s worthwhile to continue watching.”

Source: Benjamin Cowen/YouTube

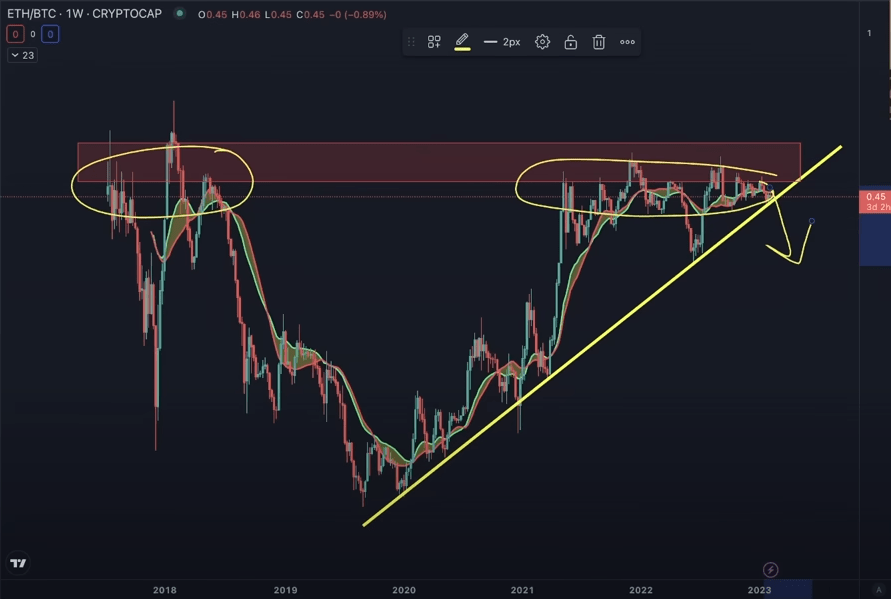

Cowen also looks that ETH in its Bitcoin pair (ETH/BTC) to gauge its strength. According to the popular analyst, ETH/BTC is coming to an inflection point, probably by next month, with the odds leaning toward a downward move.

“This is also coming to a sort of a point sometime by March. Not only is the ETH/USD coming to a decision point by that March and April timeframe, you could argue the ETH/BTC valuation is coming to a very similar phase. Another way that I thought was worthwhile to take a look at the ETH/BTC valuation is to not just measure the price relative to Bitcoin because the supply is of course changing. Why don’t we measure the market cap of Ethereum divided by the market of Bitcoin?

I look at it in the top range over here and I can’t help but wonder if it’s not just looking like this [2018], where it has this sort of distribution phase in this upper region only to ultimately break to the downside.”

Source: Benjamin Cowen/YouTube

At time of writing, ETH is trading at $1,534.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM