Binance’s CZ: High Inflation And Recession Fears Will Drive Bitcoin Adoption

It’s safe to say CZ is bullish on bitcoin and crypto’s future. Changpeng Zhao visited CNBC’s Squawk on the Street and flipped the prevalent bearish narrative on its head. In less than 2 minutes. Most of the things CZ said are based on common sense and a basic understanding of market forces, but still, it’s calming to hear a leader of the industry saying them. Especially in this fear-ridden stage of the cycle we’re in.

.@binance CEO @cz_binance: The macroeconomics situation will be high inflation, the talk about recession…all of those things drive adoption into #Bitcoin.@CNBC pic.twitter.com/EP8OHwPeAa

— Squawk on the Street (@SquawkStreet) July 28, 2022

Notice that even though Binance’s business is dependent on altcoins’ performance, especially BNB, CZ makes a clear distinction between bitcoin and crypto in general. On the other hand, even though the interview is about bitcoin, CZ sneaks crypto here and there.

In any case, let’s analyze what Binance’s CEO thinks about the current market conditions and the future of bitcoin and crypto.

What Did CZ Squawked On US National TV?

The first thing the interviewer was interested in was the way that bitcoin bulls have defended the “20Kish” line. According to CZ, that was “the last peak” so there’s a “psychological barrier” there. So far, bitcoin’s price had never go lower than the previous cycle’s all-time high. This time it was different, probably because of Tesla’s paper hands and the Terra collapse. However, the market ended up defending the 20K line.

The interviewer then asked about other factors, like the increase in money supply or the bitcoin’s correlation to Nasdaq. According to CZ, those are two relevant factors, but in the end “it’s a mass psychology market” and the last ATH is the barrier. It’s only fair that we quote Binance Academy for an explanation of the psychology of market cycles:

“In short, market sentiment is the overall feeling that investors and traders have regarding the price action of an asset. When the market’s sentiment is positive, and prices are rising continuously, there is said to be a bullish trend (often referred to as a bull market). The opposite is called a bear market, when there is an ongoing decline in prices.”

Recently, as we regularly do here at NewsBTC, we checked on the famed fear and greed index for insights into the current market sentiment. This is what we found:

“Last week, the indicator’s value had risen up to even 34 as the coin’s price saw a recovery rally. However, as the run ended and the crypto once again slumped down, so did the sentiment among the investors.

The report notes that this trend indicates participants in the BTC (and wider crypto) market believe that this recent rally was just a fakeout.”

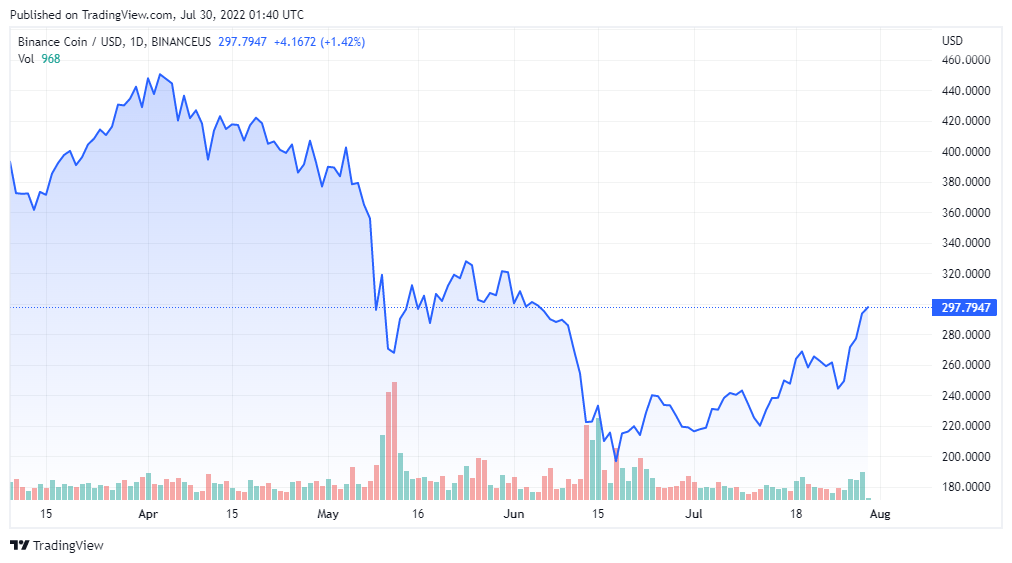

BNB price chart on BinanceUS | Source: BNB/USD on TradingView.com

What’s the next catalyst?

Back to the interview, the next question was about what factor could catapult bitcoin and crypto into their next chapter. Cautiously, CZ said that no one can forecast that accurately. “Nobody really forecasted NFTs, DeFi, etc. Which probably drove the last bullrun.” And in 2017, ICOs seemed to be the catalyst. “Six months before those things happened, very few people can forecast it.”

In bull markets, exercise risk management.

If everything went to 0, will your life still be ok? If no, you invested too much. Reduce it by half and ask again.

Don’t over invest. (Not financial advice)

— CZ ? Binance (@cz_binance) July 29, 2022

Then and only then, CZ speculated. He thinks that the market is so much bigger this time around, with so many new applications being developed. The whole space is moving in a positive direction, with most countries adopting regulatory frameworks instead of banning bitcoin and cryptocurrencies. It’s hard not to be bullish in an environment like this, even if the market is still fearful about the prices.

The last phrase is the funniest, and it goes into the current state of the world. “The macroeconomic situation, there’s going to be high inflation, the talk about recession, etc. All of those things drive adoption into bitcoin… into crypto.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren