Big Bitcoin ‘price move on the horizon’ anticipated heading into October

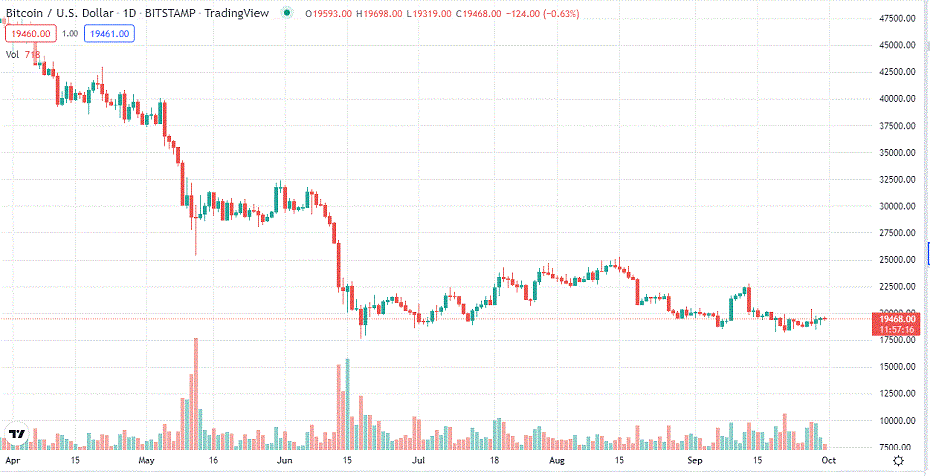

As September comes to an end, Bitcoin’s (BTC) price is holding firm, appearing to stabilize above $19,000 as volatility attempts to subside. The stability in Bitcoin’s price is partly backed by the asset standing out as a favorable hedge at a time the U.S. dollar is toppling other global fiat currencies.

Based on the recent price movement, Kitco News analyst Jim Wyckoff suggested on September 30 that the drop in Bitcoin volatility could indicate ‘a bigger price move is on the horizon.’ Specifically, the analysts pointed out that the collapsing volatility is a result of Bitcoin recording sideways trading despite the bears having a substantial share of control.

On the asset’s prospects, Wyckoff stated that if the price surpasses the September high of around $20,000, the scenario will trigger bulls. Still, bears will dominate if the asset crosses into next month with September’s lows.

Bitcoin in October

Interestingly, Bitcoin is entering into October, a month known to favor the asset, and it could be a key psychological boost for most investors. Therefore, investors are likely looking forward to capitalizing on the bullish season but will remain weary of the prevailing macroeconomic factors.

Although Bitcoin is showing signs of a potential rally, the macroeconomic factors continue to present a gloomy picture when the asset is looking for a boost. It is worth pointing out that the initial concept of BTC was meant to survive such conditions characterized by interest rate hikes and a slowing economy.

In this line, the volume of Bitcoin trading and other global fiat currencies is recording a spike. As reported by Finbold, investors are increasingly ditching the British pound and the Euro in favor of Bitcoin.

Furthermore, the crypto community is betting on Bitcoin to rise above the $20,000 level as the push to exit the bear market continues. In this line, Finbold reported that the cryptocurrency community on CoinMarketCap projected Bitcoin will trade at $22,857 by the end of October.

Crypto decoupling from equities

Amid the conditions, Bitcoin has increasingly correlated with the stock market, but there are signs of decoupling. Notably, the correlation between Bitcoin, Ethereum (ETH) and the S&P 500 was down by -2.4% as of September 29.

Furthermore, crypto trading expert Michaël van de Poppe suggested that the flagship cryptocurrency can set sights on $19,600 if it holds the $19,300 level noting that the asset can seem “some momentum.”

In the meantime, Bitcoin is focusing on regaining the $20,000 level, trading at $19,900 by press time with gains of over 3% in the last 24 hours.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur