As Bitcoin Price Hits $23,500, Crypto Analyst Says ‘Bears Are Sweating’

At 9:23 UTC on Friday (July 22), the Bitcoin ($BTC) price hit $23,500, and seems on its way to $24,000.

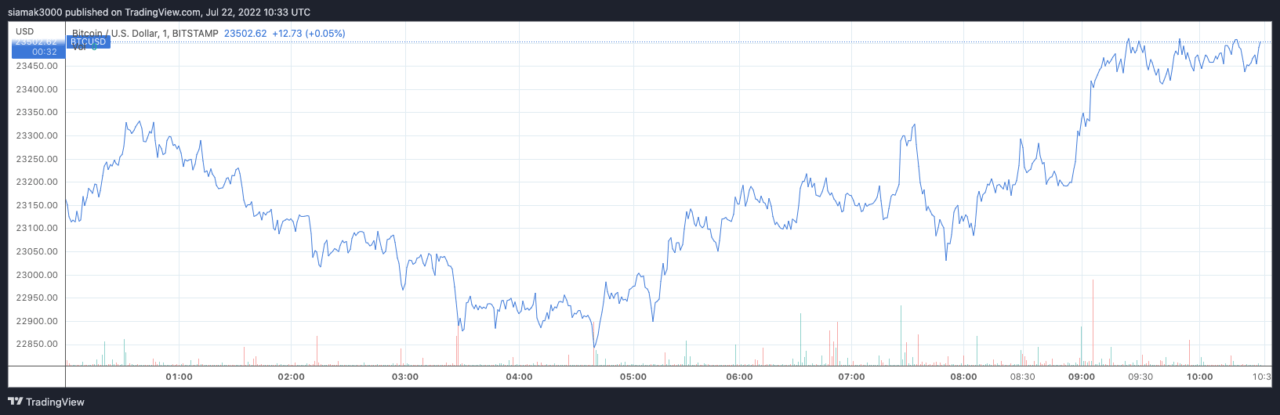

Source: TradingView (24-Hour BTC-USD Price Chart for Bitstamp)

Currently (as of 10:33 UTC on July 22), Bitcoin is trading around $23,502, up 2.45% in the past 24-hour period. Interestingly, the $BTC price has increased by 13.21% since July 17 when Bitcoin’s latest rally started.

And since June 13, when crypto lender Celsius announced on its blog that due to “extreme market conditions” it was “pausing all withdrawals, Swap, and transfers between accounts”, $BTC has gone from $22,450 to $23,502, which is a gain of 4.68%.

Bitcoin’s price action led crypto analyst and educator Koroush Khaneghah (who goes by the pseudonym “Kourosh AK” on Twitter) to tell his over 310K Twitter followers:

Bears are sweating.

— Koroush AK (@KoroushAK) July 22, 2022

As you probably already know, on Wednesday (July 20), Tesla CEO Elon Musk — who is the world’s richest person (with an estimated net worth of $235.8 billion as of 20 July 2021) according to Forbes — explained why his company decided to sell 75% of its Bitcoin holdings in Q2 2022.

According to Seeking Alpha’s transcript of Tesla’s Q2 2022 Earnings Conference Call, Musk and Tesla CFO Zachary Kirkhorn talked about Tesla’s cryptocurrency sales in the quarter.

Kirkhorn said:

“Within operating expenses, Boston and Berlin-related startup costs have wound down as these factories have moved into production and their costs are now reflected in automotive COGS. Additionally, we converted a majority of our Bitcoin holdings to Fiat for a realized gain, offset by impairment charges on the remainder of our holdings, netting a $106 million cost to the P&L included within restructuring and other. We also incurred restructuring charges related to targeted staffing reductions.“

Musk then added:

“Yes, actually, it should be mentioned that the reason we sold a bunch of our Bitcoin holdings was that we were uncertain as to when the COVID lockdowns in China would alleviate. So it was important for us to maximize our cash position, given the uncertainty of the COVID lockdowns in China. We are certainly open to increasing our Bitcoin holdings in future. So this should not be taken as some verdict on Bitcoin. It’s just that we were concerned about overall liquidity for the company given COVID shutdowns in China. And we have not sold any of our Dogecoin.“

Although this disappointing news initially resulted in a small dip in the price of Bitcoin, the mood in the crypto market since then seems to have improved quite a bit.

And yesterday, TRON Founder Justin Sun said that TRON DAO would be buying the same amount of bitcoins that were sold by Tesla in Q2 2022:

.@elonmusk sold, we buy. https://t.co/mvRcfC7wQj

— H.E. Justin Sun??? (@justinsuntron) July 21, 2022

Another bullish comment from yesterday came from Blockstream Co-Founder and CEO Adam Back, who said that “Bitcoin is displacing gold over time.”

#bitcoin is displacing gold over time, as Lindy effect builds confidence, adoption and awareness grows, more financial institutions offer bitcoin, and as the younger generation inherits investments and wealth – they are more likely to reallocate to BTC than gold.

— Adam Back (@adam3us) July 21, 2022

Image Credit

Featured Image by Whistofino via Pixabay.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Lisk

Lisk  Hive

Hive  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD