Analyst Predicts Big Correction in Tech Stocks That Drags Bitcoin With It – Here’s His Downside Target

A widely followed crypto analyst is predicting a massive correction in tech stocks that would drive the value of Bitcoin (BTC) to new bear market lows.

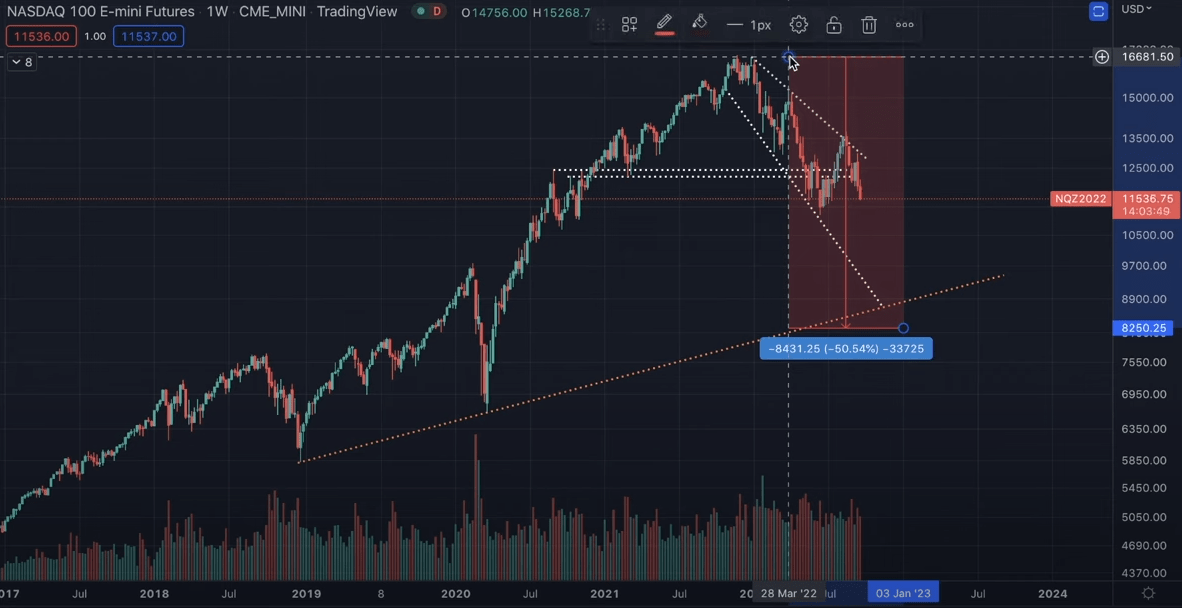

In a new video update, popular crypto analyst Nicholas Merten tells his 514,000 YouTube subscribers that he believes technology indices like the Nasdaq are due for a 50% devaluation from the highs.

“Our general target is that at a minimum, just from where we’re at right now, we should at a minimum expect technology indices like the NASDAQ are going to be probably correcting 50%.

We are well overdue for a proper recessionary bear market, depressionary bear market, where instead of the kind of 15% to 30% dips that we’ve gotten many times over the last decade that soon after recover very swiftly, we should be expecting a harsh correction that is going to take us down 40%, 50% or 60%.

I don’t want to call the exact date nor the exact value that we’re going to go to because no one really knows that but I want to give ourselves a goal post that, potentially, over the coming months going into Q1 of 2023, we could see the Nasdaq come down another 28% that would essentially take us from [its] all-time highs down to a clean 50 to 50.5%.”

Source: Nicholas Merten/YouTube

Merten says that such a decline for the Nasdaq is bad news for Bitcoin, and gives a rough price target for the leading digital asset.

“If we think about the fact that Bitcoin would be holding neutral to the Nasdaq, we take it here to our Bitcoin chart and look at an equalized amount of decline in Bitcoin’s price from where we’re at now and that would take us roughly down towards the $13,600 to $14,000

.”Bitcoin is changing hands for $19,134 at time of writing, a 1.7% gain on the day. A decrease to Merten’s price range would mark a dip of around 28% for BTC.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond